If you’re doing business with Chinese companies, you’ve likely heard the term “due diligence” more times than you can count. But in China, reliable and transparent business information hasn’t always been easy to come by for international partners. This opacity can feel like a significant barrier, turning potential opportunities into daunting risks. How can you verify who you’re really dealing with? How do you know if a company is financially stable, legally compliant, or even legitimately registered?

This is where China’s National Enterprise Credit Information Publicity System (NECIPS) becomes your most powerful tool. Think of it as the official, government-run ledger for the Chinese corporate world. For any foreign business looking to enter the Chinese market, partner with a local manufacturer, or extend credit to a Chinese buyer, understanding this system is not just useful—it’s essential.

In this guide, we’ll break down everything you need to know about the NECIPS: what it is, what golden nuggets of information it holds, how you can access it, and why it should be the starting point of every business verification you conduct in China.

The “What”: China’s Official Corporate Registry

The National Enterprise Credit Information Publicity System (often shortened to the Enterprise Credit Information Publicity System or referred to by its website, gsxt.gov.cn) is the Chinese government’s centralized platform for disclosing corporate information. Established under the Enterprise Information Publicity Interim Regulations, its primary goal is to promote market transparency, corporate integrity, and fair competition by making key business data accessible to the public.

Managed by the State Administration for Market Regulation (SAMR), it serves a dual function:

- A Compliance Portal for Companies: All legally registered businesses in Mainland China are mandated by law to use this system to file their annual reports and disclose significant changes (like address, shareholders, or registered capital).

- A Verification Tool for the Public: It allows anyone—investors, partners, banks, or potential clients—to look up basic corporate data for free.

In essence, it’s the closest equivalent to a national online business registry that China has, designed to build a “social credit” system for enterprises.

The “Why”: Why This System is a Game-Changer for Foreign Businesses

Before systems like NECIPS, gathering credible information about a Chinese company was a challenging, often opaque process. Today, it represents a monumental shift towards transparency. For foreign businesses, it directly addresses several core pain points:

- Combating Information Asymmetry: It provides a baseline of truth, allowing you to independently verify claims made by a potential partner.

- Reducing Fraud Risk: You can quickly confirm a company’s legal existence, its registered status, and key identifying details, helping to avoid shell companies or scams.

- Supporting Informed Decision-Making: The data forms the foundational layer for any serious risk assessment, credit decision, or due diligence process.

- Ensuring Regulatory Compliance: For multinationals, using this official source is a critical step in fulfilling their own anti-corruption and “Know Your Customer” (KYC) compliance obligations.

The “What’s Inside”: Key Information You Can Find

This is where the rubber meets the road. The NECIPS houses a wealth of data points. Here’s a breakdown of the most critical categories for a foreign investor or partner:

1. Basic Registration Information

This is the company’s “birth certificate.” It includes the official business name (in Chinese and sometimes English), its unique Unified Social Credit Code (akin to a tax ID/business number), legal representative, registered address, registered capital, business scope, and date of establishment.

2. Shareholder & Capital Information

You can see the list of shareholders (individuals or corporate entities) and their contribution percentages. Crucially, it shows both the subscribed capital (the amount promised) and the paid-in capital (the amount actually deposited), which is a vital indicator of financial substance.

3. Key Personnel

Details about the company’s legal representative, directors, supervisors, and senior managers are listed. This helps in understanding the management team behind the operations.

4. Historical Changes (Changelog)

The system logs all major changes filed by the company, such as adjustments to registered capital, address moves, shareholder transfers, and business scope expansions. This timeline can reveal a company’s growth pattern or raise red flags about instability.

5. Annual Reports

Companies must file an annual report by June 30th each year. While the full report contains extensive data, the publicly disclosed parts on NECIPS typically include contact information, operational status (e.g., active, liquidated), and website details. Some companies voluntarily disclose more detailed financial figures.

6. Administrative Penalties

One of the most critical sections. It lists any administrative punishments levied by Chinese authorities against the company. This could include fines for false advertising, environmental violations, tax issues, or product quality problems—clear indicators of operational and compliance risk.

7. Pledged Assets & Intellectual Property

Records of assets (like equipment or real estate) used as loan collateral and registered intellectual property rights (like patents or trademarks used as security) are disclosed here.

8. Abnormal Operations & Serious Violations Lists

If a company fails to file its annual report on time or cannot be contacted at its registered address, it will be marked as having “Abnormal Operations.” Persistent issues can lead to being listed as a “Seriously Dishonest Entity,” which carries severe restrictions on its business activities.

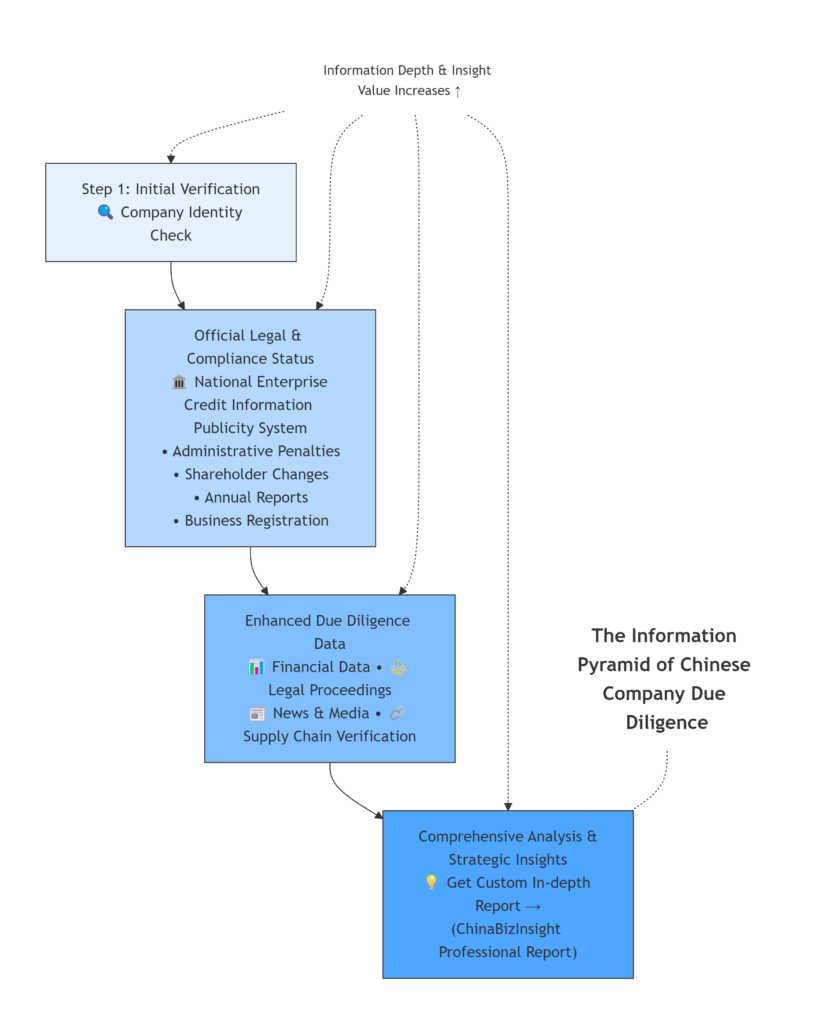

Visual Guide: The Information Pyramid of Chinese Company Due Diligence

How to Access and Use the System (The Practical Guide)

The primary portal is https://www.gsxt.gov.cn.

Step 1: Navigate the Interface

The website is primarily in Chinese. While there is an “English” button, the translation is often partial, and most search results and data pages will revert to Chinese. This language barrier is the first major hurdle for most foreign users.

Step 2: Conduct a Search

You can search by the company’s exact Chinese name or its 18-digit Unified Social Credit Code. Using the Chinese name is most common. Accuracy is key—a single wrong character will yield no results.

Step 3: Interpret the Results

Once you find the company, you’ll land on its main profile page. Information is organized into tabs (e.g., “Basic Information,” “Shareholders,” “Administrative Penalties”). You can click through each tab to view the details. Crucially, you can download a formal “Enterprise Credit Information Publicity Report.” This PDF document, bearing the official system watermark, is the authoritative proof of the records and is often required for formal business processes.

Important Updates: The 2024 Revisions

The governing regulations were updated in March 2024, reinforcing the system’s role. Key points for foreign businesses to note:

- Emphasis on Accuracy & Recourse: Both companies and government departments are responsible for the truthfulness of published information. The public has the right to report inaccuracies and request corrections.

- Enhanced Scrutiny: Market regulators conduct random and targeted inspections on the published information, potentially outsourcing checks to professional agencies.

- Stricter Penalties for Non-Compliance: Companies that falsify information or fail to report can face significant fines (up to 200,000 RMB), be placed on severe violation lists, and their executives can be barred from holding positions in other companies.

The Limitations: What the System Does NOT Tell You

Understanding the system’s boundaries is as important as knowing its contents. The NECIPS is an excellent starting point, but it is not a complete due diligence solution. It generally does not provide:

- Detailed Financial Statements: While some companies disclose high-level figures, full balance sheets, income statements, and cash flow statements are not publicly available here.

- Ongoing Litigation: Information about civil lawsuits or court proceedings is not centralized in this system.

- Operational Insights: Data on sales volume, market share, client lists, or supplier relationships.

- Real-time Updates: There can be a lag between a corporate event and its filing/publication on the system.

- Analysis or Risk Scoring: The system presents raw data; it does not interpret it or provide a creditworthiness score.

This is where professional business intelligence services bridge the gap. Firms like ChinaBizInsight build upon this official foundation, integrating NECIPS data with legal records, financial analytics, news sources, and on-the-ground verification to deliver a comprehensive picture. For instance, while you can see shareholders on NECIPS, a dedicated Executive & Shareholder Risk Report can trace their other business involvements and associated risks, adding a crucial layer of depth.

Your Action Plan: Using NECIPS Effectively

- Make It Your First Step: Before any serious negotiation, retrieve the company’s public report from NECIPS. Verify its basic legitimacy.

- Look for Red Flags: Pay close attention to the “Administrative Penalties” and “Abnormal Operations” lists. Recent, serious penalties are major warning signs.

- Cross-Check Information: Ensure the details provided by your potential partner (address, legal rep name, business scope) match the official record.

- Acknowledge the Gaps: Recognize that a clean NECIPS record is a good sign, but it’s only the beginning. For high-value deals, it’s prudent to invest in a professional due diligence report that delves into the areas NECIPS doesn’t cover.

- Consider the Language & Complexity: If navigating the Chinese interface and interpreting the legal/financial nuances is challenging, partnering with a local expert service can save significant time and prevent costly misunderstandings.

Conclusion: Your Foundational Tool for Trust in China

China’s National Enterprise Credit Information Publicity System is a transformative tool that has brought unprecedented transparency to the Chinese business landscape. For the foreign business community, it demystifies the first and most critical question: “Is this company real and legally compliant?”

By making this system your standard first checkpoint, you move from operating on hearsay to building partnerships on a foundation of verified, official data. It empowers you to ask sharper questions, identify basic risks early, and approach the vast Chinese market with greater confidence and control.

Remember, in the complex world of international business, knowledge isn’t just power—it’s your primary risk mitigation strategy. And it all starts with knowing how to look up the facts.

Ready to go beyond the basics? Understanding the official record is the first step. For a comprehensive analysis that includes financial health, legal disputes, and in-depth background checks, explore our tailored Business Credit Reports designed specifically for international partners.