When a European textile importer discovered its Hong Kong supplier had falsified factory certifications—after losing $2 million in advance payments—it learned a harsh lesson: A basic Hong Kong company search is merely the first step in risk mitigation, not the finish line.

Foreign partners often rely solely on the Companies Registry (CR) or Business Registration (BR) documents, believing these official records guarantee legitimacy. Yet as Section 45 of Hong Kong’s Companies Ordinance clarifies, while the Registrar must keep records publicly accessible, this transparency doesn’t equate to verification. The Ordinance explicitly states: “The Registrar is not responsible for verifying the truth of the information contained in a document” (Sec. 62).

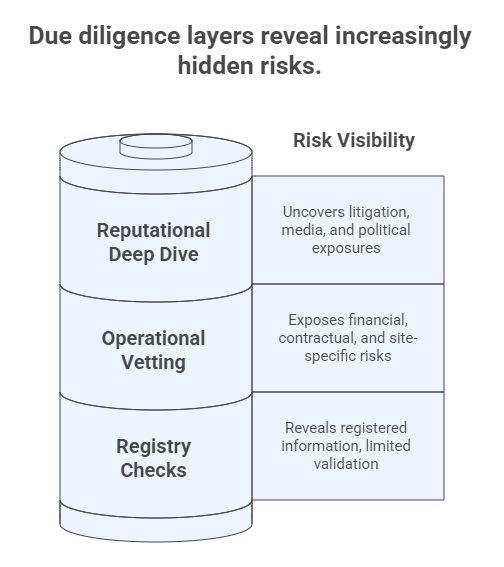

Here’s why deeper due diligence is non-negotiable:

Layer 1: Registry Checks – Necessary but Flawed

What You Get:

- Registered address, directorship, share capital (Sec. 27)

- Status (active/dissolved)

- Constitutional documents (Articles of Association)

Critical Gaps:

- No Validation of Claims: A registered address (Sec. 27(3)) could be a virtual office. Site verification is irreplaceable.

- Hidden Controllers: Nominee directors are legal but obscure beneficial ownership.

- Stale Data: Filings like annual returns (Sec. 107) may lag operational changes by months.

- Incomplete Risk Picture: Registry data won’t reveal pending lawsuits or regulatory penalties.

Case Study: A U.S. investor found a HK supplier’s CR filings “clean.” Later due diligence uncovered the director was disqualified (Sec. 45(1)(a)(iii)) for fraud in a separate venture—a fact absent from the registry.

Layer 2: Operational Vetting – Where Real Risks Surface

Registry data is static; operations are dynamic. Cross-verify through:

1. Financial & Contract Analysis

- Authenticate Financials: Demand audited statements. Scrutinize anomalies like sudden revenue spikes or inconsistent margins.

- Decode Contracts: Check clauses on force majeure, IP ownership, and termination penalties. Ambiguities here caused 37% of Sino-foreign JV failures (ICC 2023 Report).

2. Physical & Digital Site Visits

- Factory Audits: Confirm production capacity, equipment, and labor conditions.

- Cyber Checks: Test IT security protocols. 68% of Asian suppliers breached in 2023 lacked basic data encryption (Kaspersky).

3. Third-Party Verification

- Bank References: Confirm credit lines and payment history.

- License Checks: Validate industry-specific permits (e.g., HK FDA for food exports).

Layer 3: Reputational Deep Dive – Unmasking Hidden Threats

1. Litigation & Regulatory History

- Court Searches: Check HK’s Judiciary database for lawsuits (Sec. 42 allows rectification of register errors post-litigation).

- Regulatory Penalties: Probe breaches with HK Customs, SFC, or the Competition Commission.

2. Media & Digital Footprint

- Negative News: Scandals often surface in local Chinese-language press first.

- Online Sentiment: Analyze Glassdoor reviews (employee disputes) or forum complaints.

3. Political & Sanctions Exposure

- CCP Connections: While legally irrelevant, de facto ties can impact supply chains during geopolitical tensions. Check:

- Leadership roles in Party committees (disclosed in some mainland subsidiaries’ reports).

- Sanctions Lists: Screen against OFAC, EU, and UN lists.

The Cost of Complacency: When Layered Due Diligence Fails

In 2022, a German retailer sourced electronics from a “registered” HK firm. They skipped operational checks. The result:

- ☑️ CR Status: Active

- ☒ Reality: No warehouse (virtual address only)

- ☒ $1.8M lost in undelivered goods

Your Action Plan: Beyond the Registry

- Start with CR/BR: Verify incorporation and standing.

- Demand Proof, Not Promises: Validate operations via audits, contracts, and bank records.

- Dig for Dirt: Deploy reputational scans covering litigation, media, and sanctions.

“Trust, but verify” is obsolete. Verify, then verify again.

Foreign partners can’t afford blind spots. While HK’s registry offers transparency, true security lies in triangulating data from legal, operational, and reputational sources.

CTA:

Go beyond the registry—try our Enhanced Due Diligence Package for cross-checked operational, financial, and reputational intelligence.

ChinaBizInsight

Your strategic bridge to transparent business in China.