Doing business with a Chinese company requires more than a handshake. Whether sourcing products, forming joint ventures, or extending credit, verifying your partner’s legitimacy is critical. China’s dynamic market offers immense opportunity but carries risks like shell companies and inflated credentials. The 2024 Company Law of China (effective July 1, 2024) introduces significant changes impacting how companies operate and how you assess them. Relying solely on a website or brochure is a major risk.

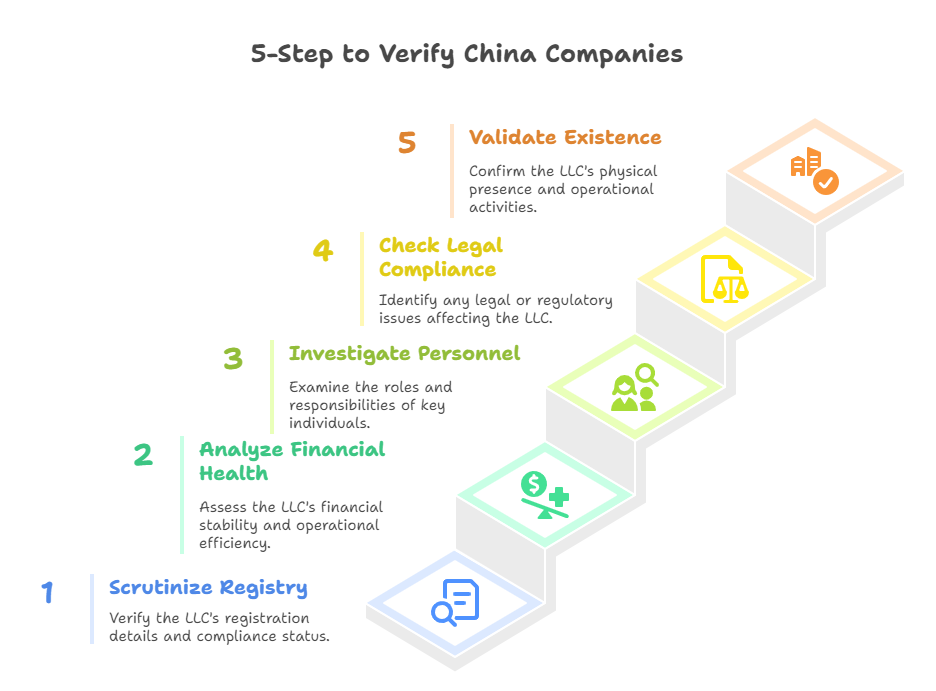

This updated 5-Step Framework empowers you to systematically verify a Chinese company’s legitimacy and make confident decisions under the new legal landscape.

Why Verification is Critical (Especially After July 2024)

The 2024 Company Law brings stricter regulations, particularly concerning capital contributions, director liability, and transparency. Key verification-relevant changes include:

- Stricter Capital Deadlines: Shareholders must fully pay subscribed capital within 5 years of establishment (previously indefinite). Verify actual payment status.

- Enhanced Director/Manager Liability: Clearer fiduciary duties (loyalty/diligence) increase personal liability risks for misconduct. Background checks are essential.

- Shareholder Rights Forfeiture: Companies can now strip non-paying shareholders of their equity rights after formal notice. This impacts ownership stability.

- Strengthened Disclosure: Companies must accurately disclose shareholder contribution details (amount, method, date) via the official National Enterprise Credit Information Publicity System (NECIPS).

- Corporate Veil Piercing: Shareholders can be held personally liable for company debts if they abuse corporate structures to evade obligations.

Ignoring these can lead to financial loss, contract disputes, reputational damage, or involvement in illicit activities.

Your 5-Step Verification Framework

Step 1: Scrutinize the Official Registry (NECIPS)

- The Foundation: China’s official company registry (gsxt.gov.cn) is your primary source for core legal existence data.

- What to Verify (Focus 2024):

- Registration Status: Confirm active (“Existing”) status. Avoid “Revoked” or “Deregistered” entities.

- Registered & PAID-IN Capital (Critical): Check Subscribed Capital versus Paid-in Capital. Under the new law, verify alignment with the 5-year payment window. Large subscribed capital with minimal paid-in capital is a major red flag. Check payment methods.

- Legal Representative: Identify who legally binds the company. Cross-reference later.

- Shareholders & Ultimate Beneficial Owners (UBOs): Identify direct shareholders and trace corporate shareholders to natural person UBOs. New rules enhance scrutiny on controllers.

- Business Scope: Does their claimed activity match the official scope? Operating beyond it is illegal.

- Address: Verify consistency with other sources.

- Establishment Date & Duration: Check operational history and license validity.

- Change History: Review past changes to capital, address, legal rep, shareholders.

- Abnormal Operations List: Check for serious compliance failures flagged by authorities.

- Action: Obtain the official Enterprise Credit Information Publicity Report from NECIPS. This government-issued document, bearing official watermarks/seals, is the bedrock of legitimacy verification. [Consider obtaining the official Enterprise Credit Report for the most authoritative view].

Step 2: Analyze Financial Health & Operations

- Beyond Basics: NECIPS provides registration data, not deep operational health.

- What to Verify:

- Financial Reports: Scrutinize annual reports (if available on NECIPS or provided) for consistency. Larger companies may have audited reports.

- Tax Compliance: Indicators on NECIPS or local tax platforms are crucial (inconsistencies are red flags).

- Asset Verification: For significant deals, independently verify key assets (property, equipment, IP). Does claimed scale match reality?

- Supply Chain Checks: Validate key supplier/customer relationships if possible.

- Action: Supplement the NECIPS report with a Customized Business Credit Report. These aggregate data from legal, financial, operational, and public records, providing a richer picture of stability, risks, and performance. Look for coverage of legal proceedings, contract fulfillment, industry reputation, and news sentiment. [A Professional Enterprise Credit Report offers this essential depth].

Step 3: Investigate Key Personnel (Directors, Shareholders, Legal Rep)

- People Matter: Leadership integrity and competence directly impact your risk.

- What to Verify (Leverage 2024 Rules):

- Identity & Credentials: Verify names and claimed qualifications.

- Disqualifications: Confirm they are not legally barred from their positions (e.g., due to past bankruptcy liability, relevant criminal convictions).

- Track Record & Reputation: Search for litigation history (involving them personally), bankruptcy involvement, or regulatory penalties. Use Chinese court databases.

- Conflicts & Related Parties: Identify other companies they control. Could these create conflicts? Verify UBOs behind corporate shareholders.

- Legal Rep Focus: Pay special attention to the Legal Representative’s authority and potential liability.

- Action: Obtain a dedicated Executive & Shareholder Risk Report. This focuses specifically on uncovering litigation, enforcement actions, disqualifications, and related-party networks involving key individuals.

Step 4: Check for Legal & Compliance Red Flags

- Proactive Risk Detection: Uncover past or present problems indicating future trouble.

- What to Verify:

- Litigation History: Search court databases for lawsuits involving the company as defendant (especially contracts, debts, IP).

- Enforcement Actions: Check national enforcement blacklists (“Dishonest Persons Subject to Enforcement”) and administrative penalty databases. Blacklisting severely hampers operations.

- Industry Licenses/Permits: Verify all necessary permits for their specific industry. Operating without them is illegal.

- IP Ownership: Verify claimed trademarks/patents through official databases.

- Negative News: Search for significant negative media reports or credible complaints.

- Action: Comprehensive Business Credit Reports often include litigation and enforcement data. Dedicated database searches are crucial for high-risk engagements.

Step 5: Validate Physical Existence & Operations

- Ground Truth: Does the company actually exist and operate as claimed?

- What to Verify:

- Site Visit (Gold Standard): Physically visit the registered office and operational sites. Match the description? Operational? Scale/Condition? Meet personnel.

- Alternative Verification:

- Request recent utility bills/leases for the registered address.

- Conduct verified video calls showing facilities.

- Verify land/property ownership records.

- Check active, professionally answered phone lines.

- Verify domain registration (Whois) details.

- Third-Party References: Request and contact references (suppliers, customers). Verify authenticity.

- Action: Physical verification is irreplaceable for significant commitments. Budget accordingly.

Conclusion: Build Trust Through Systematic Verification

Verifying a Chinese partner is prudent risk management and the foundation for successful, long-term relationships. The 2024 Company Law raises the stakes, making rigorous due diligence non-negotiable.

By applying this 5-Step Framework – leveraging mandatory NECIPS disclosures, understanding new shareholder/director obligations, and utilizing professional services when needed – you significantly mitigate risks and gain confidence to engage with legitimate Chinese businesses. Don’t leave your success to chance; invest in thorough verification. Explore proven solutions for verifying Chinese companies securely.

ChinaBizInsight

Your strategic bridge to transparent business in China.