Knowing your Chinese partner starts with understanding their legal foundation. As China’s revised Company Law takes effect (July 1, 2024), navigating its corporate landscape is crucial for international businesses. This guide demystifies China’s primary company structures, their legal implications, and why this knowledge is vital for your due diligence.

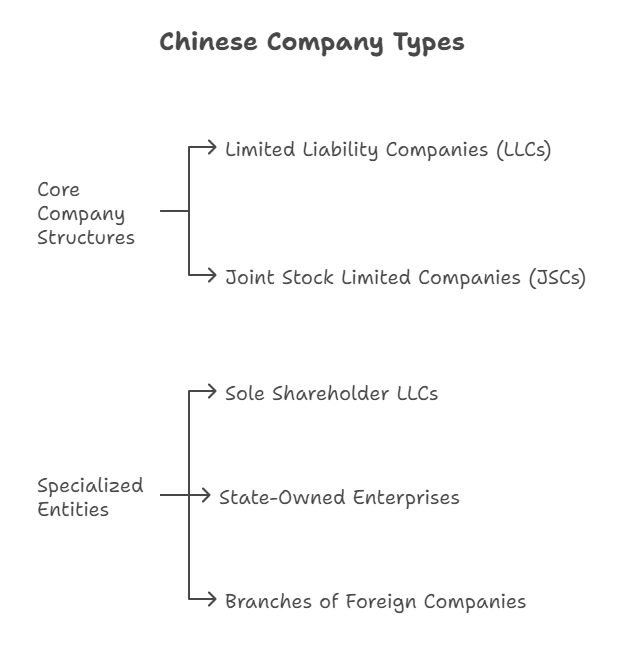

I. Core Company Structures Under Chinese Law

China’s Company Law (2024 Revision) recognizes two fundamental entities:

- Limited Liability Companies (LLCs | 有限责任公司)

- Purpose: Designed for SMEs, joint ventures, and family businesses.

- Key Features:

- Limited Liability: Shareholders’ liability capped at their capital contribution (Art. 4).

- Shareholder Limits: 1–50 shareholders (Art. 42).

- Flexible Governance: Simplified structures allowed for small entities (e.g., single-director/no board) (Art. 75).

- Capital: Registered capital must be fully paid within 5 years of incorporation (Art. 47).

- Best For: Foreign JVs, small-medium suppliers, asset-holding vehicles.

- Joint Stock Limited Companies (JSCs | 股份有限公司)

- Purpose: Tailored for large enterprises, public listings, and capital-intensive ventures.

- Key Features:

- Equity Division: Capital split into tradable shares (Art. 142).

- Shareholder Scale: 2–200 founders; unlimited post-IPO shareholders (Art. 92).

- Complex Governance: Mandatory board, supervisors/audit committee, strict disclosure rules (Art. 120, 130).

- Funding: Enables IPOs and public/private share offerings (Art. 151, 154).

- Best For: Publicly traded suppliers, investment targets, tech scale-ups.

II. Specialized Entities: Niche Structures You May Encounter

- Sole Shareholder LLCs (一人有限责任公司)

- Risk Note: Shareholder must prove personal/assets separate from company finances. Failure → personal liability (Art. 23).

- Use Case: Wholly foreign-owned enterprises (WFOEs).

- State-Owned Enterprises (国家出资公司)

- Governance: State-asset regulators act as shareholders. Board dominated by external/state-appointed directors (Art. 168–177).

- Compliance Focus: Enhanced internal controls and Party committee oversight (Art. 170).

- Why It Matters: SOEs dominate strategic sectors (energy, infrastructure). Due diligence is complex but critical.

- Branches of Foreign Companies (外国公司分支机构)

- Key Limits: Not independent legal entities. Parent company bears unlimited liability (Art. 247).

- Operations: Must register locally and maintain operating funds (Art. 245).

- Risk Insight: Contracting with a branch? Verify parent company guarantees.

III. Why Company Type Matters for Your China Business

| Risk Factor | LLC | JSC |

|---|---|---|

| Liability Exposure | Limited to contributions | Limited to share value |

| Info Transparency | Low (private) | High (public disclosures) |

| Governance Scrutiny | Flexible | Rigorous (regulatory oversight) |

| Capital Verification | Mandatory (5-year rule) | Pre-IPO audits required |

Real-World Scenarios:

- Trading Partner: An LLC supplier with ¥100k registered capital goes bankrupt. You can only claim against its remaining assets, not owners’ personal wealth (Art. 3).

- M&A Target: Acquiring a JSC? Scrutinize shareholder agreements and class shares (e.g., veto-power stocks) (Art. 144).

- Compliance Risk: An SOE partner’s internal Party committee decisions may impact contracts (Art. 170).

IV. How to Verify a Chinese Company’s Legal Status

Never rely on a website or business card. Key documents include:

- Business License (营业执照): Confirms type, registered capital, scope, and legality.

- Articles of Association (公司章程): Details governance rules and shareholder rights.

- Credit Report: Reveals ownership, financials, litigation, and regulatory penalties.

⚠️ Due Diligence Gap: 73% of foreign firms struggle to validate Chinese partners’ licenses or financials (2023 EU Chamber Survey).

V. ChinaBizInsight: Your Verification Partner

Cut through complexity with our authoritative reports:

- Official Business Credit Report: Sourced from China’s National Enterprise Credit Information Publicity System. Validates registration, capital, and compliance.

- Custom Due Diligence Reports: Uncover litigation, ownership risks, and financial health (Standard/Professional/Finance & Tax Editions).

- Document Authentication: Get Chinese licenses/credits apostilled for court or bank use abroad.

Case Example: A German machinery buyer used our Professional Due Diligence Report to uncover a supplier’s ¥2.3M unpaid court judgments – renegotiating payment terms saved their project.

Key Takeaways

- LLCs = Flexibility for private ventures.

- JSCs = Structure for scale and investment.

- SOEs = State influence; deep due diligence essential.

- Branches = No liability shield; parent responsibility.

- Verification is non-negotiable: Always validate licenses, ownership, and financials.

Don’t gamble on assumptions. Verify your Chinese partner’s legal standing now with a ChinaBizInsight Company Report.

ChinaBizInsight: Know your Chinese partners. Trust your cross-border business.

ChinaBizInsight

Your strategic bridge to transparent business in China.