Securing financing for international trade often hinges on collateral. When that collateral involves assets tied to a Chinese company, foreign lenders and traders face significant hurdles. How can you be sure the machinery, inventory, or receivables pledged truly exist, belong to the company, and aren’t already encumbered? Relying solely on representations from an unknown entity thousands of miles away is a substantial risk. This is where China’s Official Enterprise Credit Report becomes an indispensable tool for mitigating risk and enabling secure transactions.

Why Validating Chinese Collateral is Uniquely Challenging

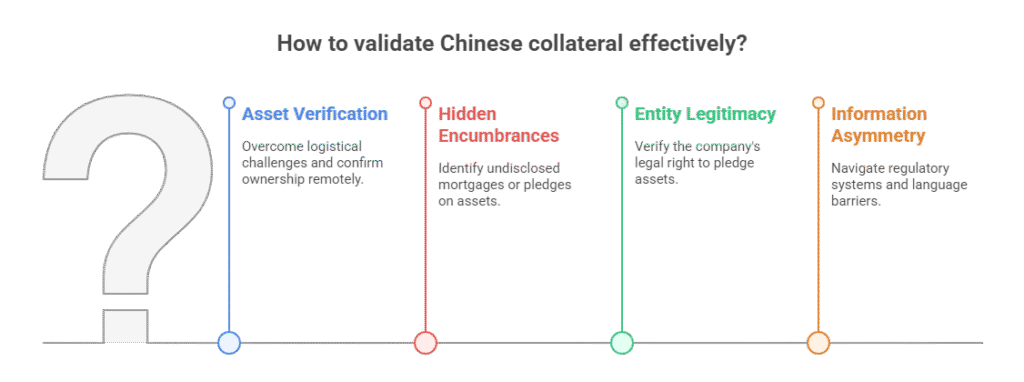

The opacity often associated with Chinese business information creates specific obstacles for foreign entities:

- Asset Verification Difficulty: Physically inspecting assets located in China can be logistically complex, expensive, and sometimes inconclusive. How do you confirm ownership and current condition remotely?

- Hidden Encumbrances: Assets might already be pledged as security for other loans (through undisclosed mortgages, pledges, or guarantees), leased, or subject to litigation. Traditional searches might miss these.

- Entity Legitimacy Concerns: Is the company offering the collateral a legitimate, active entity with the legal right to pledge the assets? Does it have a history of compliance or significant risks?

- Information Asymmetry: Lack of familiarity with Chinese regulatory systems, registries, and language barriers make independent verification daunting.

The Official Enterprise Credit Report: Your Verification Powerhouse

Issued directly from China’s National Enterprise Credit Information Publicity System (NECIPS) and bearing official watermarks/logos, the Official Enterprise Credit Report is the most authoritative single source for verifying a Chinese company’s fundamental standing and uncovering potential red flags related to collateral. Key sections provide critical verification points:

- “照面信息” (Basic Registration Information):

- Registration Status: Confirms if the company is “存续” (In Operation/Exist), “吊销” (Revoked), “注销” (Dissolved), or “清算” (In Liquidation). Only “存续” companies are viable candidates. Example: The sample report clearly shows “存续(在营、开业、在册)” (Exist (Operating, Open, Registered)).

- Registered Capital & Paid-in Capital: While not directly indicative of current assets, significant discrepancies between registered capital and actual paid-in capital (if visible in the report or through deeper dives) can raise questions about financial substance.

- Scope of Business (经营范围): Verifies if owning/operating the type of asset being pledged falls within the company’s legally permitted activities. Example: A company whose scope doesn’t include machinery ownership couldn’t legitimately pledge factory equipment.

- Shareholders & Investment Information (发起人及出资信息 / 股东及出资信息):

- Ultimate Beneficial Ownership (UBO): Identifies major shareholders. Understanding who controls the company is crucial for assessing reliability and potential related-party risks affecting the collateral. Example: The sample report lists major corporate shareholders.

- External Investment (对外投资信息): Reveals subsidiaries or other companies the target invests in. Assets held by these subsidiaries are not assets of the parent company and cannot be pledged by the parent. This prevents over-pledging based on consolidated group assets. Example: The sample report shows investments in 4 other companies; assets owned by those entities are separate.

- Change Information (变更信息):

- Capital Changes: Records of increases or decreases in registered capital signal significant financial events.

- Address Changes: Frequent changes might indicate instability or make asset location verification harder.

- Shareholder/Key Personnel Changes: Sudden shifts in ownership or management, especially before seeking financing, can be a red flag.

- Pledges & Encumbrances (关键登记信息):

- 动产抵押登记信息 (Chattel Mortgage Registration): This is absolutely critical for collateral validation. This section lists assets (like equipment, inventory, receivables) the company has already mortgaged to secure other debts. Assets listed here are encumbered and generally cannot be used as collateral for new financing. Example: The sample report states “暂无动产抵押登记信息” (No Chattel Mortgage Information Available), a positive sign for potential new lenders.

- 股权出质登记信息 (Equity Pledge Registration): Shows if shareholders have pledged their equity in the company. While this doesn’t directly encumber company assets, it signals financial stress on owners and potential future instability.

- 知识产权出质登记信息 (IP Pledge Registration): Reveals if patents, trademarks, or copyrights have been pledged.

- Risk Records (风险信息):

- 行政处罚信息 (Administrative Penalties): Fines or sanctions from regulators (market, tax, environmental, safety) indicate compliance failures and potential operational/legal weaknesses. Example: The sample report shows “暂无行政处罚信息” (No Administrative Penalty Information).

- 经营异常信息 (Operations Abnormalities): Being listed here (e.g., for failing to disclose annual reports, an unreachable registered address) signals serious governance or operational problems, severely undermining credibility. Example: “暂无经营异常信息” (No Operations Abnormality Information).

- 严重违法信息 (Serious Violations): Indicates major legal breaches, making the entity highly risky. Example: “暂无严重违法信息” (No Serious Violation Information).

- 司法协助信息 (Judicial Assistance): Reveals if courts have frozen assets or equity due to litigation. Frozen assets cannot be pledged or sold. Example: “暂无司法协助信息” (No Judicial Assistance Information).

Implementing Credit Reports in Collateral Validation

- Mandatory Requirement: Make the submission of a recent (within 1-3 months) Official Enterprise Credit Report a non-negotiable condition for any trade finance deal involving Chinese collateral.

- Focus on Key Sections: Scrutinize the Registration Status, Scope of Business, Chattel Mortgages, Shareholders, External Investments, and all Risk Records sections meticulously.

- Cross-Reference: Use the information (company name, registration number) to search specialized asset pledge registries if possible (though the NECIPS report is the primary consolidated source).

- Professional Translation & Analysis: Ensure accurate translation and interpretation of the report by experts familiar with Chinese business terminology and regulations. Don’t rely on automated tools for critical due diligence.

- Combine with Other Checks: The report is powerful, but use it alongside financial analysis (if available), site visits (where feasible), and checks against sanctions lists. For deeper financial risk assessment, consider supplementing with a Standard Business Credit Report or Professional Enterprise Credit Report.

Conclusion: Secure Transactions Start with Verified Foundations

Accepting collateral from a Chinese company without verifying its legitimacy and the unencumbered status of its assets through the Official Enterprise Credit Report is akin to sailing into a storm without charts. This authoritative document provides the transparency needed to:

- Confirm the company’s legal existence and operational status.

- Verify its authority to own/pledge specific asset types.

- Uncover existing liens and encumbrances (especially critical chattel mortgages).

- Identify significant ownership structures and external investments.

- Flag critical compliance failures and legal risks.

By integrating the Official Enterprise Credit Report into your trade finance due diligence process, you transform uncertainty into informed decision-making. It empowers lenders and traders to structure transactions securely, protect their financial interests, and confidently navigate the complexities of cross-border trade with China. Don’t let information gaps undermine your collateral security – demand the official report.

ChinaBizInsight

Your strategic bridge to transparent business in China.