For global investors and partners, understanding the true health and risks of a Chinese subsidiary often feels like navigating a labyrinth. Public information on the subsidiary itself might be limited or fragmented. However, a powerful, often underutilized resource exists: the Official Enterprise Credit Report of its parent company. This government-mandated document, sourced directly from China’s National Enterprise Credit Information Publicity System (NECIPS), can be a goldmine for insights into its subsidiaries.

Why Parent Company Reports Matter for Subsidiary Assessment

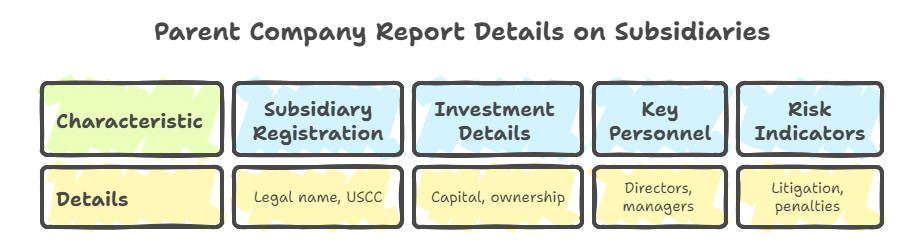

Under Chinese corporate law and regulations like the Company Law (2024 Revision) and the Interim Regulations on Enterprise Information Publicity (2024 Revision), parent companies have significant disclosure obligations regarding their subsidiaries. Key information mandated for inclusion in their Official Enterprise Credit Report includes:

- Subsidiary Registration Details: The parent’s report lists subsidiaries by their full legal names and unique Unified Social Credit Codes (USCC). This is the fundamental identifier for any Chinese business entity.

- Investment Amounts and Ratios: The report details the parent’s investment in each subsidiary, including the registered capital contribution and the percentage of ownership or control held. This reveals the level of commitment and control.

- Key Personnel Links: Directors, supervisors, and senior managers (especially the legal representative) appointed by the parent to the subsidiary are often listed. Identifying shared management helps assess governance integration and potential conflicts.

- Risk Indicators: While subsidiary-specific penalties might be detailed in their own reports, major subsidiary litigation, significant penalties imposed on the subsidiary, or the subsidiary being listed on operation exception catalogs can sometimes be flagged within the parent’s report, especially if it materially impacts the parent’s operations or reputation. Furthermore, if a subsidiary is involved in serious illegal activities, it may trigger annotations on the parent’s record.

Decoding the Parent Report: Key Sections for Subsidiary Insights

When analyzing a parent’s Official Enterprise Credit Report, focus on these critical sections to shed light on its subsidiaries:

- Basic Information (“照面信息” – Zhàomiàn Xìnxī): Confirm the parent’s own legitimacy (registration status, operating period). An abnormal status here raises immediate red flags for the entire group.

- Shareholders & Investment Information (“发起人及出资信息” / “对外投资信息” – Fāqǐrén jí Chūzī Xìnxī / Duìwài Tóuzī Xìnxī):

- This is the core section for subsidiary identification. Look for explicit lists titled “对外投资信息” (Outward Investment Information).

- Entries will include the subsidiary’s full name, USCC, registered capital amount, and the parent’s investment amount/percentage. Example from Sample Report: “新疆新投华赢能源科技有限公司 91650105MAE5DEA34N”.

- Key Personnel (“主要人员” – Zhǔyào Rényuán): Identify individuals holding positions like Director, Supervisor, or Manager within the parent company who also hold positions (especially Legal Representative, Executive Director, General Manager) within the subsidiary. This highlights control and potential bandwidth issues.

- Change Information (“变更信息” – Biàngēng Xìnxī): Track changes in the parent’s outward investments. Entries like “新增对外投资” (Added Outward Investment) signal new subsidiary acquisitions, while “减少对外投资” (Reduced Outward Investment) or specific subsidiary name removals indicate divestments or exits. Changes in the parent’s investment amount in a specific subsidiary are also recorded here.

- Administrative Penalties (“行政处罚信息” – Xíngzhèng Chǔfá Xìnxī): While primarily detailing penalties against the parent itself, significant penalties levied against a major subsidiary, especially those impacting finances or operations, might be mentioned, particularly if the parent bears responsibility. The absence of major penalties here is a positive sign for group governance, but always verify the subsidiary’s own report.

- Abnormal Operations & Serious Illegal Activities (“经营异常信息”, “严重违法信息” – Jīngyíng Yìcháng Xìnxī, Yánzhòng Wéifǎ Xìnxī): If a subsidiary’s severe legal issues directly implicate the parent or are considered material to the parent’s standing, it could be noted here. However, this is less common than subsidiary-specific listings.

Limitations and the Need for Direct Subsidiary Reports

While invaluable, relying solely on the parent’s report has limitations:

- Detail Level: Parent reports provide high-level registration and investment data but lack the subsidiary’s operational details, financials (unless consolidated), granular risk history, or specific management structure beyond key parent-appointed roles.

- Completeness: Disclosure focus is on the parent. Not every minor subsidiary action or risk event will bubble up to the parent’s report.

- Timeliness: Updates occur, but there can be a lag between a subsidiary event and its reflection in the parent’s public record.

Therefore, the parent company’s Official Enterprise Credit Report is the essential starting point to map the subsidiary landscape and identify potential red flags at the group level. However, a comprehensive risk assessment requires obtaining the subsidiary’s own Official Enterprise Credit Report. This provides the full picture:

- Detailed operational status and history

- Complete shareholder structure (beyond just the parent)

- Full record of administrative penalties, litigation, and abnormal listings

- Financial information (if disclosed in annual reports)

- Comprehensive list of key personnel

Overcoming the Hurdles: Language, Access, and Verification

Foreign investors face challenges accessing and interpreting these reports:

- Language Barrier: Reports are primarily in Chinese.

- Platform Navigation: Accessing NECIPS requires understanding the Chinese interface.

- Data Consolidation: Correlating parent and subsidiary reports manually is time-consuming.

- Verification: Ensuring the reports are authentic and up-to-date is crucial.

Conclusion: A Strategic Imperative

Leveraging the parent company’s Official Enterprise Credit Report is a fundamental step in the due diligence process for any Chinese subsidiary. It provides legally mandated, authoritative data on the subsidiary’s existence, the parent’s level of investment and control, key personnel links, and potential high-level group risks. It allows investors to verify basic claims and identify areas needing deeper investigation via the subsidiary’s own report. In China’s complex business environment, neglecting this readily available official source means operating with incomplete information. Combining analysis of both parent and subsidiary reports forms the bedrock of informed investment and partnership decisions, significantly mitigating risk.

Need authoritative, translated, and analyzed Official Enterprise Credit Reports for both Chinese parent companies and their subsidiaries? Our expertise ensures you get the accurate, actionable insights you need for confident decision-making. Explore our Official Enterprise Credit Report service or contact us for tailored due diligence support.

ChinaBizInsight

Your strategic bridge to transparent business in China.