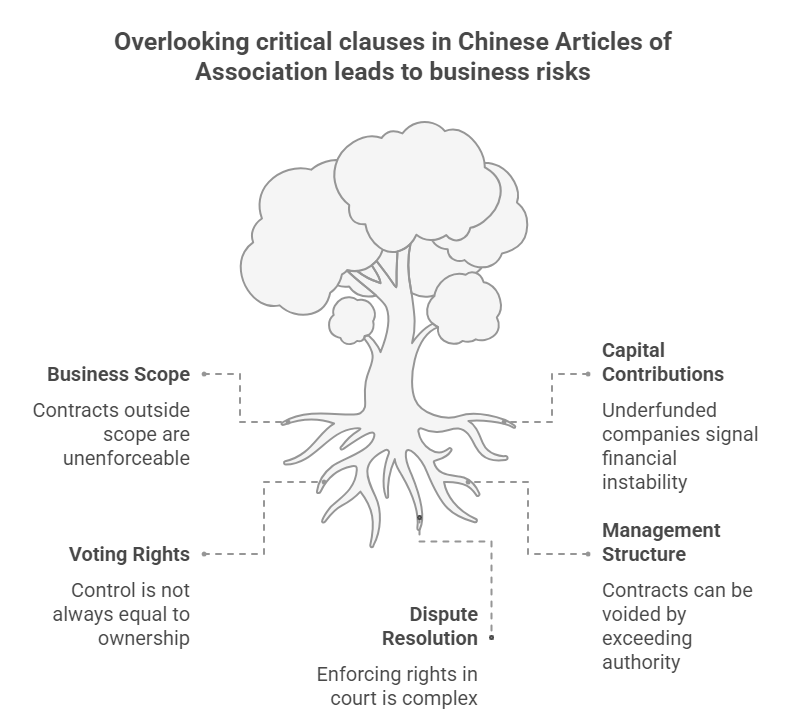

When evaluating Chinese business partners, foreign companies often focus on credit reports and financial data. Yet one critical document frequently overlooked holds immense power: the Articles of Association (公司章程). Far more than a formality, this legally binding charter governs a company’s very existence and operations. Ignoring its provisions can expose foreign partners to unexpected risks.

China’s updated Company Law (effective July 1, 2024) reinforces the AoA’s significance. Let’s dissect five clauses where seemingly mundane details carry substantial weight:

1. Business Scope: The Legal Boundary Fence

(Sample Reference: Page 3 of Enterprise Credit Report – “Business Scope Change”)

The registered business scope defines a company’s legal operating perimeter. Operating beyond this scope invalidates contracts and exposes companies to penalties. Watch for:

- Specificity vs. Vagueness: “Industrial product sales” is dangerously broad. Legitimate scopes list exact categories (e.g., “wholesale of semiconductor components”).

- Licensed Activities: Clauses stating “Engaging in XXX requires separate administrative permits” (常见表述: “依法须经批准的项目…”). Trading hazardous chemicals, financial services, or medical devices requires explicit permits beyond the AoA.

- Recent Changes: Frequent modifications (as seen in the sample report) signal strategic shifts or regulatory compliance issues. Verify permits match current scope.

Why it Matters: Contracts for ultra vires activities (outside the scope) are unenforceable. You risk partnering with a company operating illegally.

2. Capital Contributions & Shareholder Liability: Beyond the Registered Capital

(Ref: Company Law 2024, Art. 47, 48, 88)

The AoA details shareholder obligations. The 2024 law tightens rules:

- Payment Deadlines: Shareholders must fully pay monetary contributions within 5 years of incorporation (Art. 47). Non-monetary assets (IP, property) require timely ownership transfer.

- Valuation & Liability: Art. 48 mandates realistic valuation of non-cash assets. Overvaluation makes shareholders liable for deficiencies. Art. 88 exposes both sellers and buyers of unpaid shares to joint liability if deficiencies exist.

- Transfers & Succession: Art. 90 allows inheritance unless restricted by the AoA. Check clauses limiting share transfers to pre-approve new partners.

Why it Matters: Underfunded companies or shareholders dodging contributions signal financial instability. Acquiring unpaid shares could saddle you with unexpected debts.

3. Voting Rights & Control Levers: Who Really Holds Power?

(Ref: Company Law 2024, Art. 144, 146)

The AoA can alter standard “one share, one vote” rules:

- Differential Voting Rights (DVRs): Art. 144 permits shares with enhanced (e.g., 10 votes/share) or reduced voting power. Founders often retain control via DVRs, even with minority ownership.

- Veto Rights: Clauses may grant minority shareholders or specific classes veto power over major decisions (M&A, asset sales, debt issuance).

- Class Rights: Art. 146 mandates supermajority approval from affected classes for changes impacting their rights (e.g., altering dividend priority).

Why it Matters: Assuming majority ownership equals control is dangerous. Identify silent controllers and potential roadblocks to strategic decisions.

4. Management Structure & Authority: The Decision-Making Engine

(Ref: Company Law 2024, Art. 67, 69, 121)

The AoA defines who runs the company and their limits:

- Board Composition: Specifies director numbers, appointment methods (e.g., shareholder-nominated, employee representatives), and committees (like Audit Committees, which can replace Supervisory Boards per Art. 69/121).

- Delegated Authority: What decisions rest solely with the Board vs. requiring Shareholder approval? Can the Board authorize loans, guarantees, or major investments without a shareholder vote?

- Chairman/CEO Powers: Defines the scope of daily operational authority. Can the CEO sign major contracts alone?

Why it Matters: Contracts signed by managers exceeding AoA-granted authority can be voided. Understand who can legally bind the company.

5. Dispute Resolution & Dissolution: Planning for the Unthinkable

(Ref: Company Law 2024, Art. 229, 231)

The AoA dictates how conflicts end or escalate:

- Arbitration Clauses: Mandatory arbitration (常见: CIETAC, Beijing/Shanghai/Shenzhen Court) prevents lawsuits. Know the forum and rules.

- Deadlock Mechanisms: Provisions for resolving board/shareholder deadlocks (e.g., mediation, buy-out rights).

- Dissolution Triggers: Beyond legal defaults (insolvency), AoAs may include specific events (e.g., key partner exit, prolonged losses).

Why it Matters: Enforcing rights in Chinese courts is complex and slow. Arbitration clauses are binding. Knowing exit triggers protects your investment.

Leveraging the AoA for Due Diligence

The AoA isn’t just a document; it’s a risk map. Combine its analysis with an Official Enterprise Credit Report to verify registered scope, shareholder identities, and capital status. Scrutinize changes recorded in the report against the current AoA. For complex structures or high-value deals, Professional Enterprise Credit Reports offer deeper analysis linking AoA clauses to operational and legal risks.

Obtaining the AoA: Publicly listed companies disclose theirs. For private firms, partners may share it under NDA. Otherwise, official retrieval via channels like Company Documents Retrieval services is essential for the authoritative, filed version. Don’t rely on drafts or unsigned copies.

Pro Tip: Ensure translations are legally certified. Nuances matter. Partner with experts fluent in Chinese corporate law and document verification.

ChinaBizInsight

Your strategic bridge to transparent business in China.