For tech companies operating in or engaging with China, patents are more than legal protections – they’re strategic assets. With China leading global patent filings (over 1.58 million invention patents granted in 2023 alone, CNIPA data), navigating this landscape requires identifying truly high-value patents. Not all patents are created equal. Understanding the criteria used to evaluate patent quality is crucial for effective portfolio management, competitor analysis, licensing negotiations, and investment decisions.

Official Screening Criteria: The Foundation

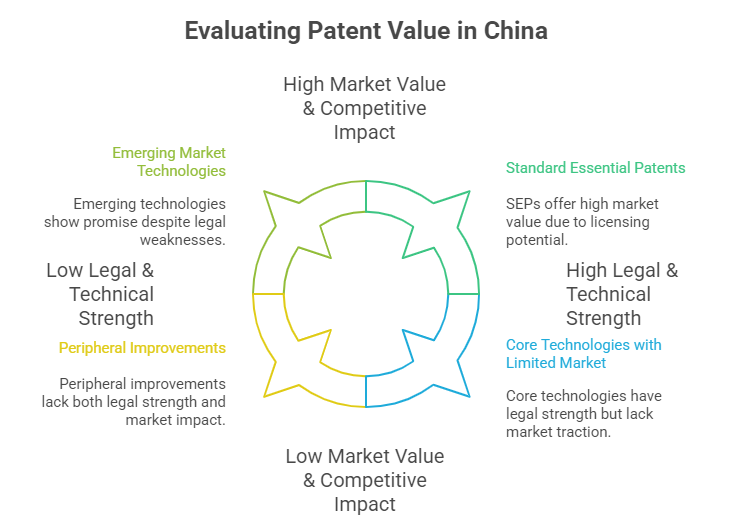

Chinese authorities and experienced evaluators primarily assess patent value through several core dimensions:

- Legal Status & Stability:

- Valid & Maintained: The patent must be in force, with annual fees paid. A lapsed patent holds no value.

- Stable Rights: Has the patent survived invalidation challenges (or is it likely to)? Patents with a strong validity history are significantly more valuable. Check for any ongoing invalidation proceedings via official channels.

- Clear Ownership: Title must be unambiguous and free of disputes or complex co-ownership issues that could hinder enforcement or licensing. Verify ownership through official registers.

- Technical Strength & Innovation:

- Substantive Examination: Invention patents undergo rigorous examination in China. Having passed this process indicates a baseline of novelty, inventiveness (non-obviousness), and industrial applicability.

- Technical Significance: Does the patent cover a core, foundational technology within its field, or a peripheral improvement? Core tech patents are inherently more valuable.

- Scope of Protection (Claim Breadth): Broad claims offer wider protection and are harder to design around, making them more powerful and valuable than narrow claims limited to specific implementations. Analyze the independent claims.

- Difficulty of Circumvention: Can competitors easily achieve similar results without infringing? Patents representing unique, hard-to-replicate solutions command higher value.

- Market Value & Competitive Impact:

- Market Application: Does the patented technology address a significant, existing, or rapidly growing market need? Relevance is key.

- Commercialization Potential: Is the technology embodied in successful products/services, or does it have clear, viable pathways to market adoption? Patents generating revenue (or with high potential to) are prime targets.

- Competitive Advantage: Does the patent provide a strong barrier to entry for competitors or protect a key differentiator for the patent holder? Its strategic importance within the market landscape is critical.

- Standard Essential Patents (SEPs): Patents declared essential to industry standards (e.g., 5G, Wi-Fi) are extremely valuable due to licensing revenue potential, though they come with Fair, Reasonable, and Non-Discriminatory (FRAND) licensing obligations.

Beyond the Basics: Advanced Evaluation Factors

While the above forms the core, sophisticated evaluators and companies consider these additional layers:

- Portfolio Context: A single patent’s value is often amplified when part of a dense “thicket” or family of related patents covering a technology comprehensively, making infringement harder to avoid. Geographic coverage (family size in key markets like China, US, EU) also boosts value.

- Citation Analysis:

- Forward Citations: How often has this patent been cited by later patent applications? High citation counts often signal foundational technology and influence.

- Backward Citations: What is the quality and relevance of the prior art it cites? Efficiently overcoming strong prior art indicates higher inventiveness.

- Litigation History: Has the patent been successfully enforced in court? A proven track record in litigation significantly increases its perceived strength and deterrent value. Conversely, a history of being challenged or invalidated (even partially) diminishes it.

- Maintenance Duration: Patents maintained close to their full term (20 years for inventions) typically indicate ongoing commercial value, as companies won’t pay fees for unused assets. Analyze the payment history.

- Technical Lifecycle: Is the technology still relevant, or is it becoming obsolete? The remaining useful economic life of the underlying technology directly impacts patent value. Assess market trends and emerging alternatives.

Implementing a High-Value Patent Strategy

- Internal Audit: Rigorously evaluate your own portfolio using the criteria above. Identify core, high-value assets for protection and potential monetization, and prune low-value or obsolete patents to save costs.

- Competitor Intelligence: Apply the same screening to key competitors’ Chinese patent portfolios. This reveals:

- Their core technological strengths and R&D focus.

- Potential freedom-to-operate risks for your products.

- Licensing or acquisition opportunities (identifying their undervalued or underutilized assets).

- Weaknesses in their protection that could be exploited.

- M&A & Investment Due Diligence: Never acquire a company or invest in a tech startup based solely on patent quantity. Scrutinize the quality and strategic alignment of the target’s patents using these high-value criteria. Are you buying robust assets or expensive paper? Comprehensive due diligence is non-negotiable.

- Licensing & Partnerships: High-value patents are the cornerstone of profitable licensing deals. Understanding their strength allows for better negotiation. Conversely, when taking licenses, ensure the patents licensed are genuinely valuable and necessary.

- Aligning R&D & IP Strategy: Focus R&D efforts on areas where strong, defensible patents can be obtained. Use patent landscaping (based on high-value indicators) to identify white spaces and avoid crowded, low-value areas.

The Verification Imperative

Identifying high-value patents isn’t guesswork; it requires meticulous verification of the underlying facts:

- Authenticity & Legal Status: Confirm the patent exists, is valid, and belongs to the claimed entity. Official Chinese patent registers are the primary source.

- Ownership Chain: Ensure clear title and check for any encumbrances (liens, exclusive licenses).

- Claim Scope & Amendments: Obtain and analyze the official granted patent document, paying close attention to the claims as they define legal protection. Review any amendment history during prosecution.

- Litigation/Invalidation History: Search court and patent office records for any challenges or enforcement actions related to the patent.

Reliable verification forms the bedrock of any high-value patent strategy. Misjudging a patent’s legal standing or scope can lead to costly strategic errors. Partnering with experts who provide accurate, official comprehensive IP verification reports is essential for confidence in your Chinese patent decisions. For deeper due diligence, consider supplementing patent analysis with insights from Official Enterprise Credit Reports to understand the financial health and operational legitimacy of the patent-holding entity.

Conclusion

In China’s dynamic and competitive tech ecosystem, patent strategy must focus on quality over quantity. By systematically applying high-value patent screening criteria – legal stability, technical strength, market impact, portfolio context, and verified factual data – tech companies can make smarter decisions. Whether managing their own portfolio, assessing competitors, evaluating investments, or negotiating deals, the ability to identify and leverage truly high-value Chinese patents is a critical competitive advantage. Success hinges not just on innovation, but on the strategic recognition and validation of the most powerful intellectual property assets.

ChinaBizInsight

Your strategic bridge to transparent business in China.