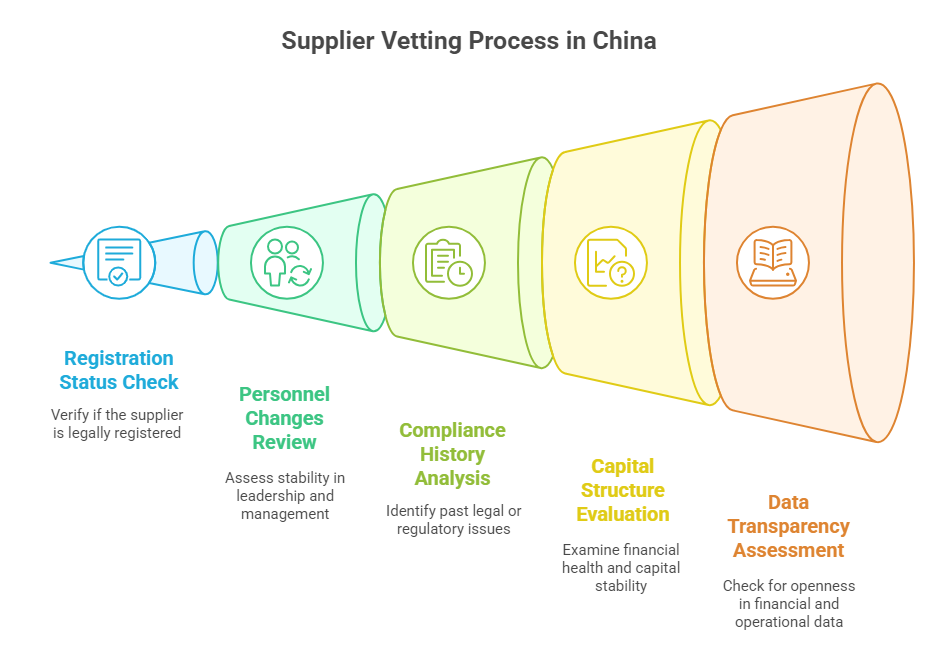

Finding reliable suppliers in China is crucial, but verifying their legitimacy can be challenging. Official Enterprise Credit Reports (OECRs), sourced directly from China’s National Enterprise Credit Information Publicity System (NECIPS), are fundamental tools for due diligence. While these reports offer valuable insights, identifying potential risks requires understanding key warning signs. Here are 7 critical red flags to watch for during your supplier vetting process:

- Abnormal Registration Status or Scope:

- Red Flag: The report lists the company’s status as “Revoked” (吊销), “Cancelled” (注销), “In Liquidation” (清算), or “Abnormal” (经营异常). Crucially, also check if the registered business scope does not explicitly cover the products or services the supplier claims to offer.

- Why it Matters: A revoked/cancelled status means the company legally no longer exists. “Abnormal” often indicates failure to submit annual reports, inability to be contacted at the registered address, or hidden business risks. Operating outside the approved scope is illegal and signifies high regulatory risk. The sample report shows a “Continued (Operating)” status, which is positive.

- Action: Verify current status via NECIPS or a trusted provider. Cross-check claimed products/services against the official scope. Avoid companies with abnormal statuses or mismatched scopes.

- Frequent and Significant Changes in Key Personnel (Directors, Supervisors, Legal Representative):

- Red Flag: Multiple changes in the Legal Representative, Directors, or Supervisors within a short period (e.g., several changes within a year or two), especially involving key founders suddenly leaving.

- Why it Matters: Frequent leadership churn can signal internal instability, management disputes, potential attempts to evade liability for past actions, or even efforts to distance individuals from problematic companies. Stability in core management is generally a positive indicator.

- Action: Review the “Change Information” and “Senior Management” sections meticulously. Look for patterns – is turnover unusually high? The sample report shows significant management changes in early 2024.

- History of Administrative Penalties or Serious Violations:

- Red Flag: Any entries listed under “Administrative Penalty Information” (行政处罚信息) or “Serious Illegal Activities Information” (严重违法信息). Pay close attention to the nature of the violations (e.g., environmental breaches, tax evasion, product quality issues, illegal operations, false advertising) and the frequency.

- Why it Matters: Penalties indicate past non-compliance with Chinese laws and regulations. Repeated violations or severe penalties (like large fines or operational suspensions) signal significant operational risk, poor governance, and potential reputational damage. The sample report shows no penalties, which is good, but expired hazardous chemical licenses hint at potential compliance lapses needing verification.

- Action: Obtain details of all penalties. Assess the severity, recency, and relevance to your potential engagement. Consider it a major warning sign.

- Unpaid or Abnormal Registered Capital:

- Red Flag: A significant gap between the Subscribed Capital (认缴资本 – what shareholders pledged) and the Paid-in Capital (实缴资本 – what’s actually deposited), especially if the paid-in amount is very low or zero. Watch for companies with unusually high subscribed capital but minimal paid-in capital.

- Why it Matters: Under the Company Law (2024 Revision), shareholders generally have 5 years to fully pay subscribed capital. A large gap, particularly if the payment deadline is approaching or passed, can indicate undercapitalization, financial weakness, or shareholders unwilling to commit real resources. It raises doubts about the company’s ability to meet financial obligations. The sample report shows full paid-in capital for the current shareholders.

- Action: Compare Subscribed vs. Paid-in Capital figures. Scrutinize the shareholder contribution records in the report.

- Frequent and Significant Changes in Shareholders/Equity Structure:

- Red Flag: Numerous changes in shareholders or equity percentages within a short timeframe, especially if involving major stakes or the entry/exit of investment entities.

- Why it Matters: Frequent equity shifts can indicate instability, financial distress requiring new investment, disputes among owners, or even attempts to obscure the ultimate beneficial owners (UBOs). It complicates understanding who truly controls the company. The sample report shows significant shareholder changes in late 2023 and 2024.

- Action: Analyze the “Shareholder & Contribution Information” and “Equity Change Information” sections. Track the history of ownership changes. Who are the current significant shareholders?

- Withholding Key Financial or Operational Data:

- Red Flag: In the annual report sections, the company consistently selects “The company chooses not to disclose” (企业选择不公示) for critical metrics like Total Assets, Revenue, Profits (Profit Total, Net Profit), Liabilities, and even Number of Employees or Social Security contributions.

- Why it Matters: While companies have some discretion on disclosing certain financials in public reports, consistent non-disclosure of all key figures is a major transparency issue. It prevents assessing the supplier’s financial health, scale, stability, and even the validity of their employee claims. The sample report shows the company withheld all key financial data and employee counts in its annual reports.

- Action: Note which data points are missing. Consider this a significant lack of transparency. A Standard or Professional Business Credit Report might aggregate more data points from other sources.

- Operational Discrepancies and Negative Public Records:

- Red Flag: While less common in the core OECR, findings from linked systems or supplementary checks can reveal red flags. This includes:

- Abnormal Operations Records: Listings for fake registered addresses, hiding important facts, or evasion of debt.

- Judicial Assistance Information: Court orders freezing assets or equity.

- Negative News & Litigation: Discovered through broader due diligence (court announcements, credible media reports) showing major lawsuits, product recalls, labor disputes, or significant negative publicity.

- Why it Matters: These indicate active, serious operational or legal problems impacting the supplier’s reliability and continuity.

- Action: The OECR provides a foundation. Look for entries in sections like “Judicial Assistance Information” or “Abnormal Operations”. Supplement the OECR with a deeper Professional Business Credit Report that includes risk scoring, legal proceedings, and news monitoring. For key personnel, an Executive Risk Report is advisable.

- Red Flag: While less common in the core OECR, findings from linked systems or supplementary checks can reveal red flags. This includes:

Beyond the Report: The Power of Verification and Context

An OECR is a snapshot from an official source, but it’s just the starting point. Here’s how to strengthen your vetting:

- Verify Authenticity: Ensure the report is genuine and current by checking the NECIPS watermark, QR code (if present), and issuance timestamp. Reports obtained through services like ChinaBizInsight guarantee authenticity.

- Context is Key: A single red flag might need explanation; multiple flags are a strong danger signal. Consider the industry norms and the severity of the issues found.

- Supplement with Deeper Reports: Basic OECRs lack financial depth, legal details, and risk analysis. Upgrade to a Standard Business Credit Report for essential risk indicators or a Professional Business Credit Report for comprehensive due diligence, including legal proceedings, financial health assessments (where available), and in-depth operational analysis.

- Physical Verification: For critical suppliers, consider an on-site visit to verify the company’s existence, operations, and scale.

- Apostille/Legalization: If using the OECR or other Chinese documents (like Business License) for official purposes overseas (e.g., bank account opening, legal proceedings), you will need Apostille (for Hague Convention members) or Consular Legalization services.

Conclusion: Vigilance is Paramount

Official Enterprise Credit Reports are indispensable for mitigating risk when sourcing from China. By diligently checking for these 7 red flags – abnormal status, management instability, penalties, capital issues, ownership volatility, lack of transparency, and operational/legal problems – you gain critical insights into a supplier’s legitimacy and reliability. Remember, the OECR is a foundation. Combining it with deeper due diligence reports, verification, and context transforms it into a powerful tool for making informed, secure sourcing decisions in the complex Chinese market. Know your Chinese partners thoroughly before you commit. Let our expertise in retrieving and analyzing these crucial documents guide your safe entry and success in China. Explore our range of due diligence reports, including the essential Official Enterprise Credit Report, to empower your supplier vetting process.

ChinaBizInsight

Your strategic bridge to transparent business in China.