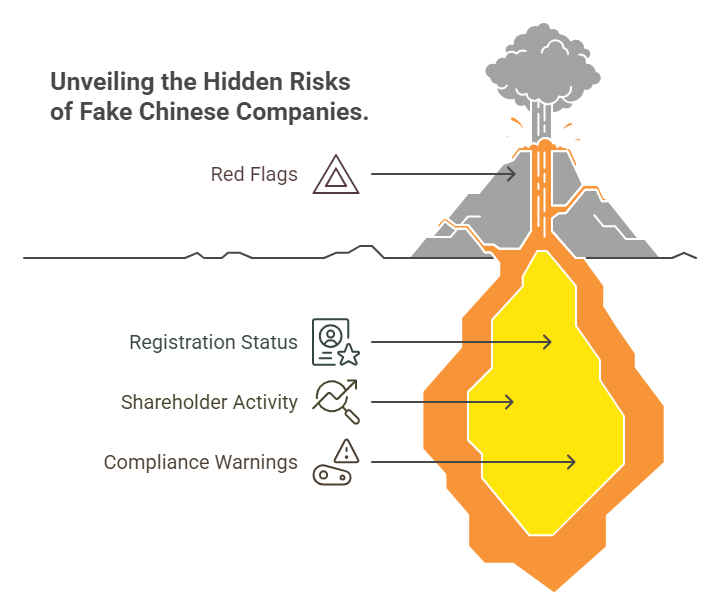

Verifying the legitimacy of a Chinese business partner is critical for mitigating fraud, financial loss, and reputational damage. While scams like shell companies, forged licenses, and identity theft are prevalent, China’s National Enterprise Credit Information Publicity System (NECIPS) offers a powerful tool for due diligence. Here’s how to spot red flags in an official Enterprise Credit Information Publicity Report – the bedrock of Chinese corporate transparency.

What is an Official Enterprise Credit Information Publicity Report?

Maintained by China’s State Administration for Market Regulation (SAMR), the NECIPS is the government’s central database for business registration and compliance data. An Official Enterprise Credit Report provides verified details like:

- Registration Status: “存续” (Active), “吊销” (Revoked), “注销” (Dissolved), or “经营异常” (Abnormal Operations).

- Key Details: Registered capital, legal representative, address, scope of business.

- Shareholders & Changes: History of ownership and capital contributions.

- Administrative Penalties: Fines, violations, or regulatory sanctions.

- Annual Reports: Self-reported operational and financial data (selectively disclosed).

⚠️ Critical Red Flag #1: Registration Status & Basic Details

- Status ≠ “存续” (Active): “吊销” (Revoked) or “注销” (Dissolved) means the company is defunct. “经营异常” (Abnormal) signals serious compliance failures (e.g., false address, unreported changes).

- Mismatched Business Scope: Verify if the company’s actual activities (e.g., manufacturing electronics) align with its registered scope. Operating beyond scope is illegal.

- Unrealistic Registered Capital: Extremely high capital (e.g., ¥500 million) with no operational history may indicate “capital dumping” – funds withdrawn post-registration, leaving an empty shell. Under China’s 2024 Company Law, shareholders must fully fund capital within 5 years.

- Virtual/Shared Addresses: Many fraudulent companies use mass-registered addresses (e.g., “深圳市前海商务秘书有限公司”). Cross-check with maps and physical verification.

💡 Case Study: A report shows “新投华赢石油化工(深圳)” (Xin Tou Hua Ying Petrochemical) with a registered capital of ¥50 million. However, its frequent address changes (2023: “深圳市南山区科苑路16号东方科技大厦2401-3”) and shifting shareholder structure (4 major changes between 2022-2024) suggest instability or potential restructuring to obscure ownership.

⚠️ Critical Red Flag #2: Suspicious Shareholder & Management Activity

- Frequent/Dramatic Shareholder Changes: Rapid turnover of owners (>3 changes in 2 years) can indicate money laundering or asset stripping.

- High-Risk Legal Representatives: Search the legal rep’s name in NECIPS. If they are linked to multiple dissolved/penalized companies (“老赖” or discredited persons), consider it a major warning.

- Unfunded Capital Contributions: Reports list both subscribed (promised) and paid-in capital. Large gaps between them suggest financial weakness or bad faith. Post-2024, companies have stricter deadlines to fund capital.

📊 Table: Key Shareholder Risk Indicators

| Indicator | Low Risk | High Risk |

|---|---|---|

| Shareholder Stability | Minimal changes (>2 years) | Frequent changes (e.g., 3+/year) |

| Capital Contribution | Fully paid-in | Significant gap between subscribed & paid-in |

| Legal Rep History | Clean record, few associations | Multiple revoked companies or penalties |

⚠️ Critical Red Flag #3: Compliance & Operational Warnings

- Administrative Penalties: Look for sections like “行政处罚信息” (Administrative Penalties). Fines for tax evasion, fake invoices (“虚开发票”), or environmental violations signal systemic fraud risks.

- Abnormal Operations Listings (“经营异常”): Common reasons include:

- Failure to disclose annual reports.

- Using a fake registered address.

- Concealing equity changes.

- Inconsistent Annual Reports: Cross-check self-reported data (e.g., employee count, revenue) with industry benchmarks. A “trading company” claiming ¥100M revenue with only 5 employees is implausible.

💡 Case Study: The sample report for “新投华赢” lists multiple expired “危险化学品经营许可证” (Dangerous Chemical Licenses). Operating without valid permits is illegal and a major liability red flag for partners.

Beyond the Basic Report: Enhanced Due Diligence

While the official report is foundational, deeper risks require investigation:

- Verify Physical Operations: Use services like Company Site Verification to confirm offices, factories, or warehouses exist.

- Check Executive Risk Reports: Directors/Shareholders with hidden debts or court judgments pose reputational risks. (See: Executive & Shareholder Risk Report)

- Audit Financial Health: Standard or Professional Credit Reports add bank credit ratings, supplier disputes, litigation history, and financial analysis.

- Validate Licenses & Certificates: Use official channels to confirm business licenses, industry permits, and product certifications.

Protect Your Business: Trust, But Verify

China’s official Enterprise Credit Report is your first line of defense, but scammers exploit gaps in self-reported data. Combining it with enhanced reports and on-ground verification is crucial:

“In China, due diligence isn’t a checkbox – it’s an ongoing process. Fraud evolves faster than regulations.” – ChinaBizInsight Compliance Team

Need authoritative verification?

→ For Official NECIPS Reports: Order an Official Enterprise Credit Report (with English translation).

→ For Enhanced Due Diligence: Explore our Standard or Professional Credit Reports with legal, financial, and operational risk analytics.

ChinaBizInsight

Your strategic bridge to transparent business in China.