For global businesses partnering with Chinese companies, understanding the tightened rules on related-party transactions (RPTs) under China’s revised Company Law (effective July 1, 2024) is crucial. Article 182 establishes a strict disclosure and approval framework, aiming to prevent insiders from exploiting their positions. Failure to comply carries severe consequences. This article dissects the core requirements of Article 182 and presents illustrative case studies based on pre-reform enforcement patterns, highlighting the very risks the new law targets.

Understanding Article 182: The Shield Against Self-Dealing

Article 182 mandates:

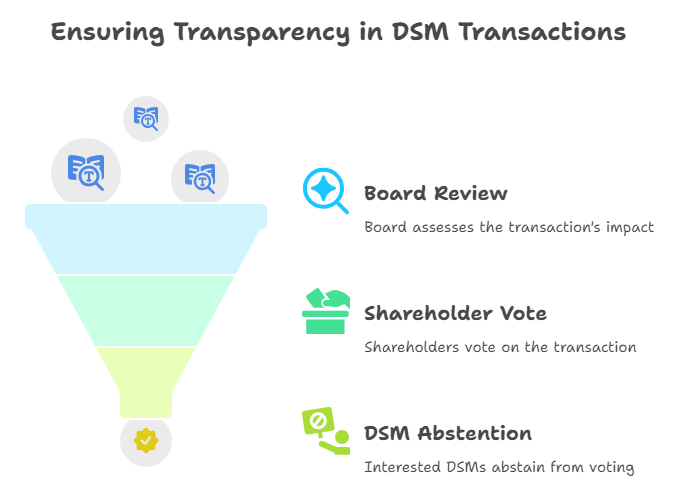

- Disclosure & Approval: Directors, supervisors, and senior managers (DSMs) must report any direct/indirect transactions or contracts between themselves (or their close relatives/controlled entities) and the company to the Board or Shareholders’ Meeting.

- Board/Shareholder Vote: The transaction must be approved by a resolution of the Board or Shareholders’ Meeting, as stipulated in the company’s articles of association.

- Abstention: The interested DSM(s) involved cannot vote on the resolution approving their own transaction.

The Rationale: This prevents DSMs from prioritizing personal gain over the company’s welfare, ensuring fairness for all shareholders, especially minority and foreign investors.

Case Studies: Past Violations Mirroring Article 182’s Concerns

While the new law is freshly enacted, historical cases vividly illustrate the types of undisclosed or unfair RPTs Article 182 aims to eradicate:

- Case: The “Service Fee” Drain (Pre-2024 Pattern – Representative of Targeted Behavior)

- Scenario: The controlling shareholder and CEO of a privately-owned Chinese manufacturing company (Company A) also owned a separate distribution company (Company B). Company A consistently sold its products to Company B at prices significantly below market value. Simultaneously, Company B charged Company A exorbitant “management service fees.”

- Violation (Equivalent to Art. 182): The CEO failed to formally disclose this fundamental conflict of interest and the detrimental terms of the transactions to Company A’s board or shareholders for proper scrutiny and approval. The transactions were not conducted at arm’s length.

- Impact: Company A suffered sustained losses, eroded profitability, and diminished shareholder value. Minority shareholders (including a foreign VC fund) discovered the scheme through a costly third-party audit during a funding round, leading to legal disputes and reputational damage. Under the new law, the CEO could be forced to disgorge profits made by Company B and face shareholder lawsuits for damages.

- Case: Asset Transfer to the Chairman’s Family (Public Company Example – Luckin Coffee Context)

- Scenario: Prior to its fraud scandal becoming public, executives at Luckin Coffee (NASDAQ: LK) engaged in complex transactions involving related parties. While the core fraud involved fabricated sales, investigations also revealed concerns about undisclosed related-party dealings and asset transfers benefiting insiders, contributing to the opacity that enabled the larger fraud. While not the sole cause, the lack of transparency around RPTs was a critical red flag.

- Violation (Pattern relevant to Art. 182): The failure to adequately disclose and obtain proper independent approvals for transactions involving entities controlled by or closely linked to company insiders violated fundamental principles of governance and transparency now explicitly codified in Article 182. The transactions lacked arm’s length terms and independent oversight.

- Impact: Massive shareholder losses, delisting from NASDAQ, bankruptcy restructuring, and severe legal penalties for involved individuals. The scandal severely damaged trust in Chinese listed entities. Article 182’s strict disclosure and independent approval requirements are designed to prevent such opaque dealings.

- Case: The Overpriced Acquisition (SOE Context – Pre-Reform)

- Scenario: A director of a Chinese state-owned enterprise (SOE) influenced the Board to approve the acquisition of a technology startup. The purchase price was substantially higher than independent valuations suggested. It was later revealed the startup was partially owned by the director’s spouse.

- Violation (Equivalent to Art. 182): The director had a clear conflict of interest but failed to fully disclose the extent of their spouse’s ownership stake in the target company during the Board’s deliberation and vote. The director likely participated in the vote approving the transaction. This violated the core principles of disclosure, abstention, and independent approval.

- Impact: The SOE overpaid for the asset, wasting state-owned resources. The director faced internal disciplinary action and potential administrative penalties. Minority shareholders questioned governance standards. Article 182 makes such non-disclosure and failure to abstain a clear legal violation with defined consequences, including disgorgement of benefits and liability for damages.

Consequences of Violating Article 182: More Than Just a Slap on the Wrist

The New Company Law provides teeth to enforce Article 182:

- Disgorgement of Profits (Art. 186): Any income obtained by the DSM (or their related party) from the undisclosed/unapproved transaction must be surrendered to the company.

- Liability for Damages (Art. 188): If the violation causes losses to the company, the responsible DSM(s) are liable for compensation.

- Invalidation of Transaction: Courts may potentially void transactions that constitute severe breaches of fiduciary duty, even if not explicitly stated in Art. 182, based on general principles.

- Reputational Nuclear Fallout: Discovery of such violations destroys trust with investors, partners, and regulators, crippling future business prospects.

Protecting Your Business: Due Diligence is Non-Negotiable

For international partners, robust due diligence on Chinese counterparties is paramount. ChinaBizInsight is your essential partner:

- Identify the Network: Our Customized Due Diligence Reports meticulously map a company’s shareholders, directors, supervisors, senior managers, and their known affiliated entities (using official registries, litigation records, licensing data, and public disclosures). We uncover the potential web of related parties.

- Scrutinize the Transactions: We analyze available financials and public records for patterns suggesting unusual RPTs (e.g., consistently favorable pricing to specific suppliers/customers linked to insiders, unexplained asset transfers).

- Assess Governance Health: Our reports evaluate the target’s corporate governance structure, board independence (where applicable), and historical compliance record – indicators of how seriously they take RPT rules like Article 182.

- Ongoing Monitoring: Risks evolve. Our monitoring services alert you to significant changes in ownership, key personnel, or new regulatory actions against the company that might signal governance issues.

Conclusion: Article 182 – A Landmark for Transparency, Vigilance Remains Key

Article 182 of China’s New Company Law marks a significant step towards curbing abusive related-party transactions and protecting all shareholders. The historical cases demonstrate the real-world harm caused by the very practices this law now strictly prohibits and penalizes. For international businesses, understanding this law is not optional; it’s fundamental to risk management.

Relying solely on surface-level information is insufficient. Deep, professional due diligence that specifically probes for related-party risks and assesses governance compliance is your strongest defense against hidden liabilities and reputational disasters. Let ChinaBizInsight illuminate the shadows and empower you to partner with Chinese businesses confidently and securely.

Discover the full picture of your Chinese partners. Explore ChinaBizInsight’s Due Diligence Reports & Business Verification Services Today.

ChinaBizInsight

Your strategic bridge to transparent business in China.