Imagine this: Your Hong Kong-based supplier vanishes overnight. After frantic calls, you discover they’ve been struck off the Companies Register. Outstanding invoices? Trapped in corporate limbo. For creditors chasing dissolved Hong Kong entities, Section 800(2) of Hong Kong’s Companies Ordinance transforms debt recovery into a legal labyrinth.

The Section 800(2) Roadblock: A 6-Month Countdown

Under Section 800(2), restoring a dissolved company requires proving it maintained “a place of business in Hong Kong” within 6 months before dissolution. This isn’t a formality—it’s a forensic challenge。

Why this window matters:

- Physical Evidence Gap: Landlords lease premises to new tenants; utility records expire.

- Digital Traces Vanish: Bank accounts close; domain registrations lapse.

- Statutory Deadline: Restoration petitions must be filed within 6 years of dissolution (Section 799(3)).

A 2023 Hong Kong Law Society report found 68% of failed restoration attempts stumbled on Section 800(2)’s location requirement.

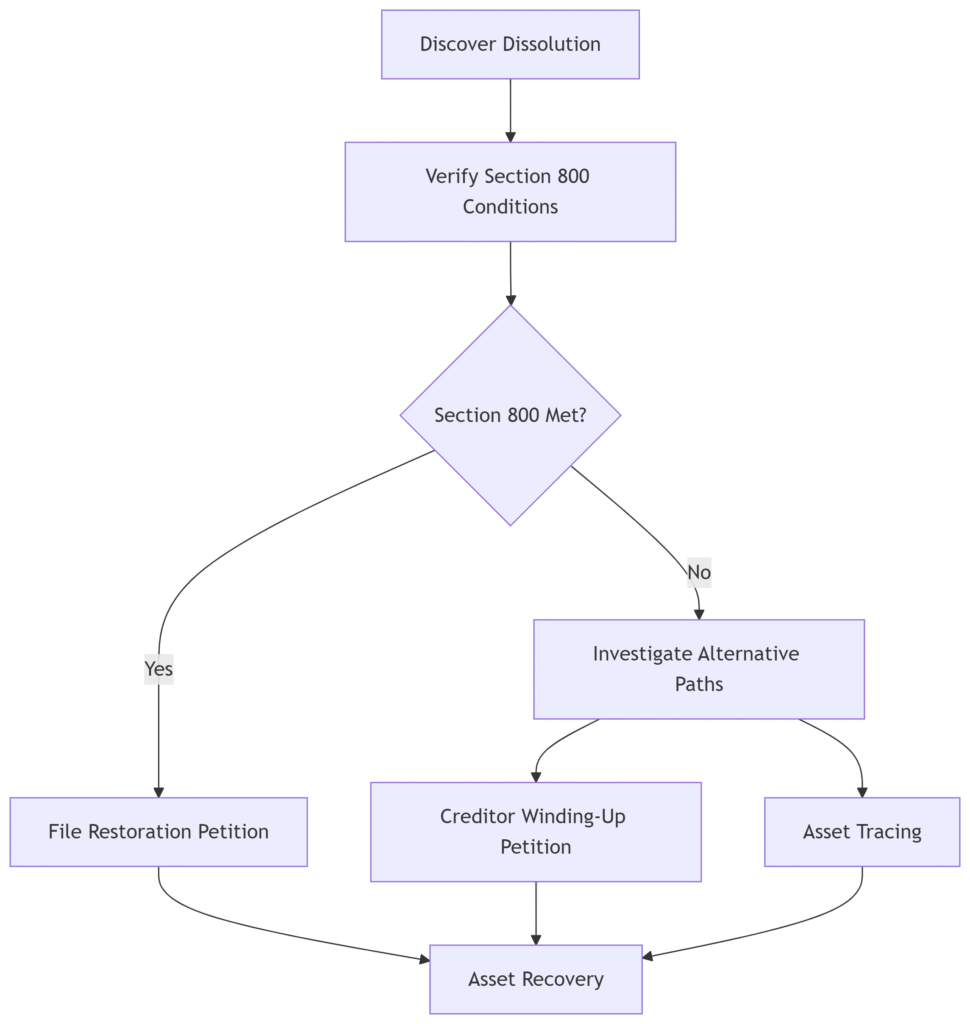

3 Legal Avenues to Bypass the Asset Recovery Trap

1️⃣ Director/Member Restoration Petition (Sections 799-800)

Process:

- Step 1: File application with Registrar + evidence of Hong Kong operations (e.g., office leases, tax filings)

- Step 2: Submit updated corporate documents (Section 800(2)(b))

- Step 3: Gazette notice of restoration (Section 801(2))

Critical Evidence:

- Tenancy contracts

- MPF contribution records

- Business registration certificates

Case Study: A German machinery supplier recovered HK$1.2M by submitting the debtor’s Octopus business card transactions proving active operations 4 months pre-dissolution.

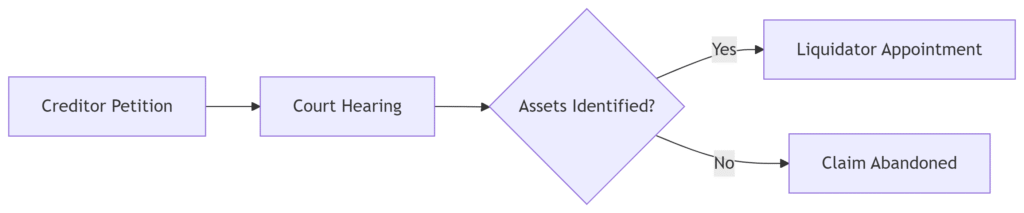

2️⃣ Creditor Petition for Compulsory Winding Up

If restoration fails, petition under Section 881(1) Companies (Winding Up) Ordinance:

Key Advantage: Liquidators can reverse asset transfers made within 2 years of dissolution (Section 276B).

3️⃣ Asset Tracing Through Corporate Associates

When direct claims fail:

- Investigate shadow directors (Section 2)

- Trace asset transfers to related entities

- Demand transaction audits under Section 846

Example: A UK retailer uncovered debtor assets hidden in a BVI shell using intercompany loan records obtained via court order.

The Cross-Border Recovery Blueprint

Critical Investigation Tools:

- Land Registry searches for property transfers

- Bankruptcy searches against directors

- Corporate linkage reports exposing asset-shuffling

Why Most Creditors Fail (And How to Succeed)

The Data Gap:

- 79% of creditors lack time-stamped proof of the debtor’s Hong Kong operations (HK Insolvency Tribunal, 2024).

Solution: Proactive due diligence:

- Pre-Transaction: Verify suppliers’ business registration validity

- Ongoing: Monitor corporate status changes quarterly

- Post-Dissolution: Secure digital forensics within 30 days

⚠️ Statutory Alarm: The 6-year restoration deadline (Section 799(3)) starts ticking at dissolution—not discovery.

The Smart Creditor’s Checklist

- Immediately Upon Discovery:

- Order Certificate of Dissolution from Companies Registry

- Preserve all transaction evidence (emails, contracts, delivery records)

- Within 14 Days:

- Commission pre-800(2) due diligence report

- Document physical premises history

- Within 30 Days:

- File restoration petition if evidence secured

- Initiate asset tracing if Section 800(2) fails

Global Reality: 42% of cross-border debt recoveries require evidence from 3+ jurisdictions. Professional due diligence bridges the gap.

Turning Legal Traps Into Recovery Opportunities

Section 800(2) isn’t just a procedural hurdle—it’s a forensic stopwatch. Winning requires:

- Speed: Evidence decays faster than statutory deadlines

- Precision: Hong Kong’s definition of “place of business” demands documented permanence

- Creativity: Asset pathways exist beyond corporate resurrection

The companies that recover debts don’t just read laws—they anticipate dissolution patterns before suppliers vanish. In Hong Kong’s high-velocity market, your best asset isn’t legal leverage—it’s proactive intelligence.

Anchor Text: For pre-transaction due diligence, explore our Hong Kong Company Due Diligence Reports

ChinaBizInsight

Your strategic bridge to transparent business in China.