Imagine this: You legally purchase branded goods overseas at competitive prices, import them to China through authorized channels, and suddenly face trademark infringement lawsuits. This is the complex reality of parallel imports—a practice caught between global trade efficiencies and rigid intellectual property protections. As China’s consumer market grows (projected to reach $8.5 trillion by 2025), understanding court rulings on parallel imports becomes critical for risk management.

The Legal Tightrope: Trademarks vs. Market Realities

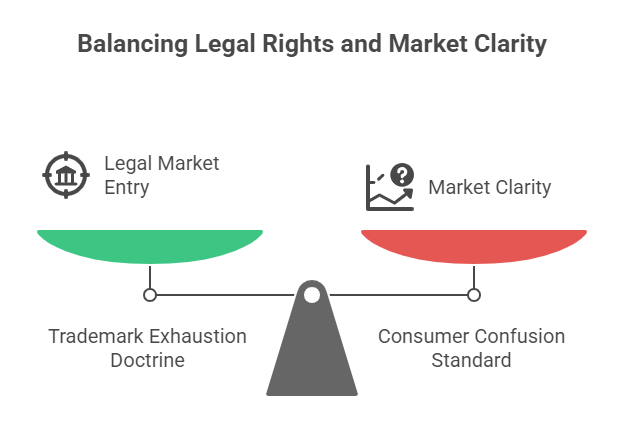

China lacks explicit legislation on parallel imports, creating ambiguity. Courts navigate this using core principles:

- Trademark Exhaustion Doctrine: Once genuine goods enter the market legally, IP rights are “exhausted.” Resales typically don’t infringe trademarks (Trademark Law, Art. 57).

- Consumer Confusion Standard: Does repackaging or relabeling mislead buyers about origin or quality? If yes, infringement claims often succeed.

Decoding Key Court Rulings: A Shift Toward Pragmatism?

Recent cases reveal evolving judicial attitudes:

- “Michelin Tires” Case (2015):

- Scenario: A company imported authentic Michelin tires from abroad without brand authorization.

- Ruling: Infringement. Why? Tires were modified for Chinese road standards, potentially compromising safety and brand reputation.

- Takeaway: Altering goods—even genuine ones—voids exhaustion protection.

- “Longines” Case (2019):

- Scenario: A retailer sold authentic Longines watches sourced globally without permission.

- Ruling: No infringement. The court emphasized the watches were unaltered and clearly bore authentic trademarks.

- Takeaway: Genuine, unmodified products benefit from trademark exhaustion. Origin matters less than product integrity.

- “Nike v. Xiamen Customs” (2022):

- Scenario: Nike blocked parallel imports of its shoes, claiming infringement.

- Ruling: Customs released the goods. Courts prioritized consumer access to authentic products over rigid channel control.

- Takeaway: Judicial support for parallel imports is rising if quality and branding remain intact.

Critical Risks Beyond Legal Wins

Even favorable rulings present operational hazards:

- Gray Market Mix-Ups: Parallel channels can unintentionally enable counterfeit infiltration. Diligent supplier verification is non-negotiable.

- Warranty Voidance: Manufacturers often deny warranties for imports outside official channels, frustrating end consumers.

- Unpredictable Enforcement: Local customs or courts may inconsistently apply rulings, creating compliance uncertainty.

Strategic Actions for Safe Parallel Importing

Mitigate risks with these steps:

- Demand Unbroken Chains of Custody: Insist on documentation proving authorized purchase at every distribution stage.

- Never Modify Packaging or Products: Any alteration (labels, manuals, components) invites infringement claims.

- Verify Supplier Legitimacy: Audit suppliers rigorously. Use tools like ChinaBizInsight’s Intellectual Property Verification Reports to confirm trademark and patent statuses in China.

- Transparent Consumer Communication: Clearly disclose product origins and any warranty limitations.

The Future Landscape

China’s courts increasingly balance IP protection with market competition. Recent trends suggest:

- Growing acceptance of international exhaustion (rights extinguished after first global sale).

- Emphasis on consumer harm as a decisive factor over technical infringement.

- Potential for clearer legislation as parallel trade volumes surge.

Conclusion: Opportunity Requires Diligence

Parallel importing offers significant cost advantages in China’s vast market. However, success hinges on respecting trademark integrity, ensuring product authenticity, and navigating judicial nuances. By prioritizing transparency and verification, businesses can leverage this model while minimizing legal exposure. As courts continue refining their approach, proactive compliance isn’t just prudent—it’s a competitive advantage.

ChinaBizInsight

Your strategic bridge to transparent business in China.