The tropical island of Hainan has officially entered a new era of economic openness. On December 18, 2025, the Hainan Free Trade Port (FTP) commenced its island-wide customs operation, commonly referred to as “Fengguan.” For global investors, this isn’t about isolation; it’s about unprecedented integration with the global economy under a unique “inland customs territory” model.

Think of Hainan as a massive, connected special economic zone. The “first line” between Hainan and the rest of the world is now more open, while the “second line” between Hainan and mainland China is carefully managed. This translates to tangible benefits like a dramatically expanded Zero-Tariff goods list (covering ~74% of tariff lines), a 15% corporate and personal income tax rate for eligible entities, and streamlined customs procedures.

The opportunity is clear. But for a foreign investor, the crucial first step is not just seeing the prize—it’s correctly navigating the setup process. Establishing a compliant and qualified entity is the master key to unlocking these benefits. This guide will walk you through the essentials of company registration, obtaining “preferential entity” status, and completing crucial customs filings in the new Hainan FTP.

Step 1: Laying the Foundation – Company Registration in Hainan

The journey begins with incorporating a legal entity on the island. The standard vehicle for most foreign-invested business operations is a Wholly Foreign-Owned Enterprise (WFOE) or a Joint Venture.

Key Requirements & Process:

- Company Name Pre-approval: Your chosen name must be unique and compliant with Chinese naming conventions.

- Business Scope Definition: This is critical. Your stated business activities must be precise and should ideally align with Hainan FTP’s “Encouraged Industries” catalogue, which now spans over 1,100 sectors like biomedicine, digital economy, and high-end manufacturing. Alignment with this catalogue is often a prerequisite for subsequent tax benefits.

- Registered Capital: While the minimum capital requirements have been relaxed in many sectors, you must declare a credible amount that supports your business scale and secures investor visas.

- Legal Representative & Key Personnel: Appointment of a legal representative (who can be a foreigner) and directors is required.

- Registered Office Address: You must have a tangible, non-virtual office address in Hainan.

- Submission & Approval: Documents, including the Articles of Association, investment certificates, and passports of key personnel, are submitted to the Hainan Provincial Market Supervision Administration (the local branch of SAMR). The process has been streamlined, but accuracy is paramount.

Why Due Diligence is Your First Investment:

Before you even submit paperwork, it’s prudent to conduct background checks. Are your potential local partners credible? If acquiring an existing shelf company, is its history clean? Ensuring the legitimacy of every element in your corporate structure prevents future legal and operational nightmares. This is where professional verification services prove invaluable. A thorough Enterprise Credit Report can reveal a target company’s financial health, legal disputes, and compliance record, forming a solid basis for trust and negotiation. For international use, such due diligence documents often require official authentication or apostille.

Step 2: The Golden Ticket – Qualifying as a “Preferential Entity” (享惠主体)

Not all companies in Hainan automatically enjoy the FTP’s core policies. To import the vast range of Zero-Tariff goods, your entity must be recognized as a “Preferential Entity” .

What is a Preferential Entity?

According to policy documents like Cai Guanshui [2025] No. 12, this status is granted to:

- Enterprises registered in Hainan FTP with independent legal person status.

- Public institutions within the FTP.

- Certain certified non-profit organizations in tech and education.

How to Apply & Key Considerations:

- Eligibility Confirmation: Primarily, your company must be a legally registered enterprise in Hainan. The business scope should support the need for importing zero-tariff goods (e.g., manufacturing equipment, raw materials for production, operational vehicles for tourism).

- Application to Hainan Authorities: The Hainan Provincial Government is responsible for determining and maintaining the list of Preferential Entities. Applications are submitted to relevant provincial departments, which assess the company’s business authenticity, operational plans, and compliance capacity.

- Dynamic List & Compliance: The list is dynamic. Authorities can add or remove entities based on assessments and compliance records. Once approved, your company is included in a shared system accessible to the Ministry of Finance, General Administration of Customs, and State Taxation Administration.

The Crucial Link: From Registration to Qualification

Your Business License is the birth certificate, but the “Preferential Entity” status is your passport to FTP benefits. The information on your registration documents must be flawless and consistent when applying for this status. Any discrepancy can cause delays or rejection. Having your corporate documents, like the Business License and Articles of Association, professionally verified and translated ensures a smooth qualification process.

Step 3: Operational Integration – Customs Registration & “Zero-Tariff” Management

With your company registered and qualified, you must integrate with the customs system to physically utilize the policies.

Key Procedures:

- Customs Registration: As an import-export enterprise, you must register with Haikou Customs, obtaining a unique customs code.

- Electronic Ledger Management: This is the cornerstone of “Zero-Tariff” goods supervision. Instead of handling each shipment as a special tax exemption case, qualified Preferential Entities manage their zero-tariff imports through a dedicated Electronic Customs Ledger. This ledger tracks the flow, storage, and use of these goods within Hainan.

- Understanding the “Two Lines”:

- At the “First Line” (into Hainan): You can import goods from overseas. If the goods are on the expanded Zero-Tariff list (excluding the limited “Import Taxable Goods Catalogue”) and you are a Preferential Entity, you enjoy exemption from import tariff, VAT, and consumption tax. You can download the official Hainan FTP Import Taxable Goods Catalogue for reference.

- Within Hainan: Zero-tariff goods can circulate between Preferential Entities without additional taxes. However, selling them to non-qualified entities or individuals within Hainan requires payment of the deferred import taxes.

- At the “Second Line” (into Mainland China): If you wish to sell zero-tariff goods or products made from them into mainland China, you generally must pay the corresponding import taxes. The major exception is the Processing Value-Added (PVA) Policy: if your Hainan-based encouraged industry enterprise processes imported materials and the added value exceeds 30%, the finished product can enter mainland China tariff-free. The detailed calculation method is outlined in the Customs Announcement [2025] No. 158.

Compliance is Non-Negotiable:

The system is built on trust and smart oversight. Customs employs big data and risk analysis to monitor ledgers. Irregularities can lead to audits, fines, removal from the Preferential Entity list, and even criminal liability for smuggling. Maintaining impeccable internal records that match your customs ledger is essential.

Bringing It All Together: A Checklist for Success

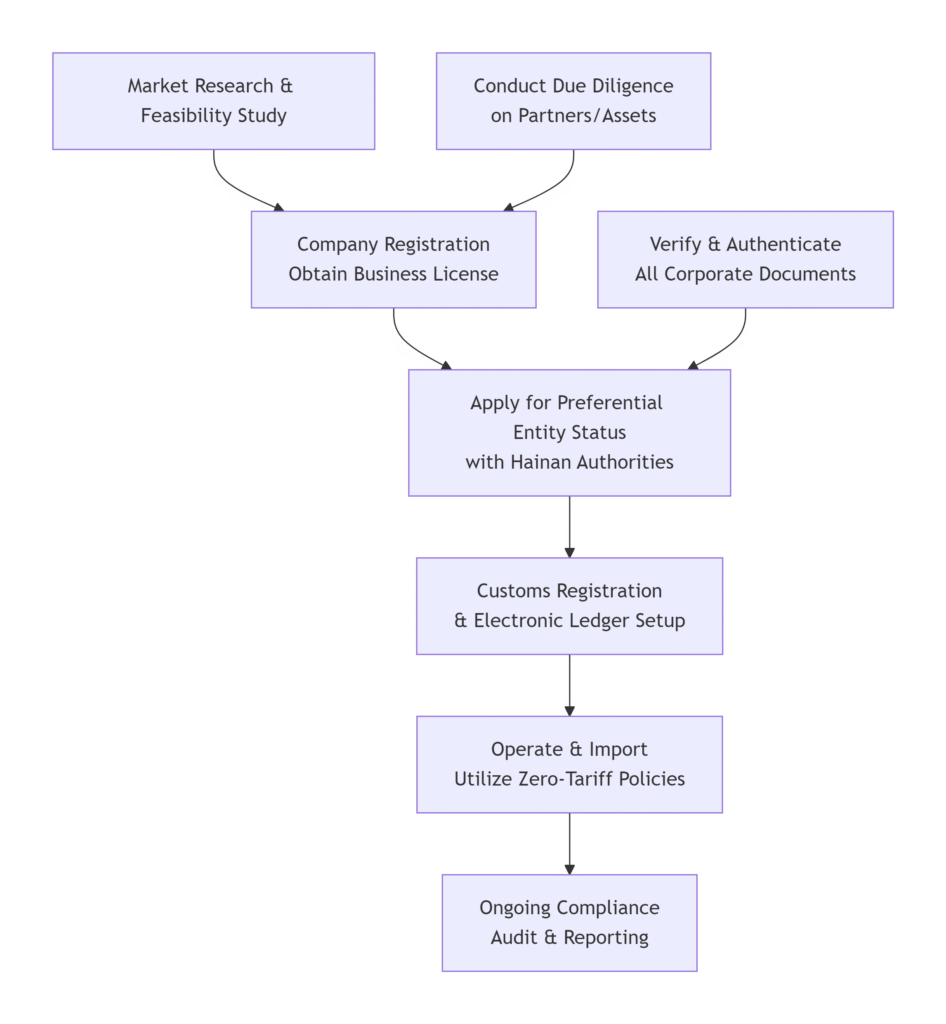

Here’s a simplified visual roadmap for your Hainan FTP setup:

Essential Document Toolkit:

To navigate this process smoothly, having the right official documents at hand is key. We recommend familiarizing yourself with these core policy texts:

- The Core Tax Policy: Notice on Tax Policies for Goods Entering/Exiting the “First Line,” “Second Line,” and Circulating within Hainan FTP (Cai Guanshui [2025] No. 12)

- The Negative List: Hainan FTP Import Taxable Goods Catalogue (Cai Guanshui [2025] No. 13)

- Restrictions List: Hainan FTP List of Prohibited and Restricted Import/Export Goods and Items

Conclusion: Partnering for a Smooth Landing

The Hainan FTP presents a visionary economic experiment. For the savvy investor, its success hinges on meticulous first steps. The policies are designed to be attractive, but the administrative framework demands precision, authenticity, and a deep understanding of regulatory nuances.

From verifying the credibility of a local partner before shaking hands, to ensuring your company’s registered details are perfect for your “Preferential Entity” application, to having your official documents ready for international submission—every step is built on a foundation of verified information.

Navigating a new regulatory landscape doesn’t have to be a solo journey. Partnering with experts who understand both the local Chinese business environment and the needs of international investors can de-risk your venture. Services that provide reliable company verification, document retrieval, and legalization are not just administrative aids; they are strategic investments in your venture’s legitimacy and long-term stability in the Hainan Free Trade Port.

ChinaBizInsight

Your strategic bridge to transparent business in China.