The container ship Pacific Voyager docked in Hong Kong waters under ominous circumstances. Not only was its cargo seized over unpaid fuel bills, but three separate lenders claimed priority over its mortgaged hull. For the German shipping firm that owned the vessel, this cascading creditor conflict triggered a 19-month legal quagmire – evaporating $14.3 million in asset value.

Such scenarios plague global maritime operators. In 2023 alone, 68% of vessel arrests in Asia stemmed from competing creditor claims, with Hong Kong emerging as a hotspot for cross-border enforcement clashes. At the heart of these disputes lies a critical question: When multiple creditors chase limited assets, who gets paid first?

The Hierarchy of Claims: Hong Kong’s Legal Framework

Hong Kong’s Companies Ordinance (Schedule 9, Part 1) establishes a strict creditor hierarchy. Recent amendments to Section 265(6) refined the definition of a “關鍵公司” (controlling company), directly impacting maritime lien priorities:

- Maritime Liens (top priority):

- Crew wages

- Salvage claims

- Collision damages

- Why they lead: These claims preserve the vessel’s immediate operational safety.

- Registered Ship Mortgages:

- Must be filed with Hong Kong’s Shipping Register

- Priority follows registration chronology (“first in time, first in right”)

- Statutory Claims:

- Port dues

- Environmental penalties

- Unsecured Creditors:

- Ship chandlers

- Insurers

- Trade creditors

The 2012 amendment replacing “控股公司” (holding company) with “控權公司” (controlling company) expanded courts’ authority to pierce corporate veils when foreign parent companies manipulate asset ownership.

Hong Kong vs. Global Rules: The Divergence Trap

Unlike the relatively harmonized U.S. system (where maritime liens always trump mortgages), Hong Kong adopts a hybrid approach blending UK common law and local statutes. Consider these critical divergences:

| Jurisdiction | Mortgage Priority | Maritime Lien Scope | Enforcement Speed |

|---|---|---|---|

| Hong Kong | Registration date | Narrow (4 categories) | 6-18 months |

| United States | Maritime liens first | Broad (includes torts) | 3-9 months |

| United Kingdom | Mortgages rank equally | Moderate | 9-24 months |

Real-world consequence: A mortgage valid in Singapore may become subordinate to salvage claims when enforced in Hong Kong – a pitfall that ensnared 23 vessels in 2022.

The 2023 Surge: Why Shipping Faces Maximum Risk

Maritime cross-claims skyrocketed post-pandemic, driven by three converging trends:

- Fleet overcapacity: Global container ship capacity grew 4.5% in 2023 while demand stagnated, squeezing operators’ cash flow.

- Debt rescheduling gaps: 41% of Asian shipowners restructured loans without updating mortgage registrations.

- Jurisdiction shopping: Creditors increasingly target Hong Kong for its creditor-friendly enforcement, with vessel arrests up 31% YoY.

Industry data reveals alarming exposure:

- Tanker operators: 58% of claims involve bunker fuel liens

- Container lines: 32% stem from terminal service disputes

- Offshore support: 67% relate to unpaid crew wages

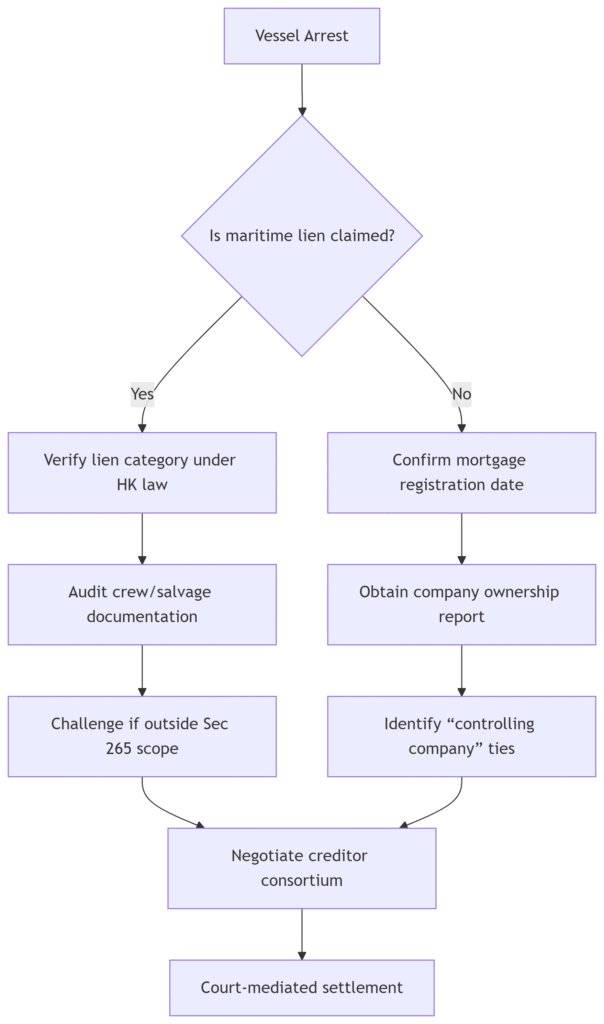

Decision Tree: Resolving Ship Mortgage Conflicts

When facing competing claims, follow this evidence-based pathway:

Pro tip: Over 80% of cases settle at Stage I when creditors receive verified company ownership structures and debt sequencing evidence.

Shield Your Assets: Due Diligence Imperatives

Preempting priority wars requires three layers of protection:

- Pre-transaction verification:

- Obtain audited Hong Kong Company Reports confirming unencumbered assets

- Cross-check Ship Register filings against corporate records

- Continuous monitoring:

- Track changes to controlling interests under amended Sec 265(6)

- Automated alerts on new creditor registrations

- Enforcement preparedness:

- Maintain lien/subordination agreements in English and Chinese

- Preserve timestamped evidence of claim communications

“The difference between senior and junior creditors isn’t just about contracts—it’s about who proves their claim fits Hong Kong’s hierarchy puzzle.”

– Marine Finance Specialist, Hong Kong High Court

The Path to Certainty

In maritime finance, uncertainty sinks fortunes. While Hong Kong offers efficient enforcement, its unique priority rules demand hyperlocal expertise. By combining rigorous due diligence (like verifying “controlling company” relationships) with proactive registration strategies, operators can transform creditor conflicts from existential threats into manageable contingencies.

Those who navigate these waters successfully don’t just survive creditor battles—they turn priority hierarchies into competitive advantages.

ChinaBizInsight

Your strategic bridge to transparent business in China.