Understanding who holds real power in a Chinese company is crucial for any foreign business seeking reliable partners, securing investments, or enforcing contracts. While official documents prominently feature the Legal Representative, the true decision-maker is often the hidden Actual Controller. Confusing these roles can lead to significant risks. This guide demystifies these key positions, explains how to identify them, and highlights why this knowledge is non-negotiable for successful dealings in China.

The Legal Representative: The Public Face & Legal Linchpin

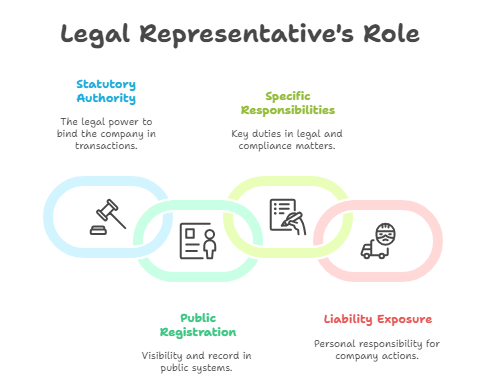

The Legal Representative (法定代表人 – Fǎdìng Dàibiǎorén) is defined under Article 10 of China’s Company Law (2024 Revision). This individual is legally mandated to act on behalf of the company, wielding significant authority:

- Statutory Authority: They are the only person authorized by law to legally bind the company in major transactions, contracts, and legal proceedings. Their signature is often essential.

- Public Registration: Their name is prominently displayed on the company’s business license (营业执照) and recorded in the National Enterprise Credit Information Publicity System (NECIPS – 国家企业信用信息公示系统). This makes them the easiest figure to identify.

- Specific Responsibilities: Key duties include signing important documents, representing the company in court or arbitration, applying for registrations/changes, and reporting compliance matters to authorities.

- Liability Exposure: Crucially, the Legal Representative bears significant personal liability. They can be subject to administrative penalties (fines, entry onto失信名单 – Dishonesty Blacklist), restrictions on high-speed travel or luxury consumption, and even criminal liability for company violations like tax evasion or environmental breaches. This is a major risk, especially if they aren’t the true controller.

The Legal Representative is typically the Chairman of the Board (董事长), Executive Director (执行董事), or General Manager (经理), as stipulated in the company’s Articles of Association (公司章程).

The Actual Controller: The Hidden Power Behind the Throne

The Actual Controller (实际控制人 – Shíjì Kòngzhì Rén) is defined under Article 265 of the Company Law. This is the entity or individual who, while not necessarily holding a formal position or being publicly registered, exercises de facto dominant control:

- De Facto Control: They exert decisive influence over the company’s management decisions, financial policies, operational strategies, and appointment of key personnel (including the Legal Representative and directors).

- Complex Structures: Control is often exercised indirectly through complex webs:

- Shareholding Pyramids: Controlling a parent company that owns the target company.

- Voting Agreements: Agreements with other shareholders to vote collectively.

- Trust Arrangements: Holding shares via nominee arrangements or trusts.

- Family Ties: Dominant influence through family members in key positions.

- Informal Influence: Significant sway through historical ties, financing relationships, or political connections.

- Opacity: Identifying the Actual Controller is notoriously difficult. They may not appear on the NECIPS report, business license, or basic shareholder registry. Deeper investigation is essential.

- Strategic Importance: Understanding the Actual Controller reveals the true source of power, strategic direction, risk tolerance, and ultimate beneficiaries. They drive long-term vision and critical deals.

Why Confusing the Two is a Major Business Risk

Relying solely on the Legal Representative is a recipe for problems:

- Misjudging Decision-Makers: Assuming the Legal Representative has final approval on major deals can lead to stalled negotiations or repudiated agreements if the Actual Controller disagrees. You negotiated with the wrong person.

- Hidden Conflicts of Interest: The Actual Controller might prioritize the interests of other entities they control over the company you’re dealing with, harming your interests.

- Enforcement Difficulties: If a dispute arises, enforcing judgments or arbitration awards against the Actual Controller’s personal assets or other holdings they control is complex if they shielded themselves legally. The Legal Representative, while liable, might lack significant personal assets.

- Reputational & Compliance Risks: The Actual Controller might be involved in unethical practices elsewhere, exposing your company to association risks. Sanctions against the Actual Controller can cripple their companies.

- Due Diligence Failure: Overlooking the Actual Controller means failing to understand the true governance and risk profile of your potential partner or acquisition target. This is a fundamental due diligence gap.

How to Identify the Actual Controller: Going Beyond the Surface

Uncovering the Actual Controller requires proactive investigation:

- Analyze NECIPS Reports Deeply: While the basic report lists shareholders and the Legal Rep, scrutinize:

- Shareholder Structure: Look beyond the immediate layer. Who owns the major shareholders? Are there investment entities or holding companies? Use the “Shareholder & Contribution Info” section as a starting point.

- Major Changes: Track significant changes in shareholders, directors, supervisors, and Legal Rep. Sudden shifts can signal a change in Actual Control.

- Review Articles of Association: These may contain clauses revealing special voting rights, board appointment powers, or veto rights granted to specific shareholders or individuals – potential indicators of control.

- Search Corporate Filings: Look for announcements about controlling shareholders or Actual Controllers, especially for larger companies or listed entities (where disclosure is stricter).

- Examine Public Procurement & Bidding Records: Winning bidders often disclose ownership structures. Check records involving the company or its suspected parent entities.

- Leverage Specialized Reports: Basic NECIPS reports are insufficient. Opt for deeper investigations:

- Professional Enterprise Credit Reports: Provide enhanced ownership mapping and background checks on key figures. (ChinaBizInsight Professional Report).

- Executive Risk Reports: Focus on key personnel (Directors, Supervisors, Senior Managers – 董监高), revealing their network of affiliations, investments, and associated risks. This network often points towards the Actual Controller. (ChinaBizInsight Executive Report).

- Consult Experts: Engage professionals with expertise in Chinese corporate structures, due diligence, and access to specialized databases.

Key Differences at a Glance

| Feature | Legal Representative (法定代表人) | Actual Controller (实际控制人) |

|---|---|---|

| Definition | Statutory representative legally authorized to act for the company. | Entity/person exercising de facto dominant control. |

| Visibility | Publicly registered, named on license & NECIPS. | Often hidden; not publicly disclosed in basic records. |

| Basis of Power | Law and Company Registration. | Ownership structure, voting rights, agreements, influence. |

| Key Role | Legally bind the company; represent externally. | Set strategy, control finances, appoint key leaders. |

| Liability | High personal liability for company actions/omissions. | Limited direct legal liability (unless proven malfeasance), but ultimate power. |

| Identification | Easily found on basic company documents & NECIPS. | Requires deep due diligence: ownership tracing, executive reports, expert analysis. |

Protecting Your Business: The Imperative of Due Diligence

For any significant engagement with a Chinese company – partnership, investment, major contract – understanding the distinction and relationship between the Legal Representative and the Actual Controller is paramount. Relying solely on the public face is inadequate and risky.

Comprehensive due diligence is your shield. This means going beyond the basic business license and surface-level credit reports. Invest in:

- Detailed Ownership Mapping: Unravel complex shareholder structures.

- Executive Background Checks: Understand the network and history of key figures.

- Analysis of Corporate Changes: Identify shifts indicating control changes.

- Professional Verification: Ensure the authenticity of provided documents. Official reports retrieved from the NECIPS and properly authenticated via Apostille or Legalization are crucial for legal certainty abroad.

By identifying the true source of power – the Actual Controller – you gain critical insights into the company’s stability, reliability, and alignment with your interests. This knowledge empowers better negotiation, informed risk assessment, and stronger contractual safeguards, forming the bedrock of successful and secure business relationships in China.

Don’t settle for the surface. Know who truly holds the reins.

ChinaBizInsight

Your strategic bridge to transparent business in China.