Introduction

When engaging in business with Chinese state-owned enterprises (SOEs), due diligence is not just a best practice—it’s a necessity. Central SOEs are among the most influential and strategically important entities in China’s economy. However, verifying their legitimacy, financial health, and operational credibility can be challenging for international partners. This guide provides a clear, step-by-step approach to help you verify a Chinese central SOE confidently.

Why Verify a Chinese Central SOE?

Chinese central SOEs are large, government-controlled corporations that play a critical role in key industries such as energy, telecommunications, infrastructure, and defense. While they often represent stable and reliable partners, it’s essential to confirm their legal status, financial standing, and compliance history to mitigate risks.

Common challenges faced by international businesses include:

- Lack of transparency in publicly available information.

- Language and regulatory barriers.

- Difficulty accessing authoritative, up-to-date data.

Verification helps you:

- Avoid fraudulent entities.

- Ensure compliance with international and local regulations.

- Make informed decisions based on reliable data.

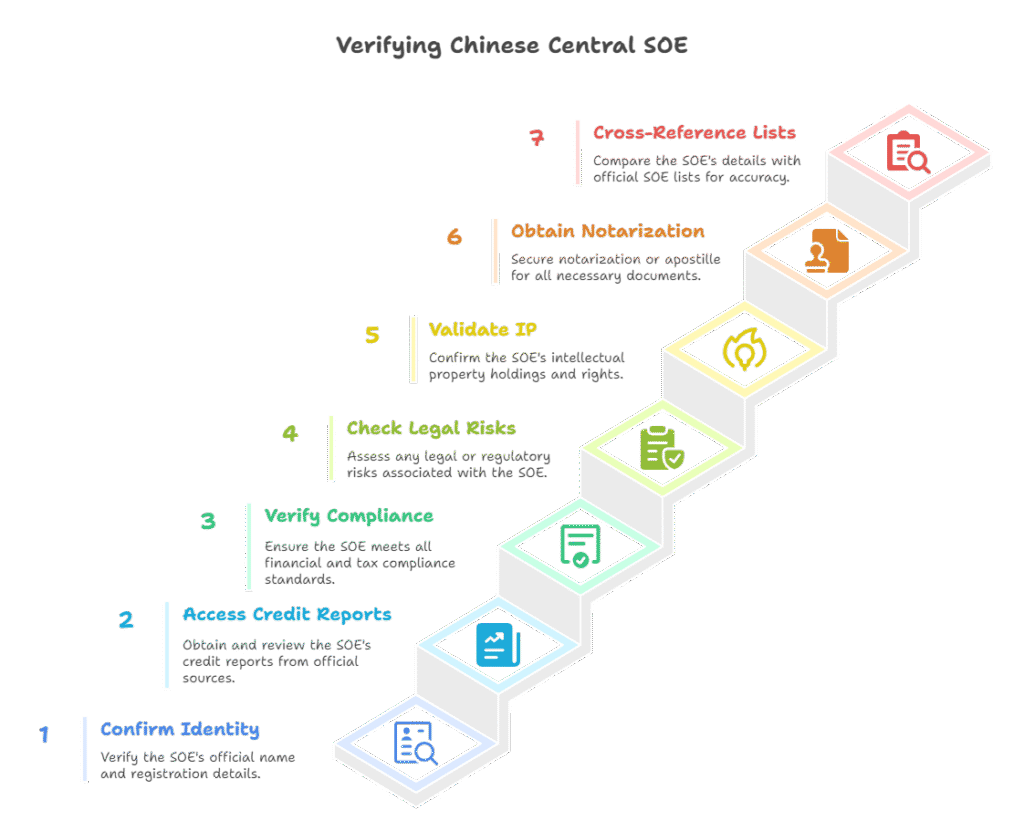

Step 1: Confirm the SOE’s Identity

Start by verifying the company’s official name and registration details. China’s National Enterprise Credit Information Publicity System (NECIPS) is the primary source for authentic business registration information. Here’s how to use it:

- Visit the official NECIPS website (http://www.gsxt.gov.cn).

- Enter the company’s Chinese name or its Unified Social Credit Code.

- Review the basic registration details, including:

- Legal representative

- Registered capital

- Business scope

- Shareholding structure

Tip: If you’re unsure about the Chinese name, cross-reference with official lists, such as the latest catalog of China’s central SOEs.

Step 2: Access Official Enterprise Credit Reports

The Enterprise Credit Information Publicity Report, available through NECIPS, provides a comprehensive overview of a company’s legal and operational status. This document includes:

- Historical changes to registration details.

- Administrative penalties or violations.

- Annual reports and社保 (social security) payment records.

For a more detailed analysis, consider ordering a Customized Enterprise Credit Report, which integrates data from multiple authoritative sources to cover:

- Legal disputes

- Financial performance

- Operational risks

- Intellectual property holdings

Step 3: Verify Financial and Tax Compliance

For a deeper understanding of an SOE’s financial health, review its financial and tax records. Key documents include:

- Annual financial reports

- Tax compliance certificates

- Invoice records (for supplier verification)

These documents are particularly useful for assessing the company’s stability and reliability. Services like our Financial and Tax Enterprise Credit Report provide structured, English-language summaries of these complex records.

Step 4: Check for Legal and Regulatory Risks

Chinese SOEs are subject to strict regulatory oversight. To ensure your potential partner has a clean record, check:

- Administrative penalties via NECIPS.

- Litigation history through local court databases.

- Customized risk reports that highlight legal exposures.

Our Executive Risk Report offers insights into the backgrounds of key executives, including their involvement in other businesses and historical risk incidents.

Step 5: Validate Intellectual Property Holdings

Many SOEs hold valuable patents, trademarks, or copyrights. Verify these assets through:

- China National Intellectual Property Administration (CNIPA) for patents and trademarks.

- Customized IP reports that summarize registrations and disputes.

Step 6: Obtain Notarization or Apostille for Documents

If you plan to use Chinese-sourced documents internationally, you’ll likely need notarization or an Apostille. Steps include:

- Having documents notarized by a local Chinese notary office.

- Submitting them to the Chinese Foreign Affairs Office for authentication.

- For Hague Convention countries, obtaining an Apostille.

We offer end-to-end Apostille and Legalization Services to streamline this process.

Step 7: Cross-Reference with Official SOE Lists

To ensure the company you’re verifying is indeed a central SOE, cross-reference it with official directories. For example, the State-Owned Assets Supervision and Administration Commission (SASAC) publishes an updated list of central SOEs.

📥 Download the latest list of China’s 100 Central State-Owned Enterprises here.

Why Use a Professional Verification Service?

While some information is publicly available, language barriers, complex processes, and the need for certified documents can make verification daunting. Professional services like ours offer:

- English-language reports tailored to international standards.

- Access to authoritative data sources.

- Expertise in navigating Chinese regulatory systems.

- Time and cost efficiency.

For example, our Official Enterprise Credit Report provides a verified, English-language summary of a company’s legal and operational status, saving you hours of research.

Conclusion

Verifying a Chinese central SOE requires careful attention to detail and access to reliable data sources. By following this step-by-step guide, you can minimize risks and build successful partnerships in China.

For those who prefer a streamlined approach, our services provide comprehensive, authoritative, and English-friendly verification reports. Feel free to explore our service options or contact us for personalized assistance.

ChinaBizInsight

Your strategic bridge to transparent business in China.