When considering partnerships, investments, or any form of collaboration with a Chinese Central State-Owned Enterprise (SOE), conducting thorough due diligence is not just recommended—it’s essential. Chinese SOEs are major players in the global economy, often leading critical industries from energy and telecommunications to infrastructure and manufacturing. However, their unique structure, close government ties, and often complex corporate histories require a specialized approach to due diligence.

This guide will walk you through the key steps and considerations for performing effective due diligence on a Chinese Central SOE, helping you mitigate risks and make informed decisions.

Why Due Diligence on Chinese SOEs Is Different

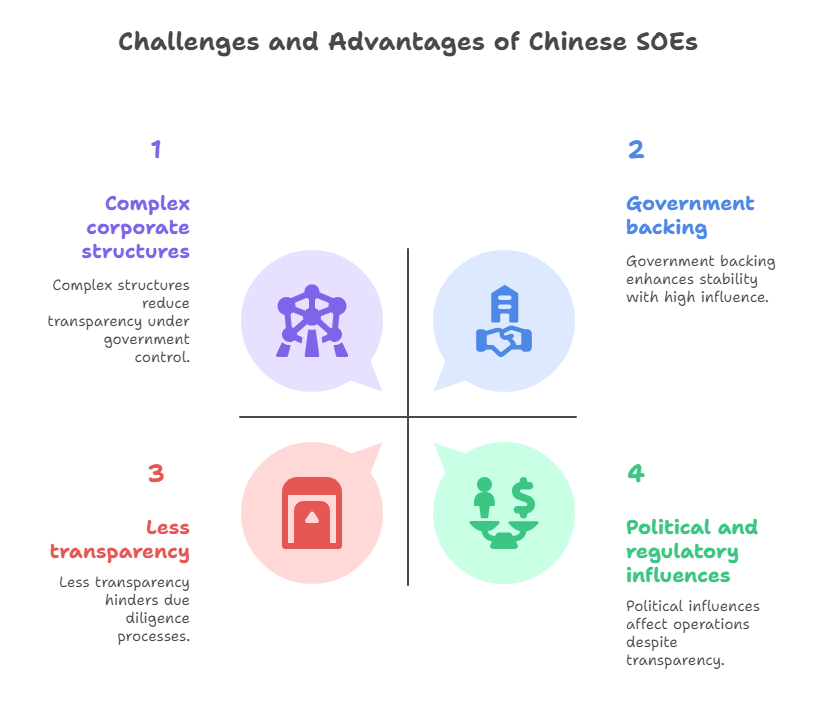

Unlike privately-owned companies, Chinese SOEs are owned or controlled by the central government. This brings both advantages and challenges:

- Government backing often means stability and resource access.

- Less transparency compared to publicly-listed companies.

- Complex corporate structures with multiple subsidiaries and affiliates.

- Political and regulatory influences that may affect business operations.

Therefore, a standard due diligence process may not be sufficient. You need to dig deeper.

Key Areas to Investigate

1. Official Business Registration and Credit Information

Start with the basics. Verify the company’s legal existence and official registration details. In China, the National Enterprise Credit Information Publicity System (NECIPS) is the primary source for such data. An official Enterprise Credit Report provides:

- Business registration status

- Registered capital and paid-in capital

- Shareholders and directors

- Historical changes

- Annual reports

- Administrative penalties and legal records

This report is the foundation of any due diligence process. It helps confirm the company’s legitimacy and provides a snapshot of its compliance history.

💡 Tip: Always ensure the report is issued by an official source and includes government stamps or digital watermarks.

2. Financial Health and Tax Compliance

While SOEs may not disclose financials as openly as public companies, there are ways to assess their financial health:

- Annual reports filed with the State Administration for Market Regulation (SAMR)

- Tax compliance records available through official channels

- Credit ratings from licensed Chinese credit agencies

For a deeper dive, consider a Financial and Tax Specialized Report, which includes insights into:

- Financial statements (if available)

- Tax payment history

- Invoice records and supplier relationships

- Debt and credit lines

This type of report is especially useful for evaluating financial stability and operational transparency.

3. Legal and Regulatory Risk Assessment

Chinese SOEs operate under strict regulatory oversight. Key areas to check include:

- Litigation history: lawsuits, arbitration, and enforcement actions

- Administrative penalties: fines or sanctions from government agencies

- Intellectual property: trademarks, patents, and copyrights

- Environmental and industry-specific compliance

A Professional Enterprise Credit Report can provide a detailed overview of these aspects, helping you identify red flags before they become deal-breakers.

4. Leadership and Key Personnel Background Checks

The people behind the company matter. Investigate the backgrounds of directors, supervisors, and senior executives. Look for:

- Other directorships or shareholdings

- Legal disputes or personal risk records

- Professional qualifications and experience

A Director and Executive Risk Report can reveal hidden risks related to key decision-makers, such as involvement in problematic businesses or legal issues.

5. Ownership Structure and Subsidiaries

Many SOEs have intricate ownership networks. Identify:

- Parent companies and ultimate controllers

- Subsidiaries, affiliates, and joint ventures

- Cross-shareholding arrangements

Understanding the corporate tree helps you assess potential contagion risks and evaluate the true scale of the enterprise.

Step-by-Step Due Diligence Process

- Define Your Objectives: Are you evaluating a partnership, investment, or supply chain relationship? Your goal will shape the depth of due diligence.

- Gather Official Documents: Obtain the company’s business license, credit report, and other publicly available records.

- Analyze Financials: Review annual reports, tax records, and—if possible—audited financial statements.

- Check Legal Records: Search for litigation, penalties, and regulatory violations.

- Verify Key Personnel: Conduct background checks on executives and major shareholders.

- Assess Market Reputation: Look for news coverage, industry reviews, and public sentiment.

- Validate Findings with Multiple Sources: Cross-reference information from official databases, third-party reports, and trusted media.

How We Can Help

At ChinaBizInsight, we specialize in providing accurate, English-language business intelligence and due diligence reports for companies operating in or with China. Our services include:

- Official Enterprise Credit Reports

- Customized Due Diligence Reports (Standard, Professional, and Financial & Tax versions)

- Executive Background Checks

- Legal and Intellectual Property Verification

- Document Authentication and Apostille Services

We understand the challenges international businesses face when dealing with Chinese SOEs. That’s why we offer comprehensive, reliable, and easy-to-understand reports that support your decision-making process.

For example, our Professional Enterprise Credit Report covers 11+ dimensions of risk and operations, giving you a 360-degree view of the target company.

Free Resource: China’s Central SOE Top100 List

To help you get started, we’ve compiled a current List of China’s 100 Central State-Owned Enterprises. This list includes the largest and most influential SOEs under the central government’s control.

Final Thoughts

Due diligence on a Chinese Central SOE requires a blend of local knowledge, access to official data, and an understanding of China’s regulatory environment. By focusing on the areas outlined in this guide, you can reduce uncertainty and build a foundation of trust with your Chinese counterparts.

If you’re looking for a reliable partner to help you navigate this process, feel free to explore our commercial due diligence reports or contact us for a consultation.

ChinaBizInsight

Your strategic bridge to transparent business in China.