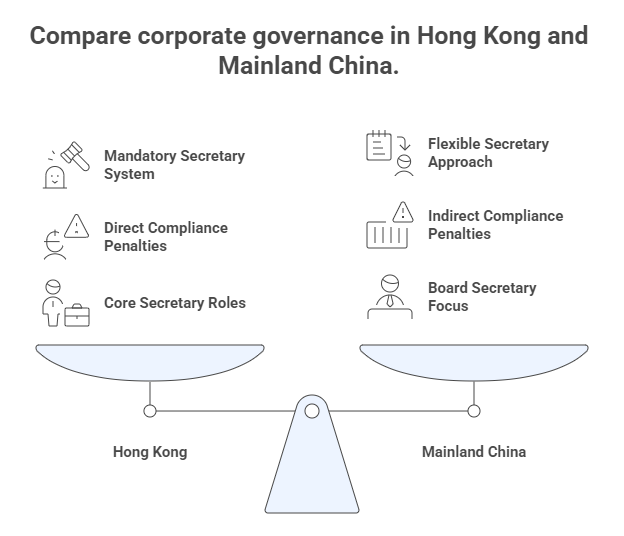

Corporate governance structures vary significantly across jurisdictions, and one of the most striking contrasts lies in the company secretary requirements between Hong Kong and Mainland China. For multinational businesses operating in both regions, understanding these differences is critical to maintaining compliance and avoiding legal pitfalls.

1. The Fundamental Divide: Mandatory vs Optional Systems

Hong Kong’s Mandatory Regime (Section 474 of HK Companies Ordinance)

Under Hong Kong law, every incorporated company must appoint a company secretary at all times (Section 474(1)). Key features:

- Qualifications: Must be a Hong Kong resident (individual) or have a registered office/local place of business (corporate entity) (Section 474(4)).

- Timing: The first secretary must be named in the incorporation documents (Section 474(2)).

- Sole Director Limitation: A sole director cannot simultaneously serve as secretary (Section 475(2)), preventing conflicts of interest.

Mainland China’s Flexible Approach

Unlike Hong Kong, Mainland China does not legally require companies to appoint a company secretary. However:

- Listed companies on Chinese stock exchanges (e.g., SSE/SZSE) must appoint a board secretary under CSRC rules.

- Private companies often designate an administrative officer to handle compliance, but this lacks statutory backing.

Governance Impact: Hong Kong’s mandatory system ensures continuity in regulatory filings, while Mainland’s flexibility may lead to compliance gaps in unlisted firms.

2. Consequences of Non-Compliance: Legal Risks Compared

Hong Kong’s Enforcement Framework

- Registrar’s Directives (Section 476): The Companies Registry may issue formal notices demanding secretary appointments within 1–3 months. Failure to comply triggers fines up to HKD 100,000 (Level 6) + daily penalties (HKD 2,000/day).

- Operational Disruption: Banks and regulators may freeze transactions if corporate records lack secretary certifications.

Mainland China’s Indirect Penalties

While no direct penalties exist for lacking a secretary:

- Listed companies face CSRC sanctions for non-compliant board secretaries.

- Administrative penalties apply for missed filings (e.g., SAIC fines for late annual reports).

Case Example: A Hong Kong subsidiary of a European firm faced HKD 48,000 in cumulative fines for delayed secretary appointment, while its Shanghai WFOE incurred no secretary-specific penalties despite similar lapses.

3. Functional Roles: Beyond Administrative Duties

Hong Kong Secretary’s Core Responsibilities

- Maintaining statutory registers (members, directors, charges).

- Organizing AGMs and filing annual returns (NAR1).

- Ensuring compliance with the Companies Ordinance and Listing Rules (for public companies).

Mainland China’s Board Secretary (for Listed Companies)

- Disclosing financial reports per CSRC guidelines.

- Coordinating shareholder meetings under the Company Law (Art. 129).

- Managing insider trading compliance.

Practical Challenge: Multinationals often mistakenly assume Hong Kong-style secretaries can oversee Mainland operations, risking governance gaps.

4. Strategic Considerations for Businesses

For Companies Operating in Both Jurisdictions

- Dual Compliance Teams: Maintain separate secretaries for Hong Kong and Mainland entities.

- Documentation Audits: Verify that Hong Kong secretaries hold valid certifications (e.g., ICSA membership).

- Centralized Monitoring: Use tools like our Professional Enterprise Credit Report to track director/secretary changes across regions.

For Investors Assessing Partners

- In Hong Kong: Confirm secretary details via the Companies Registry .

- In Mainland China: Rely on official Enterprise Credit Reports to identify de facto compliance officers.

ChinaBizInsight

Your strategic bridge to transparent business in China.