Navigating the complexities of Chinese business partners requires reliable data. The cornerstone of this verification in China is the Official Enterprise Credit Report (OECR), sourced directly from the National Enterprise Credit Information Publicity System (NECIPS). For non-Mandarin speakers, however, this vital document can seem like an impenetrable wall of characters and legal jargon. Understanding its contents is not just helpful – it’s essential for mitigating risk and making informed decisions.

Why the OECR is Your Due Diligence Foundation

Issued by Chinese market regulatory authorities, the OECR is the most authoritative public record of a Chinese company’s legal standing and operational fundamentals. Think of it as a dynamic corporate ID card. Relying solely on a company’s website or marketing materials is risky; the OECR provides government-verified facts. Its credibility stems from its source – it is an official extract from the national registry.

Decoding Key Sections: What Non-Mandarin Speakers Must Focus On

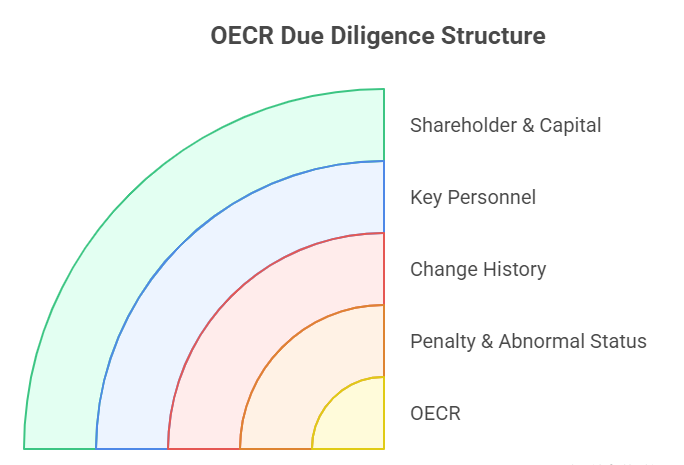

While the report is comprehensive, several sections are particularly critical for assessing risk and legitimacy:

- Basic Registration Information (照面信息):

- Unified Social Credit Code (统一社会信用代码): This 18-digit code is the company’s unique national identifier. Verify it matches other documents. Its presence confirms the company is legally registered.

- Legal Representative (法定代表人): Identifies the individual legally authorized to represent the company. Researching this person’s background is often crucial.

- Registered Capital (注册资本): States the capital pledged by shareholders. Crucially, note whether it’s subscribed (promised) or paid-in (actually deposited). Under the 2024 Company Law, shareholders generally have five years to fully pay subscribed capital. Significant discrepancies between subscribed and paid-in capital, or capital that appears unrealistically high for the industry, can be major red flags.

- Business Scope (经营范围): Lists activities the company is legally permitted to engage in. Ensure your intended partnership falls within this scope. Operations outside this scope are illegal. Phrases like “projects subject to approval by law require relevant permits” indicate regulated activities needing licenses.

- Registration Status (登记状态): Must show “存续” (Cúnxù – Operating/Exist), “在营” (Zàiyíng – In Operation), or “开业” (Kāiyè – Open for Business). Statuses like “吊销” (Diàoxiāo – Revoked), “注销” (Zhùxiāo – Cancelled), or “清算” (Qīngsuàn – In Liquidation) mean the company is defunct or non-operational.

- Registered Address (住所): The official legal address. Cross-check this with any operational addresses provided. A virtual office address, especially one linked to a business secretary company in areas like Qianhai, is common but warrants awareness.

- Shareholder & Capital Contribution (发起人及出资信息 / 股东及出资信息):

- Lists shareholders (individuals or entities) and details their subscribed and paid-in capital amounts, contribution methods (cash, assets), and deadlines. Scrutinize significant unpaid contributions or frequent shareholder changes, which can indicate instability or attempts to obscure ownership. The 2024 Company Law imposes stricter timelines for fulfilling capital commitments.

- Key Personnel (主要人员):

- Identifies Directors (董事), Supervisors (监事), and Senior Management like the General Manager (经理). Understanding who controls the company is vital. Look for overlaps with other companies or connections to high-risk individuals/entities. Frequent changes in key roles can signal internal problems.

- Change History (变更信息):

- Tracks all recorded changes: address, legal representative, registered capital, business scope, shareholders, key personnel, and articles of association. A long history of frequent changes, especially in legal rep or shareholders, can indicate instability, restructuring, or potential attempts to evade liabilities. Always check the date of the latest update – reports become stale quickly in China’s dynamic market.

- Administrative Licensing (行政许可信息):

- Details permits and licenses the company holds, especially for regulated industries (finance, healthcare, education, hazardous chemicals, food, etc.). Verify that all necessary licenses for your specific engagement are present, valid (check expiry dates!), and match the company’s stated activities. Operating without required permits is a severe compliance risk. For example, a report might list a “危险化学品经营许可证” (Wēixiǎn huàxuépǐn jīngyíng xǔkě zhèng – Hazardous Chemicals Operating License), confirming permission to trade in specific chemicals.

- Penalty & Abnormal Status Records (行政处罚信息 / 经营异常信息 / 严重违法信息):

- Administrative Penalties (行政处罚): Records fines or sanctions imposed by government agencies (market regulation, tax, environmental protection, etc.) for violations. The nature, severity, and recency of penalties are critical risk indicators.

- Business Abnormal List (经营异常名录): Companies are listed here for violations like failing to submit annual reports, concealing real registration details, or being unreachable at their registered address. This status severely damages credibility and restricts business activities. Check if the company has been removed and when.

- Serious Violations List (严重违法失信名单): The most severe public blacklist, often for serious fraud, producing fake goods, or systemic violations. Engaging with a company on this list is extremely high-risk. The 2024 Company Law and Information Disclosure Regulations emphasize the public nature of this information.

The Hidden Challenge: Optional Disclosure & Interpretation Nuances

A critical limitation for due diligence is that companies can opt-out of publicly disclosing sensitive financial data (assets, revenue, profits, taxes) and detailed employee numbers within their annual reports submitted to the NECIPS. If these sections show “企业选择不公示” (Qǐyè xuǎnzé bù gōngshì – Company chooses not to disclose), the OECR lacks this depth. This is where deeper due diligence reports become essential.

Furthermore, legal and business terminology in Chinese reports has specific connotations. Terms describing penalties (“罚款” – fine, “警告” – warning), statuses (“吊销” – revoked vs. “注销” – cancelled), or ownership structures carry precise legal meanings that require accurate interpretation to avoid misjudgment.

Beyond Translation: Getting Actionable Insights

Simply translating the characters isn’t enough. Effective due diligence requires:

- Contextual Understanding: Knowing why a particular piece of information (like frequent address changes or a specific penalty type) matters in the Chinese regulatory landscape.

- Verification: Cross-referencing OECR data with other sources where possible.

- Analysis: Identifying patterns (e.g., recurring penalties, rapid shareholder turnover) and potential red flags.

- Expert Interpretation: Leveraging professionals who understand both the language and the underlying business, legal, and regulatory implications. Misinterpreting a status or the severity of a penalty can lead to disastrous decisions.

Your Shortcut to Clarity: Partnering with China Experts

Deciphering Chinese Official Enterprise Credit Reports demands more than language skills; it requires deep local knowledge and constant vigilance regarding regulatory shifts. Attempting this alone, especially without Mandarin fluency, is time-consuming and prone to costly errors.

Partnering with a specialized provider like ChinaBizInsight offers a clear advantage. We provide not only accurate English translations of the OECR but, crucially, expert analysis highlighting the practical implications of the data for your specific business context. We identify red flags, explain nuances, and help you understand the real risk profile behind the raw data. When the standard OECR lacks financial depth (due to optional disclosure), our deeper Professional Enterprise Credit Reports fill the gap.

Furthermore, if your due diligence confirms a partnership and you require Chinese documents for use overseas, navigating the Apostille or legalization process is another complex hurdle we streamline.

Don’t let language barriers and complex regulations obscure your view of potential Chinese partners. Invest in clear, expert interpretation of the Official Enterprise Credit Report – it’s the smartest first step for secure market entry and successful partnerships in China.

ChinaBizInsight

Your strategic bridge to transparent business in China.