The Shadow Game: Why Shell Companies Thrive in Hong Kong

Hong Kong’s strategic location, robust legal framework, and business-friendly policies make it a global commerce hub. Yet these same advantages attract illicit actors exploiting corporate anonymity. Shell companies—entities with no significant assets or operations—often conceal high-risk directors behind layers of nominal shareholders. A 2021 IMF report estimated 21.7% of global shell companies incorporate in Hong Kong, frequently enabling tax evasion, money laundering, and sanctions circumvention.

The solution? Systematic director identity verification. Hong Kong’s Companies Ordinance (Cap. 622) provides tools to pierce this veil—if you know where to look.

Decoding the Register of Directors: Your First Line of Defense (Sections 641-647)

Under Section 641, every Hong Kong company must maintain a Register of Directors at its registered office or a prescribed location. This register is public-facing, allowing stakeholders to request copies (Section 642). Crucially, it must include:

| Data Point | Natural Person | Corporate Director |

|---|---|---|

| Legal Name | Full forename(s), surname, aliases | Corporate name |

| Address | Residential address (withheld)1 + correspondence address | Registered office address |

| ID Proof | HKID/passport number (partially withheld)1 | N/A |

1Sections 644-645 permit redacting residential addresses and full ID numbers for privacy, but verified data exists with regulators.

Critical Gaps & Risks:

- Shell Game Alert: Nominee directors often list virtual offices. Cross-verify addresses against property records.

- ID Masking: Partial ID redaction enables “director rotation” scams—high-risk individuals reappoint themselves under slight name variations.

- Update Delays: Companies have 15 days to report director changes (Section 645). Real-time verification is impossible using the register alone.

Case Example: In 2022, a HK shell firm invoiced €4.3M for fictitious EU exports. Its register listed a “resident director” at a virtual office. Investigation revealed the director was a deceased Malaysian national—their ID had been compromised.

Associate Networks: Unraveling Hidden Control (Section 667)

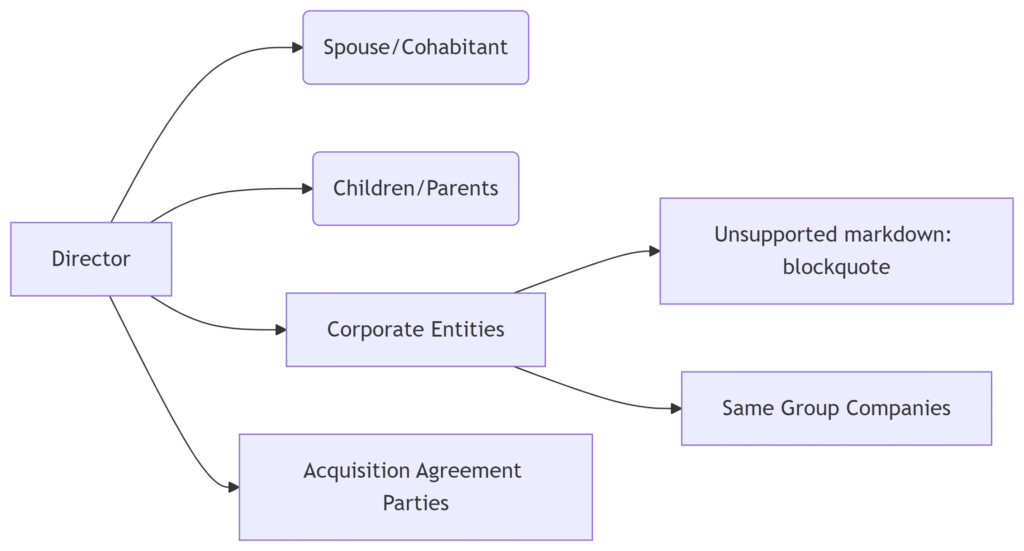

Section 667 defines “associates” as parties with direct/indirect control over a director. This includes:

Multi-Layer Ownership Exposed:

A classic shell structure might look like:

Director A (HK) → Controls Company B (BVI) → Owns 70% of Company C (HK) → Partners with Company D (Singapore)

Though A isn’t listed in C’s register, Section 667 flags them as an “associate” due to:

- Control via BVI entity (≥30% voting power)

- Likely acquisition agreements binding C’s shares

Red Flags from Associate Links:

- Politically Exposed Persons (PEPs): Associates in sanctioned jurisdictions

- Cross-Directorships: Directors sharing board seats in >3 high-risk industries

- Circular Ownership: Entity A owns B, B owns C, C owns A—obscuring true beneficiaries

Case Study: The Section 667 Audit That Uncovered a Sanctions-Busting Scheme

Background: A European bank screened a HK trading firm (“Company X”) applying for a $20M credit line. Initial director checks showed a clean profile.

Section 667 Analysis Revealed:

- Director Y’s spouse controlled a Marshall Islands entity

- That entity held 35% of a supplier to Company X

- The supplier’s actual owner was a sanctioned Russian oligarch (via a Cypriot trust)

Outcome: The credit line was rejected. HK authorities later froze Company X’s assets for evading steel export sanctions.

4 Practical Steps to Mitigate Director Risks

- Cross-Reference Registers

Combine the:

- Register of Directors (Sections 641-642)

- Register of Members (Sections 626-633)

- Annual Returns (Section 662)

Discrepancies in signatures/shareholdings indicate fraud.

- Trace “Associate” Links

Use Section 667 to map:

- Family ties (spouses/children co-holding shares)

- Interlocked companies (>30% shared ownership)

- Hidden acquisition pacts

- Verify ID Authenticity

Submit official access requests to:

- HK Company Registry: For director appointment dates

- Immigration Department: For passport validity checks (with consent)

- Monitor Changes in Real-Time

Track filings via the e-Search Platform—alerts for:

- New director appointments

- Address/name changes

- Liquidation petitions

Beyond the Register: When to Dig Deeper

The Companies Ordinance provides clues—not conclusions. Escalate investigations if directors:

✅ Hold positions in >5 companies simultaneously

✅ Use virtual offices in known shell hubs (e.g., Mong Kok, Sheung Wan)

✅ Have associates in FATF high-risk jurisdictions (Myanmar, Iran, etc.)

✅ Show inconsistent signatures across documents

Pro Tip: Pair HK registry searches with mainland China records. Many shell firms have shadow operations in Shenzhen. A comprehensive China-HK cross-border report can expose hidden subsidiaries.

Conclusion: Anonymity Is a Choice—Transparency Is Yours to Demand

Hong Kong’s registers offer powerful risk intelligence—if decoded methodically. Director checks under Sections 641-647 lay the groundwork, while Section 667 associate mapping reveals the invisible puppeteers. Yet 42% of shell firms dissolve within 12 months (HKCR 2023 data). Speed is critical.

Verify today or litigate tomorrow.

Need actionable insights? Retrieve a verified Hong Kong Company Report with director background checks, shareholder mapping, and real-time regulatory alerts.

ChinaBizInsight

Your strategic bridge to transparent business in China.