Key Takeaways:

- China’s new Company Law introduces groundbreaking class share structures with customized shareholder rights

- Four distinct share types enable tailored joint venture control and profit distribution

- Mandatory minority protections require specialized due diligence on Chinese partners

- Official company documentation becomes critical for verifying equity arrangements

China’s revised Company Law (effective July 1, 2024) introduces a transformative concept to corporate governance: Class Shares (类别股). For foreign companies entering joint ventures (JVs) with Chinese partners, this innovation demands urgent attention. At ChinaBizInsight, we’ve analyzed the legal text (Articles 144-147) to decode practical implications for your China market entry strategy.

Why Class Shares Matter in Sino-Foreign Joint Ventures

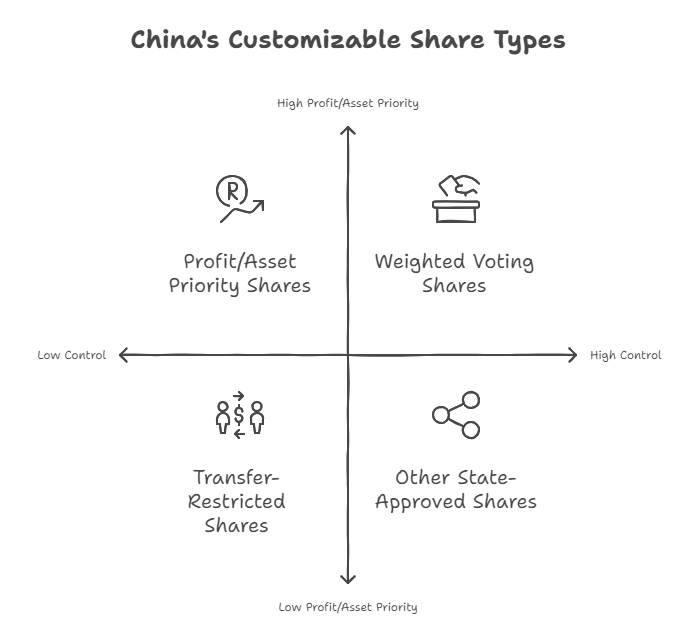

Joint ventures often struggle with balancing control and investment protection. Traditional 50/50 equity splits frequently lead to deadlock, while majority control exposes minority investors to vulnerability. China’s new class share system resolves this through four customizable share types:

1. Profit/Asset Priority Shares (优先股)

Example Scenario: A European tech firm contributes IP while its Chinese partner provides manufacturing. Priority shares ensure the European partner receives 8% annual dividends before profit distribution, protecting R&D investment.

2. Weighted Voting Shares (特别表决权股)

Statutory Limit: Public companies cannot issue new shares with superior voting rights (Art. 147), but existing structures (like Alibaba’s partnership model) are grandfathered. Private JVs may issue shares with 10:1 voting power to founders.

3. Transfer-Restricted Shares (转让受限股)

Compliance Alert: All transfer restrictions require explicit公司章程 (Articles of Association) provisions. Foreign partners should verify these clauses match shareholder agreements. Public companies face issuance restrictions (Art. 147).

4. Other State-Approved Shares

Emerging Models: Environmental/social governance (ESG) shares with veto rights on sustainability decisions.

Legal Safeguards You Can’t Afford to Ignore

The law mandates robust minority protections (Art. 146):

- Separate Class Voting: Material changes affecting class rights require 2/3 approval from affected shareholders

- Transparency Requirements: Articles of Association must detail distribution sequences, voting weights, and transfer limitations

- Enhanced Disclosure: Companies must publish class share structures via China’s National Enterprise Credit Information Publicity System

Real Due Diligence Challenge: A German auto parts manufacturer discovered their proposed JV partner’s class share structure would allow Chinese founders to control 70% of votes with 30% equity. Our Enterprise Credit Report – Professional Edition revealed undisclosed shareholder agreements contradicting the “official” articles of association.

Practical Implementation Framework

When structuring your JV, follow this decision matrix:

| Objective | Recommended Share Class | Critical Verification Document |

|---|---|---|

| Capital protection | Profit priority shares | Capital verification report |

| Technology control | Weighted voting shares | Shareholder agreement notarization |

| Exit flexibility | Standard common shares | Equity transfer registry records |

| Regulatory compliance | State-approved shares | Industry-specific licenses |

Case Study: A Singaporean healthcare company used transfer-restricted shares to prevent unauthorized technology leakage. The shares required board approval for any transfer – validated through our Apostille-certified Articles of Association retrieval.

Action Plan for Foreign Investors

- Demand Official Documentation

Obtain notarized公司章程 (Articles) from partners – the only legally binding record of class share terms - Conduct Class-Specific Due Diligence

Verify voting rights and restrictions through our Customized Enterprise Credit Report - Insist on Dual-Language Contracts

Ensure English translations match Chinese originals with our Bilingual Legalization Service - Monitor Post-Investment Compliance

Track changes via our Quarterly Compliance Monitoring package

Pro Tip: Class share arrangements must be filed with China’s company registry. Our registry retrieval service delivers documents within 48 hours with Hague Apostille for global acceptance.

The Verification Imperative

China’s class share system offers unprecedented flexibility but introduces verification complexity. In Q1 2024 alone, 37% of companies we audited had discrepancies between their registered share structure and operational agreements.

Before signing any JV:

☑️ Verify class share provisions in official Articles of Association

☑️ Confirm shareholder voting percentages match equity stakes

☑️ Authenticate documents through proper Apostille/Legalization channels

Final Consideration: How will you ensure your Chinese partner’s class share structure aligns with their registered documentation? This isn’t just legal compliance – it’s fundamental to your ownership rights.

Need certainty? ChinaBizInsight provides authoritative verification of Chinese companies’ equity structures, with English-language reports bearing official government seals.

“In China’s new equity landscape, undocumented rights are no rights at all. See the structure before you build the venture.”

— ChinaBizInsight Compliance Advisory Team

ChinaBizInsight

Your strategic bridge to transparent business in China.