Discovering that your Chinese business partner has received administrative penalties can trigger immediate concern. Regulatory sanctions range from fines to operational restrictions, directly impacting supply chain continuity, financial stability, and brand reputation. Understanding how to navigate these situations is critical for international companies relying on Chinese suppliers or partners.

The Reality of Administrative Penalties in China

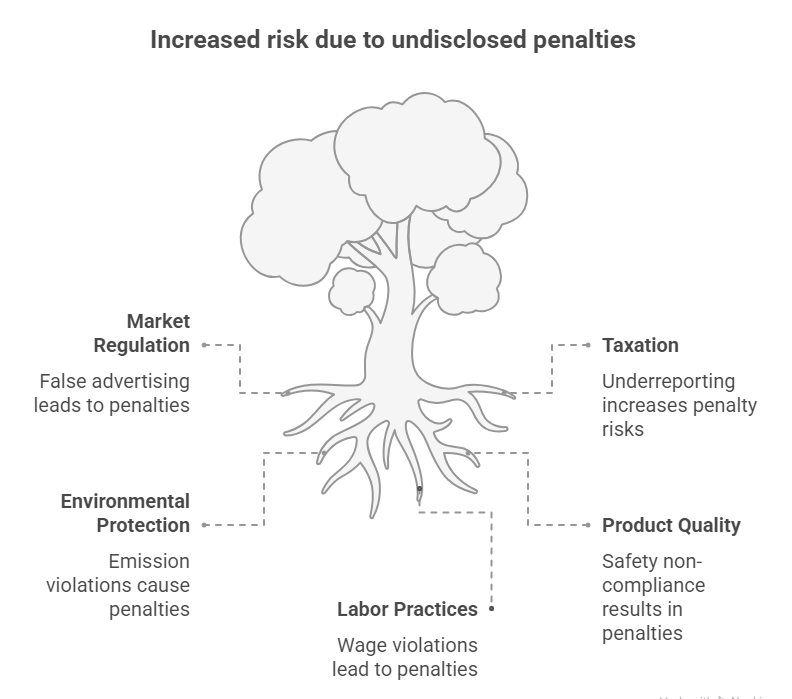

China’s regulatory framework imposes penalties for violations across multiple domains:

- Market Regulation: False advertising, unfair competition

- Taxation: Underreporting, fraudulent filings

- Environmental Protection: Emissions violations, waste mismanagement

- Product Quality: Safety non-compliance, substandard manufacturing

- Labor Practices: Wage violations, workplace safety failures

According to China’s Enterprise Information Publicity Temporary Regulations (2024 Revision), all administrative penalties must be disclosed on the National Enterprise Credit Information Publicity System (NECIPS) within 20 working days. This transparency allows stakeholders to assess partner reliability.

Decoding Penalties: Severity and Implications

Penalties vary significantly in their business impact:

| Penalty Type | Typical Causes | Business Consequences |

|---|---|---|

| Fines | Minor compliance gaps | Short-term financial strain |

| Operations Suspension | Safety violations, pollution incidents | Supply chain disruption |

| License Revocation | Fraud, major regulatory breaches | Partnership termination risk |

| Blacklisting | Repeated violations, unpaid fines | Loss of bidding rights, public shaming |

Example: A Shenzhen petroleum company (shown in our sample credit report) faced license suspension after environmental violations. Foreign buyers faced 3-month shipment delays.

Immediate Steps for Damage Control

1. Verify the Penalty Details

- Obtain the partner’s Official Enterprise Credit Report from NECIPS. Cross-check:

- Penalty amount and effective date

- Regulatory authority involved

- Violation specifics

- Tip: Use English-translated reports to avoid translation errors.

2. Assess Operational and Reputational Risks

- Critical questions:

- Does the penalty affect their production capacity?

- Are violations systemic (e.g., labor abuse) or isolated?

- Is your partner’s industry license at risk?

- Case Study: An EU toy importer discovered a supplier’s child labor fines via a credit report. They halted orders, avoiding a brand scandal.

3. Demand a Corrective Action Plan

- Require:

- Root-cause analysis

- Short-term remediation steps

- Preventative measures (e.g., ISO certification)

- Note: Under the Company Law (2024), Art. 218, companies must publicly disclose rectification progress.

4. Evaluate Continuation Viability

- Red flags demanding exit:

- History of repeated violations

- Penalties exceeding 5% of annual revenue

- Refusal to share compliance documentation

Proactive Prevention Strategies

✅ Pre-Contract Due Diligence

- Always screen partners via Official Enterprise Credit Reports. Key sections to scrutinize:

- Administrative Penalty History

- Operation Abnormalities (经营异常信息)

- Serious Violations (严重违法信息)

- Our Standard Business Credit Report includes 3-year penalty tracking with risk analysis.

✅ Continuous Monitoring

- Set quarterly NECIPS checks or automated alerts for partners.

- Statistic: 68% of penalties recur within 18 months without oversight (China Market Regulatory Annual Report, 2023).

✅ Contract Safeguards

- Include clauses:

> “Partner shall disclose administrative penalties within 48 hours. Failure constitutes material breach.”

> “Repeated violations (≥2 in 24 months) permit unilateral termination.”

Why Transparency Matters More Than Ever

China’s 2024 regulatory reforms demand stricter compliance. Penalties now affect:

- Credit Ratings: Blacklisted firms lose access to loans/public projects

- Global Compliance: EU’s CSDDD and U.S. UFLPA penalize indirect liability

- Investor Confidence: Venture capital firms screen NECIPS data pre-funding

The Bottom Line: Administrative penalties need not end partnerships—but unaddressed violations will. Vigilant monitoring and decisive action protect your operations and ethics.

“In China’s evolving regulatory landscape, visibility isn’t optional—it’s strategic armor.”

ChinaBizInsight

Your strategic bridge to transparent business in China.