For global businesses partnering with Chinese companies, financial transparency isn’t just desirable—it’s critical for risk mitigation. While China’s State Administration of Taxation has strengthened enforcement (collecting ¥1.35 trillion in back taxes in 2023 alone), tax non-compliance remains a concern. Official Enterprise Credit Reports (ECRs) and VAT invoices reveal vital clues when cross-referenced—a due diligence step many international firms overlook. Here’s how to decode these documents:

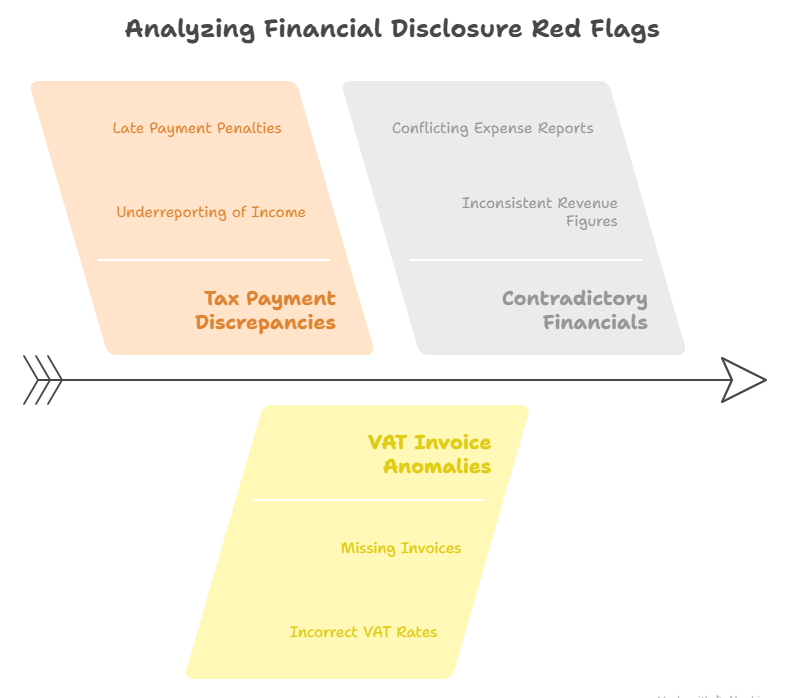

Critical Red Flags in Financial Disclosures

- Tax Payment Discrepancies:

ECRs disclose corporate income tax payments under “Tax Payment Information.” Compare this with VAT invoice volumes. A company reporting ¥10M in annual sales but only ¥200,000 in taxes raises immediate questions.

Example Calculation:Expected Tax = Annual Sales × Industry Avg. Tax Rate (e.g., 25%) Significant Deviation = Red Flag - VAT Invoice Anomalies:

- Mismatched Entity Details: Verify uniformity in company names, tax IDs, and bank accounts across invoices and ECRs. Discrepancies may indicate fake transactions.

- Illogical Sequences: Genuine VAT invoices (发票, fāpiào) have consecutively numbered codes. Gaps or duplicates suggest manipulation.

- Contradictory Financials:

ECRs may list “profitable” status while showing negligible revenue taxes. Similarly, invoices declaring high-value transactions with no corresponding ECR revenue entries signal underreporting.

Case Study: Detecting Inconsistencies

A European machinery importer reviewed a supplier’s ECR and invoices:

- ECR Claim: Annual revenue ¥50M, tax paid ¥1.2M (effective rate: 2.4%)

- VAT Invoices: Showed ¥80M in sales to 5 shell companies (all registered at virtual addresses)

Outcome: Verification revealed unreported revenue streams and tax evasion. The importer terminated the contract, avoiding potential liability.

Proactive Verification Strategies

- Triangulate Data Sources:

Cross-reference ECR tax data with:- VAT invoice amounts

- Industry benchmarks (e.g., average tax rates for manufacturing: 20-30%)

- Public procurement records (if applicable)

- Scrutinize Supply Chains:

Validate VAT invoices of subcontractors. Fraud often occurs through fictitious suppliers. Use Official Enterprise Credit Reports to confirm their operational status and tax compliance. - Monitor Changes:

Sudden drops in ECR-reported taxes without revenue declines warrant investigation. Track quarterly updates via the National Enterprise Credit Information Publicity System (公示系统).

When Evidence Demands Action

If discrepancies emerge:

- Request Clarification: Ask partners for documented explanations.

- Audit Clauses: Ensure contracts mandate third-party audits.

- Report Anomalies: Submit findings to Chinese tax authorities via 12366.cn.

Regulatory Context:

China’s 2024 Company Law (Article 217) mandates accurate financial disclosures. Violations incur penalties up to ¥200,000 and blacklisting.

Why Specialized Verification Matters

Generic financial reviews miss culturally nuanced red flags—like “阴阳合同” (yīnyáng hètóng, dual contracts showing different transaction values). ChinaBizInsight’s Financial & Tax Credit Reports integrate VAT invoice analysis with ECR data, identifying inconsistencies invisible to standard checks. For high-risk engagements, combine with Executive Risk Reports to assess leadership integrity.

Protect your operations—turn document scrutiny into strategic insight.

Verify Chinese partners with confidence →

ChinaBizInsight

Your strategic bridge to transparent business in China.