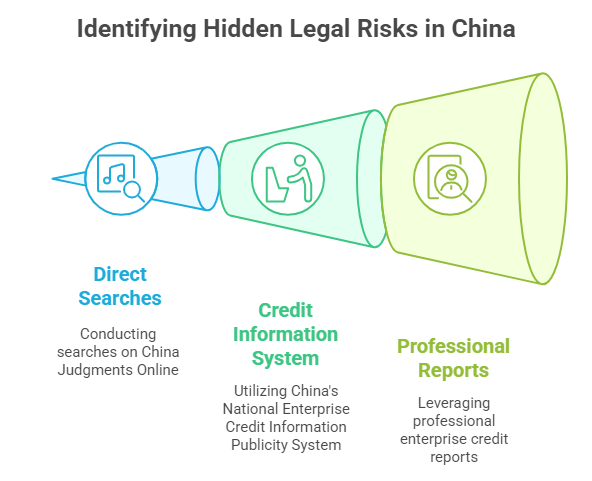

For any international business considering a partnership, investment, or transaction with a Chinese company, uncovering hidden legal risks is paramount. While glossy brochures and promising financial projections paint one picture, Chinese court records often reveal the critical hidden narrative – disputes, defaults, regulatory breaches, and other red flags that could jeopardize your venture. Ignoring these records is like sailing into fog without radar. This guide explores three practical methods to access and interpret these vital legal records, empowering you to make informed decisions.

Why Chinese Court Records Matter for Due Diligence

China’s legal system maintains extensive public records of civil, commercial, administrative, and criminal cases. These records offer invaluable insights into a company’s operational history and potential vulnerabilities:

- Litigation History: Reveals lawsuits involving the company as plaintiff or defendant, indicating potential contract disputes, IP conflicts, debt collection issues, or regulatory non-compliance.

- Enforcement Actions: Shows if the company (or its key executives) has failed to comply with court judgments, leading to enforcement measures like asset freezing, seizure, or inclusion on debtor blacklists (“Dishonest Persons Subject to Enforcement” list).

- Bankruptcy & Restructuring: Indicates severe financial distress or major restructuring events.

- Key Personnel Risks: Exposes legal issues involving executives (Directors, Supervisors, Senior Managers – collectively known as “董监高” or Dōng Jiān Gāo), which can directly impact the company’s reputation and stability.

- Regulatory Penalties: While distinct from court judgments, records of administrative penalties (fines, license revocations) imposed by regulators are often linked within legal databases or credit reports.

Failure to uncover this information can lead to devastating consequences: unexpected liabilities, damaged reputation, severed supply chains, frozen assets, or even becoming entangled in a partner’s legal battles.

Method 1: Direct Searches on China Judgments Online (中国裁判文书网)

- What it is: The official, free public database maintained by China’s Supreme People’s Court (SPC). It hosts millions of court judgments, rulings, and decisions from courts across mainland China.

- How to Access: Visit https://wenshu.court.gov.cn/ (Chinese language only).

- How to Search:

- Keyword Search: Use the company’s Chinese registered name (exact match is crucial) or its Unified Social Credit Code (USCC – 统一社会信用代码).

- Personnel Search: Search the names of key executives (法定代表人, shareholders, directors) using their Chinese ID numbers (if known) for cases directly involving them.

- Filters: Utilize filters for case type (civil, commercial, enforcement), court level, date range, and geographic location.

- Pros:

- Official Source: Directly from the judiciary, offering the highest authenticity.

- Free Access: No cost barrier.

- Comprehensive Scope: Covers a vast majority of published judgments.

- Cons & Challenges:

- Language Barrier: The entire interface and documents are in Mandarin Chinese. Machine translation tools are often inadequate for complex legal terminology.

- Search Complexity: Requires precise Chinese keywords and understanding of the database structure. Partial names or translations rarely work.

- Incomplete Data: Not all judgments are published. Cases involving state secrets, juvenile delinquency, divorce, or certain other sensitive matters are often excluded. Publication can also be delayed.

- Information Overload: Sifting through potentially hundreds of results to find relevant cases is time-consuming.

- Interpretation Difficulty: Understanding the legal nuances, implications, and case outcomes requires deep knowledge of Chinese law and procedure.

- Best For: Researchers fluent in Chinese legal Mandarin with time and expertise to navigate the platform effectively. For most international businesses, this is a starting point but rarely sufficient alone.

Method 2: Leveraging China’s National Enterprise Credit Information Publicity System (NECIPS – 国家企业信用信息公示系统)

- What it is: The government’s primary platform for disclosing basic and regulatory information on all registered enterprises in China. Operated by the State Administration for Market Regulation (SAMR).

- How to Access: Visit http://www.gsxt.gov.cn (Chinese language, limited English interface available).

- Finding Court Records:

- Search by the company’s exact Chinese name or USCC.

- Look for specific sections within the company’s profile:

- 司法协助信息 (Sīfǎ Xiézhù Xìnxī – Judicial Assistance Information): This section lists details about court orders affecting the company, primarily equity freezes (股权冻结 – Gǔquán Dòngjié) and equity pledges (股权出质 – Gǔquán Chūzhì). A freeze indicates active litigation where a court has restricted the transfer of shares, often because the company or its shareholder is a defendant. A pledge shows shares used as collateral, indicating financing but also potential risk if default occurs.

- 行政处罚信息 (Xíngzhèng Chǔfá Xìnxī – Administrative Penalty Information): While not court records per se, these detail significant fines and sanctions imposed by government regulators, indicating serious compliance failures. Look for the enforcing agency and penalty basis.

- 经营异常信息 (Jīngyíng Yìcháng Xìnxī – Abnormal Operations Information): Inclusion on this list often stems from failure to comply with reporting obligations or being unreachable at the registered address – issues that frequently precede or accompany legal troubles.

- 严重违法失信信息 (Yánzhòng Wéifǎ Shīxìn Xìnxī – Serious Violations/Dishonesty Information): This is the most severe public blacklist. Companies listed here (often called “老赖” or Lào Lài – dishonest debtors) have typically failed to comply with court judgments or committed major violations. Key executives may also be listed.

- Pros:

- Official Source: Directly from the primary business regulator.

- Centralized Key Risks: Aggregates critical legal and enforcement flags (freezes, penalties, blacklists) in one place within the company profile.

- Free Access.

- Cons & Challenges:

- Language Barrier: Primarily Chinese interface and content.

- Limited Detail: Provides summaries and basic facts (e.g., “Equity Frozen,” “Listed for Dishonesty”) but rarely includes the full case documents, context, or underlying claims found on the Judgments website.

- Not Exhaustive: Focuses on specific types of enforcement and penalties; doesn’t show the full litigation history like the Judgments website might.

- Interpretation: Understanding the significance of a freeze, penalty, or blacklisting requires context.

- Best For: Getting a quick snapshot of major, active legal/regulatory red flags. It’s an essential check but doesn’t replace deeper investigation. The information found here is a core component of the Official Enterprise Credit Report.

Method 3: Utilizing Professional Enterprise Credit Reports (The Most Effective Solution)

- What it is: Comprehensive due diligence reports compiled by professional service providers like ChinaBizInsight. These reports systematically aggregate and analyze data from official sources like NECIPS, court databases (Judgments Online), and other proprietary or licensed channels, translating and interpreting the findings.

- How it Works:

- You provide the target company’s Chinese name and/or USCC.

- Experts retrieve and analyze data from NECIPS (including Judicial Assistance, Penalties, Abnormal, Dishonesty sections).

- They conduct targeted searches on China Judgments Online using precise Chinese keywords and identifiers.

- They search other relevant legal and regulatory databases (e.g., local court bulletins, enforcement platforms).

- Findings are translated into English (or your required language), summarized clearly, and presented with context and risk assessment.

- Key Sections Covering Legal Risks in Reports:

- Judicial Assistance Information: Detailed listing of equity freezes/pledges.

- Litigation & Enforcement Records: Summaries of major lawsuits (parties involved, case type, outcome, status) sourced from court judgments.

- Administrative Penalties: Details of significant fines and sanctions.

- Abnormal Operations & Serious Dishonesty Listings: Explanation and duration of listings.

- Executive Risk Analysis (Crucial): Dedicated section or report (e.g., Executive Risk Report) revealing lawsuits, enforcement actions, or dishonesty listings involving key personnel (Directors, Supervisors, Senior Managers). This is vital as personal liabilities often impact the company.

- Pros:

- Overcomes Barriers: Eliminates language, navigation, and interpretation hurdles.

- Comprehensive: Aggregates data from multiple official sources into one coherent report, providing a much fuller picture than any single source.

- Context & Analysis: Professionals explain the meaning and potential impact of legal findings, not just list them.

- Time Efficiency: Saves hundreds of hours of manual research.

- Accuracy & Reliability: Reduces the risk of missing critical information due to search errors or incomplete understanding.

- English Language: Reports are delivered in clear, business-ready English.

- Cons:

- Cost: Involves a professional service fee (though often far less than the cost of a bad deal).

- Best For: International businesses, investors, lawyers, and consultants who need reliable, comprehensive, actionable intelligence on Chinese partners’ legal risks efficiently and accurately. It’s the definitive method for thorough due diligence.

Conclusion: Knowledge is Your Best Risk Mitigation

Uncovering legal risks hidden within Chinese court and enforcement records is non-negotiable for safe business engagement in China. While free public databases exist, their practical utility for non-Chinese speakers and those without legal expertise is severely limited. Relying solely on them risks missing critical red flags or misinterpreting findings.

Professional Enterprise Credit Reports, particularly those including specialized Executive Risk Analysis, provide the most efficient, reliable, and comprehensive solution. They transform fragmented, complex Chinese legal data into clear, actionable English intelligence, empowering you to:

- Negotiate from a position of strength.

- Structure deals with appropriate safeguards.

- Avoid partnerships with hidden liabilities.

- Protect your investments and reputation.

Don’t let language barriers or complex systems obscure the legal landscape. Invest in professional due diligence to illuminate hidden risks and pave the way for secure and successful business relationships in China.

Ready to uncover the full legal profile of your Chinese partner? Explore our comprehensive due diligence solutions:

- Gain foundational insights with the Official Enterprise Credit Report.

- Dive deep into legal and operational risks with the Professional Enterprise Credit Report.

- Specifically investigate the background of key decision-makers with the Executive Risk Report.

ChinaBizInsight

Your strategic bridge to transparent business in China.