Exiting the Chinese market used to be a notoriously complex and costly process. Foreign investors often faced bureaucratic hurdles, lengthy timelines, and significant uncertainty when attempting to close down a wholly-owned enterprise (WFOE) or joint venture. Recognizing this barrier to business fluidity, China’s updated legal framework, particularly the 2024 Company Law and revised Enterprise Information Publicity Regulations, introduces significant reforms to simplify company deregistration. Understanding these new exit pathways is crucial for any foreign business operating in China.

Why Streamlined Exit Matters

A clear and predictable exit mechanism is fundamental to a healthy investment environment. Previously, complicated deregistration processes deterred market entry, tied up resources in inactive entities, and created administrative burdens for both companies and regulators. The new rules aim to:

- Boost Investor Confidence: Providing a clear exit strategy reduces perceived investment risk.

- Improve Market Efficiency: Removing “zombie companies” (inactive but legally registered entities) frees up administrative resources and market space.

- Align with International Standards: Simplifying closure brings China closer to practices in major global economies.

Two Key Pathways: Simplified & Administrative Deregistration

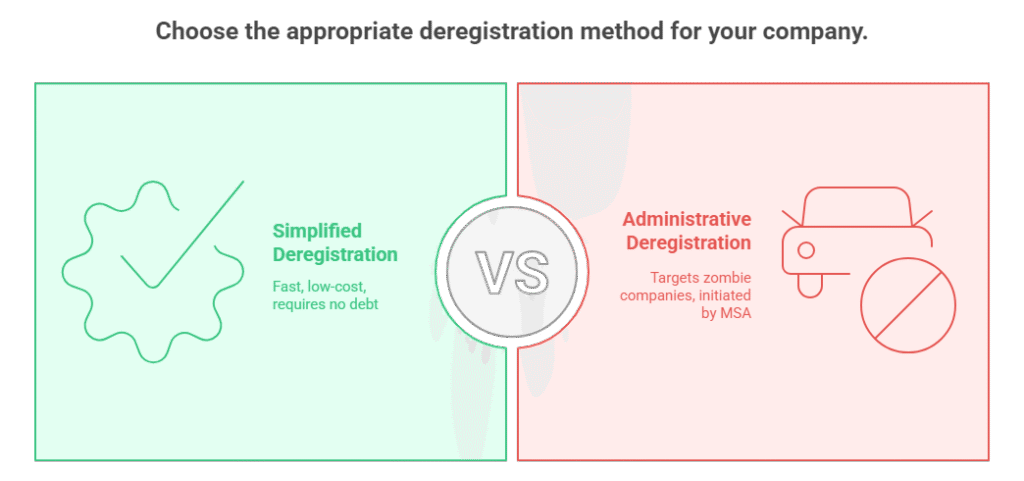

The 2024 reforms establish two primary methods for winding up a company:

- Simplified Deregistration (Article 240, Company Law):

- Eligibility: This fast-track option is available to companies that have incurred no debts during their operation or have fully settled all outstanding debts. Essentially, the company must be financially clear.

- Process:

- Shareholder Commitment: All shareholders must sign a legal commitment confirming the company has no debts or that all debts have been settled. Crucially, shareholders bear joint and several liability if this declaration is false.

- Public Announcement: The company must publish a notice of its intent to deregister via the National Enterprise Credit Information Publicity System (NECIPS). The mandatory announcement period is at least 20 days.

- Application: If no valid objections are raised during the announcement period, the company can apply to the local Market Supervision Administration (MSA) for deregistration within 20 days.

- Advantages: Dramatically faster (potentially within 1-2 months), significantly lower costs, avoids the formal liquidation process and appointing a liquidator.

- Administrative Deregistration (Article 241, Company Law):

- Target: This targets “zombie companies” – entities that have had their business license revoked, been ordered to close, or been nullified but have failed to apply for deregistration themselves within three years.

- Process:

- MSA Initiation: The company registration authority (MSA) can initiate the process.

- Public Announcement: The MSA publishes an announcement on the NECIPS, giving a 60-day period for any interested parties (creditors, shareholders, etc.) to raise objections.

- Deregistration: If no objections are filed within the 60 days, the MSA can proceed to administratively deregister the company.

- Liability Protection: Importantly, this administrative closure does not absolve the company’s original shareholders or liquidation obligors (usually directors) from their legal liabilities incurred before the deregistration. Creditors can still pursue them.

Overcoming Common Deregistration Challenges

Even with simplified procedures, hurdles remain. The 2024 rules address some, but due diligence is critical:

- Debt Settlement & Proof: The core requirement for simplified deregistration is having no debts. Obtaining an Official Enterprise Credit Report from the NECIPS is the primary starting point. This report details registered capital, shareholder contributions, potential penalties, and liens. However, it may not capture all unregistered liabilities. Thorough internal financial audits and creditor notifications are essential. Shareholders must be absolutely certain before signing the commitment.

- Tax Clearance: Obtaining tax clearance certificates from both national and local tax bureaus remains a mandatory step before deregistration. Ensure all filings (final VAT, CIT, IIT) are complete, invoices canceled, and taxes paid. Resolving any historical tax disputes is vital.

- Employee Settlement: All employee contracts must be legally terminated with full settlement of owed salaries, social insurance contributions, housing funds, and statutory severance payments. Labor disputes are a major source of deregistration delays and objections.

- Bank Account Closure: Company bank accounts can only be closed after obtaining preliminary approval from the MSA. Final closure requires the official deregistration certificate.

- Objections During Announcement: If a legitimate creditor objects during the 20-day NECIPS announcement period for simplified deregistration, the process halts. The company must resolve the debt claim (pay or reach agreement) before restarting the simplified process, or it must revert to the formal liquidation process.

Practical Tips for a Smoother Exit

- Start Early: Begin planning and gathering documentation well in advance.

- Verify Liabilities Meticulously: Rely on the official NECIPS report but conduct comprehensive internal checks. Consider professional verification services. Undiscovered debts invalidate the simplified process and expose shareholders.

- Prioritize Tax & Labor Compliance: Resolve these complex areas proactively.

- Maintain Valid Registrations: Ensure your business license, organization code certificate (if still separate), and tax registrations are valid and not expired during the exit process.

- Seek Professional Guidance: Navigating the specifics, especially verifying debt status and ensuring compliance, often requires expertise. Professional services specializing in corporate compliance and deregistration can provide invaluable support and mitigate risks. For verifying a company’s financial standing definitively, obtaining its Official Enterprise Credit Report is the authoritative first step.

Conclusion: A Welcome Step Forward

China’s 2024 deregistration reforms represent a significant and positive shift. The introduction of simplified procedures, particularly for debt-free companies, and the mechanism to clear long-dormant entities administratively, address major pain points for foreign investors. While challenges like comprehensively verifying zero-debt status persist, the new rules provide a clearer, faster, and more predictable framework for closing a business in China. Foreign companies planning their China strategy should factor in these improved exit provisions, understanding the eligibility criteria and necessary due diligence, especially the critical importance of confirming liabilities via official channels before proceeding. For complex cases or verification needs, leveraging professional Company Deregistration Service providers can streamline the journey.

ChinaBizInsight

Your strategic bridge to transparent business in China.