Under China’s newly revised Company Law (effective July 1, 2024), intellectual property (IP) remains a valid form of capital contribution. However, stricter verification and documentation requirements now apply. For foreign investors partnering with Chinese companies or establishing JVs, understanding these rules is critical to mitigate compliance and valuation risks.

Legal Basis for IP Capital Contributions

Article 48 explicitly permits IP (patents, trademarks, copyrights) as non-monetary capital, provided it:

- Is transferable under Chinese law

- Can be fairly valued by licensed assessment institutions

- Does not violate public interest or regulatory restrictions

Article 52 mandates that overvalued IP contributions trigger joint liability for shareholders. If IP valuation exceeds fair market value, contributing shareholders and directors risk personal liability for shortfalls.

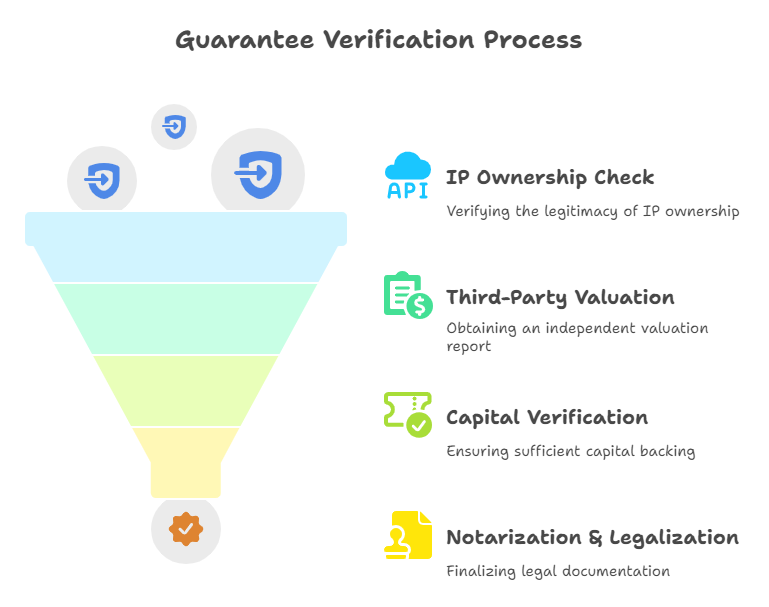

4-Step Verification Process

1. IP Ownership & Transfer Legitimacy

- Confirm registrations with China’s National Intellectual Property Administration (CNIPA).

- Verify transfer agreements are notarized.

Example: A European investor discovered a target company’s “exclusive” patent was co-owned by a university—invalidating its capital valuation.

2. Third-Party Valuation Report

Licensed appraisers (e.g., China United Assets Appraisal Group) must issue reports detailing:

- Valuation methodology (cost, market, or income approach)

- Useful life assessment

- Restrictions (e.g., licensing encumbrances)

Pitfall Alert: Software copyrights often face impairment if core developers leave.

3. Capital Verification Report (验资报告)

CPA firms audit:

- IP ownership transfer completion

- Consistency between valuation and equity issued

- Compliance with Article 47 (5-year capital contribution deadline)

4. Notarization & Legalization

- Domestic Use: Notarize valuation and capital reports by local notary offices.

- Overseas Use: Obtain an Apostille (for Hague members) or consular legalization (non-members).

Critical: Afghanistan, Algeria, and Vietnam require additional commercial declarations (see MFA guidelines).

3 Common Pitfalls & Solutions

❌ Pitfall 1: Inflated Valuations

- Solution: Cross-check valuation with industry benchmarks using tools like our Professional Business Credit Report, which includes IP transaction comparables.

❌ Pitfall 2: Incomplete Transfers

- Solution: Verify CNIPA record updates. Unregistered trademark transfers are void.

❌ Pitfall 3: Unrecognized Documentation

- Solution: Ensure reports bear official notary seals and undergo Apostille certification for cross-border enforceability.

Case Study: Avoiding Liability

A German manufacturer partnered with a Shanghai tech firm contributing software patents valued at ¥20M. Our due diligence revealed:

- Patents were pledged as loan collateral (undisclosed).

- Valuation exceeded recent arm’s-length transactions by 300%.

Result: Shareholders renegotiated equity structure, avoiding Article 52 liability.

Why Verification Matters

- Post-Investment Risks: Overvalued IP = capital shortfalls = shareholder liability (Article 50).

- Dispute Resolution: Courts require notarized verification reports as evidence.

- Exit Barriers: Auditors reject unverified IP during M&A or IPO due diligence.

Partner with Experts

Verifying IP capital contributions demands precision in legal, financial, and regulatory domains. At ChinaBizInsight, we provide:

- IP Ownership Reports: Validate registrations and encumbrances.

- Apostille Services: Legalize documents for 124+ Hague countries.

- Due Diligence Packs: Company Credit Reports with verified IP valuations.

Protect your investment. Verify before you commit.

Contact us for a free consultation on China IP compliance.

Disclaimer: This article explains general rules. Consult legal advisors for entity-specific cases. Valuation methodologies vary by industry (e.g., pharma vs. SaaS).

ChinaBizInsight

Your strategic bridge to transparent business in China.