For global pharmaceutical companies, China represents both enormous opportunity and complex challenges. One critical challenge is navigating the “patent cliff” – the point when originator drugs lose patent protection, opening the door for generic competition and significant revenue decline. Accurately predicting these cliffs in China is essential for strategic planning, portfolio management, and investment decisions. However, accessing reliable Chinese patent expiry data presents unique hurdles.

Understanding China’s Patent Term Calculation

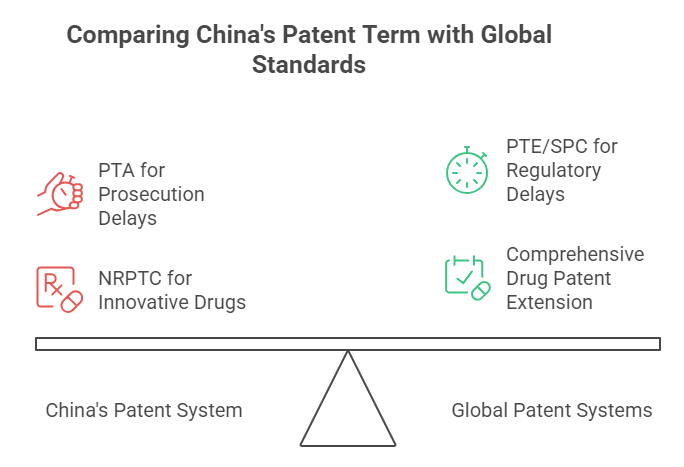

Unlike many jurisdictions where the patent term is a straightforward 20 years from filing, China has specific nuances impacting effective exclusivity periods:

- Standard Term: The baseline is 20 years from the Chinese filing date (or international filing date for PCT entries into China).

- Patent Term Adjustment (PTA): Introduced in the 2021 Patent Law amendments, PTA compensates for unreasonable delays during prosecution. If a patent grant takes more than 4 years from filing and more than 3 years from the request for substantive examination (whichever expires later), the patentee can request compensation for the unreasonable delay days (excluding delays caused by the applicant). The maximum compensation is 5 years.

- Patent Term Extension (PTE) / Supplementary Protection Certificates (SPC): Crucially, China currently lacks a formal Patent Term Extension (PTE) or Supplementary Protection Certificate (SPC) system to compensate for regulatory review time lost during drug approval. This is a major difference compared to the US (PTE), EU (SPC), Japan, and others.

- New Drug-Related Patent Term Compensation (NRPTC): The 2021 Patent Law introduced partial compensation specifically for innovative drugs. Eligible new drug patents can receive up to 5 years of additional term, provided the total effective patent term after the drug’s marketing approval in China does not exceed 14 years. This aims to offset some of the time lost during the National Medical Products Administration (NMPA) review process.

Transitional Rules and Nuances for Older Drugs

- Pre-2021 Drugs: Drugs approved before June 1, 2021, are generally not eligible for NRPTC. Their exclusivity relies solely on the standard patent term (20 years) plus any potential PTA if the grant was significantly delayed according to the new rules.

- Data Exclusivity: China provides 6 years of data exclusivity for innovative new chemical entities (NCEs), preventing generic applicants from relying on the originator’s clinical trial data during that period. This runs concurrently with patent protection but can offer a separate barrier to generic entry even after patents expire.

- Marketing Exclusivity: For certain drugs, like orphan drugs or pediatric drugs, specific (though often shorter) periods of marketing exclusivity may apply, preventing the approval of similar products.

The Challenge of Accurate Exclusivity Search

Determining the precise patent cliff date for a specific originator drug in China requires meticulous research into several interconnected elements:

- Core Patent Identification: Pinpointing the key patent(s) protecting the active ingredient, its medical use, or a specific crystalline form is paramount. This often involves searching CNIPA databases using the drug’s generic name (INN), chemical name, company name, and relevant IPC/CPC codes.

- Patent Family Mapping: Tracing the Chinese patent back to its priority application(s) to establish the correct filing date(s) is essential for term calculation.

- Prosecution History Analysis: Reviewing the patent’s file wrapper (available via CNIPA) is critical to:

- Confirm the exact grant date.

- Identify if PTA was requested and granted, and the calculated compensation period.

- Understand any potential delays attributable to the applicant (which are excluded from PTA).

- Drug Approval Timing: Confirming the exact date the drug received marketing authorization from the NMPA in China. This date is vital for assessing eligibility and calculating the NRPTC (if applicable).

- NRPTC Eligibility & Calculation: Verifying if the patent and drug meet the criteria for NRPTC (e.g., is it the first marketing approval for this active ingredient in China?) and calculating the potential extension period based on the gap between patent filing and NMPA approval (minus 5 years), capped at 5 years and the 14-year total limit.

- Data Exclusivity Status: Confirming the grant and expiry date of any data exclusivity period.

- Potential Litigation/Invalidation: Checking if the core patent is involved in ongoing invalidation proceedings or litigation, which could impact its enforceability and effective term.

Why Manual Search Falls Short

Public CNIPA databases are essential but complex. Challenges include:

- Language barrier (predominantly Chinese interfaces and documents).

- Inconsistent terminology and classification.

- Difficulty linking specific patents definitively to approved drug products.

- Complexity in interpreting prosecution histories and calculating PTA/NRPTC accurately.

- Time-consuming nature of comprehensive searches.

The Impact of the Cliff

When a key patent expires in China:

- Generic Entry: Multiple generic manufacturers typically file abbreviated new drug applications (ANDAs) rapidly.

- Price Erosion: Significant price drops (often 50-90%) occur as generics compete, driven by volume-based procurement (VBP) tenders.

- Volume Shifts: Market share rapidly transitions from the originator to generics.

- Strategic Shifts: Originators may focus on next-generation products, OTC switches, or enhanced lifecycle management for the brand.

Conclusion: The Imperative of Precise Intelligence

Navigating China’s biopharma patent cliff demands more than just knowing the nominal patent expiry date. It requires a deep understanding of China’s unique patent term calculation rules (PTA, NRPTC), regulatory exclusivities, and the ability to conduct thorough, accurate patent and drug approval linkage searches. Misjudging the effective exclusivity period can lead to significant financial miscalculations and strategic errors.

For global pharma executives, investors, and generic manufacturers, accessing authoritative and timely intelligence on Chinese patent expiries is non-negotiable. Partnering with experts who possess deep knowledge of the CNIPA system, Chinese regulations, and the specific intricacies of pharma IP is crucial for making informed decisions in this dynamic and high-stakes market. Obtaining a comprehensive intellectual property report is often the most reliable way to secure the verified data needed to accurately map the patent cliff landscape in China.

ChinaBizInsight

Your strategic bridge to transparent business in China.