You’ve secured the Official Enterprise Credit Report (OECR) from China’s National Enterprise Credit Information Publicity System (NECIPS). It lists registration status, shareholders, key personnel, and administrative penalties – a vital foundation. Yet, seasoned international partners know: relying solely on this official snapshot is like navigating a complex market with only a basic map. Why? Critical gaps exist, and savvy businesses use supplementary tools to uncover the full picture.

Here’s why the OECR isn’t enough:

- Limited Financial Transparency: Companies often withhold sensitive financials (assets, revenue, profit) and detailed employee counts from public view on the OECR.

- Operational Nuances Missing: It doesn’t reveal current trading health, management stability beyond formal appointments, supplier/customer relationships, or real-time market reputation.

- Risk Coverage Gaps: While it lists some administrative penalties, it doesn’t comprehensively cover ongoing lawsuits (beyond final judgments), deep financial distress signals, negative media coverage, or operational controversies.

- “On Paper” vs. Reality: The report confirms legal existence but doesn’t verify if the company actively operates from its registered address or possesses the claimed capabilities.

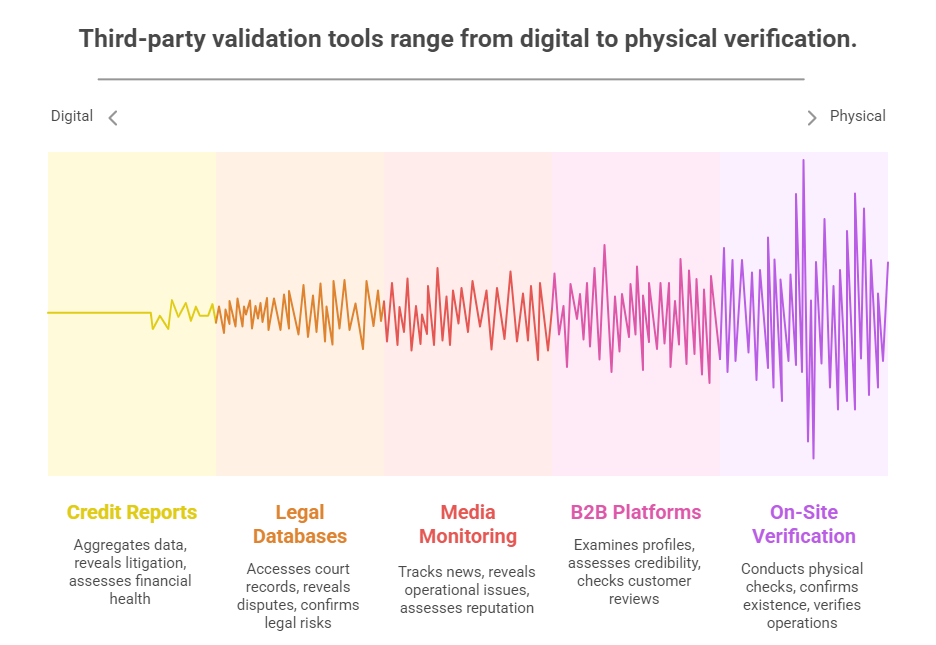

Filling the Gaps: 5 Third-Party Validation Tools

To mitigate risks and gain confidence, integrate these tools with your OECR analysis:

- Commercial Credit Reports & Risk Platforms:

- What they do: Aggregators like Qichacha, Tianyancha, or specialized international providers gather data far beyond the OECR. They compile legal records (lawsuits, judgments, enforcements), financial estimations (based on taxes, procurement), patent/trademark filings, news mentions, industry rankings, affiliated entities (complex corporate trees), and even social media sentiment.

- Key Insights: Uncover undisclosed litigation, assess financial health indicators, map complex ownership structures revealing ultimate beneficiaries (key for KYC), identify intellectual property assets, and gauge market reputation via news/opinion.

- Limitations: Accuracy and depth vary, especially for private SMEs. Some financial data is estimated. Requires skilled interpretation to avoid noise. Subscription costs apply. How it Complements OECR: Provides dynamic risk scoring, litigation history, financial health proxies, and corporate linkage mapping missing from the static OECR. Consider a Standard Business Credit Report for a structured, verified compilation of this wider data.

- Legal Proceedings Databases:

- What they do: Platforms like China Judgments Online (中国裁判文书网 – public but complex) or commercial legal databases (e.g., LexisNexis, Westlaw, PKULaw in China) provide access to court records – lawsuits, judgments, arbitrations, and enforcement actions.

- Key Insights: Reveal active disputes, historical litigation patterns, debt recovery issues, contract disputes, intellectual property conflicts, and regulatory non-compliance leading to court action. Confirms the nature and severity of legal risks hinted at (or missed) by the OECR.

- Limitations: Access can be fragmented (different courts/platforms). Some cases, especially settlements or sensitive matters, may not be published. Requires legal expertise to interpret filings accurately. How it Complements OECR: Validates and expands on the OECR’s penalty list, uncovering the ongoing legal health and potential contingent liabilities.

- Media & Industry Intelligence Monitoring:

- What they do: Systematic tracking of news (financial press, industry journals, local news), social media (Weibo, industry forums), regulatory announcements, and industry analyst reports mentioning the target company and its key executives.

- Key Insights: Uncovers operational issues (factory incidents, product recalls, labor disputes), management changes/scandals, significant contracts won/lost, market expansion/retreat, regulatory investigations (beyond final penalties), customer/supplier disputes, and overall market perception and stability.

- Limitations: Requires filtering for credibility and relevance. Negative news might be suppressed domestically. Provides indicators, not always verified facts. How it Complements OECR: Offers real-time insights into the company’s operational reality, reputation, and market standing – the “living” context absent from the formal OECR snapshot.

- Supplier Vetting & B2B Platform Checks:

- What they do: Examining the company’s profile and activity on major B2B platforms like Alibaba, Global Sources, Made-in-China, or industry-specific portals. Includes checking verifications (e.g., Alibaba Gold Supplier assessments), customer reviews, response rates, transaction histories (if visible), product listings, and years active.

- Key Insights: Assesses operational credibility, export experience (if relevant), responsiveness, customer satisfaction levels, and consistency of online presence. Reviews can reveal red flags about product quality, payment issues, or reliability.

- Limitations: Information is self-reported by the company. Reviews can be manipulated. Activity levels don’t guarantee overall financial health. How it Complements OECR: Provides evidence of actual trading activity, customer interactions, and market reputation, adding practical validation to the legal existence confirmed by the OECR.

- Third-Party On-Site Verification Services:

- What they do: Engaging a reputable local agency to conduct physical checks. This includes verifying the company’s operational presence at its registered address, interviewing management (briefly), observing facility size/condition/activity levels, checking local AIC records, and sometimes discreetly gathering local reputation feedback.

- Key Insights: Confirms physical existence and scale of operations (“bricks and mortar”), assesses operational viability, verifies key contacts, and identifies any glaring discrepancies between the OECR/reported information and observable reality. Crucial for high-value deals or new partners.

- Limitations: Most expensive option. Provides a snapshot in time. Depth depends on the scope agreed. How it Complements OECR: Delivers the ultimate ground-truth verification, physically confirming the existence and operations that the OECR legally documents. Essential due diligence often includes comprehensive verification services.

Building a Holistic View

Think of the OECR as the essential legal skeleton of a Chinese company. The third-party tools listed above add the muscle, nerves, and circulatory system – the operational, financial, reputational, and risk elements that determine whether the entity is healthy, viable, and a trustworthy partner. Using these tools in combination significantly reduces the risk of fraud, unexpected liabilities, and partnership failures. They transform basic compliance checking into true strategic due diligence.

Ready to move beyond the basic report? Ensure your next partnership or investment in China is built on a foundation of comprehensive verification. Explore our suite of due diligence solutions designed to give you the clarity and confidence you need.

ChinaBizInsight

Your strategic bridge to transparent business in China.