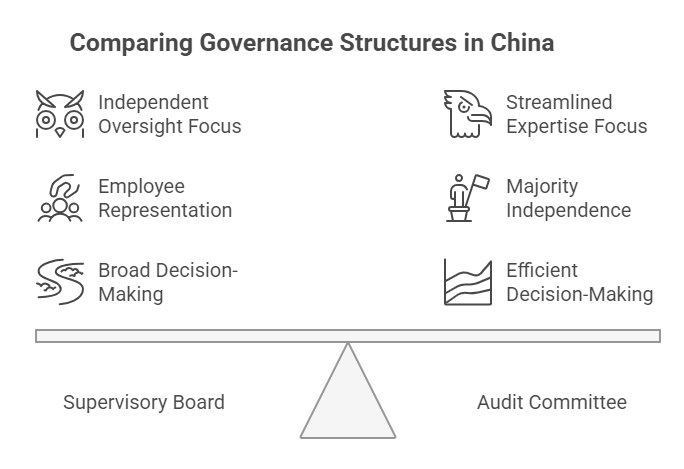

China’s revised Company Law (effective July 1, 2024) introduces significant flexibility in corporate governance. A critical decision for businesses is choosing between the traditional Supervisory Board (Jianshi Hui) and the newer Audit Committee (Shenji Weiyuanhui) model. Understanding this choice is vital for compliance, risk control, and operational efficiency.

Why Governance Structure Matters in China

Corporate governance directly impacts regulatory compliance, investor confidence, and operational transparency. The 2024 Company Law (Articles 69, 121) allows companies to tailor structures to their size, complexity, and ownership model. Selecting the wrong framework risks:

- Non-compliance penalties (fines up to ¥200,000 under Article 251)

- Decision-making bottlenecks

- Reduced appeal to international partners

The Supervisory Board: Independent Oversight

Role: An independent body monitoring directors/senior management, reviewing finances, and safeguarding shareholder rights (Article 78).

Composition:

- Minimum 3 members (Article 76 for LLCs, Article 130 for JSCs)

- ≥1/3 employee representatives (elected democratically)

- Strict independence: Directors/executives cannot serve (Articles 76, 130)

Key Powers:

- Financial Audits: Inspect accounting records/assets (Article 78(1)).

- Misconduct Oversight: Recommend removal of non-compliant directors/executives (Article 78(2)).

- Convene Shareholder Meetings: If the board fails to act (Article 78(4)).

- Legal Action: Sue directors/executives harming company interests (Article 78(6)).

Best For:

- SMEs needing straightforward oversight

- State-owned enterprises (SOEs) requiring layered checks

- Companies prioritizing worker participation

The Audit Committee: Streamlined Expertise

Role: A board-level committee replacing the Supervisory Board, handling financial oversight and risk management (Articles 69, 121).

Composition:

- ≥3 directors (including independent members)

- No mandated employee reps (unlike Supervisory Boards)

- Majority independence: Over 50% must hold no other company role (Article 121(2))

Key Powers:

- Financial Reporting: Approve disclosures and auditor appointments (Article 137).

- Internal Controls: Oversee risk management frameworks.

- Efficiency: Decisions by majority vote (Article 121(3)), avoiding multi-body delays.

Critical for Listed Companies:

- Must pre-approve auditor hires, financial disclosures, and CFO appointments (Article 137).

Best For:

- Larger/complex organizations (e.g., multinationals, JSCs)

- Listed companies requiring integrated governance

- Firms valuing specialized expertise over broad representation

Comparative Analysis: Key Differences

| Criteria | Supervisory Board | Audit Committee |

|---|---|---|

| Legal Basis | Articles 76-82 (LLCs), 130-133 (JSCs) | Articles 69 (LLCs), 121 (JSCs) |

| Independence | Fully independent of management | Board-appointed; majority independent |

| Employee Representation | Mandatory (≥1/3) | Not required |

| Approval Authority | Limited to oversight/recommendations | Binding resolutions (e.g., auditor hires) |

| Best Suited | SMEs, SOEs, labor-intensive firms | Large/listed companies, global entities |

How to Choose: 4 Decision Factors

- Company Size & Complexity

- <300 employees: Supervisory Boards are simpler (Article 68 exempts smaller LLCs from mandatory employee reps).

- Multinationals/JSCs: Audit Committees align with global standards (e.g., US SEC requirements).

- Ownership Structure

- SOEs: Often require Supervisory Boards for state-asset protection.

- Foreign-invested enterprises: Prefer Audit Committees for familiarity.

- Regulatory Demands

Listed companies must have Audit Committees for critical financial decisions (Article 137). - Cost & Efficiency

Audit Committees reduce overhead by consolidating functions. Supervisory Boards add checks but may slow decisions.

Implementing Your Governance Model

Step 1: Amend Articles of Association

Explicitly state your chosen structure (Audit Committee or Supervisory Board) per Articles 46(6), 95(7).

Step 2: Appointment & Elections

- Supervisory Board: Employee reps elected via staff congress (Article 76).

- Audit Committee: Directors appointed by shareholders/board (Articles 69, 121).

Step 3: Document Authority

Define powers in bylaws, especially for Audit Committees (e.g., pre-approval rights under Article 137).

Step 4: Compliance Checks

- Verify member independence.

- Ensure SOEs meet state-asset oversight rules (Article 176).

⚠️ Exception: State-owned enterprises cannot replace Supervisory Boards with Audit Committees (Article 176).

Real-World Implications

- A German auto supplier with a Shanghai JV adopted an Audit Committee to align with its global parent’s governance, cutting reporting time by 30%.

- A Shenzhen tech SME retained its Supervisory Board to maintain worker representation, boosting employee trust during expansion.

Key Takeaways Under the 2024 Law

- Flexibility: Companies can choose governance models fitting their needs (Articles 69, 121).

- Accountability: Both structures enforce director/executive compliance (Articles 180–181).

- Risk Mitigation: Robust governance prevents penalties (fines up to ¥200,000 for non-compliance).

Closing Thought

Your governance model isn’t just a legal requirement—it’s a strategic asset. Whether prioritizing oversight (Supervisory Board) or agility (Audit Committee), align your choice with operational realities and stakeholder expectations.

Verify Chinese partners’ governance compliance with authoritative reports from ChinaBizInsight. Our due diligence dossiers include:

- Official Company Credit Reports

- Board Structure Verification

- Statutory Document Authentication

Ensure your partnerships start with clarity.

References:

- Company Law of the People’s Republic of China (2024 Revision), Articles 69, 76–83, 121, 130–137, 176.

- China Securities Regulatory Commission (CSRC), Governance Guidelines for Listed Companies.

ChinaBizInsight

Your strategic bridge to transparent business in China.