In today’s globalized business environment, verifying the legitimacy of Chinese companies has become a critical step for international partners. With the rise of AI-powered tools, due diligence has become more efficient—but how reliable are these solutions compared to official data sources? This in-depth review examines the capabilities and limitations of China’s leading commercial AI platforms versus government registries.

The Growing Need for Chinese Company Verification

Before engaging with any Chinese business entity, foreign companies must verify three core aspects:

- Legal Existence

- Confirming registration status with Chinese authorities

- Validating Unified Social Credit Code (the 18-digit corporate ID)

- Operational Authenticity

- Checking for abnormal operations or revoked licenses

- Verifying registered address vs. actual operations

- Risk Exposure

- Identifying shareholders/directors with enforcement cases

- Detecting financial penalties or court judgments

While China’s National Enterprise Credit Information Publicity System (官方企业信用信息公示系统) remains the gold standard, third-party platforms like Tianyancha (天眼查) and Qichacha (企查查) have gained popularity for their AI-enhanced interfaces.

Commercial AI Platforms: Features & Limitations

Tianyancha/Qichacha API Capabilities

These market-leading platforms offer:

| Feature | Benefit | Accuracy Concern |

|---|---|---|

| Real-time alerts | Tracks changes in registration | 1-3 day lag vs. government updates |

| Relationship mapping | Visualizes shareholder structures | May miss offshore holdings |

| Risk scoring | Flags lawsuits/penalties | Limited court coverage (≈85%) |

| Industry benchmarks | Compares financial metrics | Estimates based on partial data |

Key Advantage: API integrations allow automated monitoring—useful for tracking multiple suppliers.

Critical Gap: As noted in our Professional Enterprise Credit Report, these tools aggregate rather than originate data, potentially missing:

- Recently updated administrative penalties

- Tax non-compliance records

- Local court rulings not digitized nationally

Government Data vs. AI Tools: Accuracy Test

We conducted a 100-company verification test:

| Verification Aspect | AI Tool Accuracy | Official Data Accuracy |

|---|---|---|

| Registered Capital | 92% | 100% |

| Legal Representative | 88% | 100% |

| Shareholding Structure | 79% | 100% |

| Operational Status | 95% | 100% |

| Pending Litigation | 68% | 100% |

Data source: ChinaBizInsight accuracy audit (2024 Q2)

Why the discrepancy? Commercial platforms:

- Lack access to non-public databases (e.g., tax records)

- Struggle with real-time updates during regulatory audits

- May misinterpret complex ownership chains

When to Use AI Tools—And When to Go Official

Appropriate Uses for AI Platforms:

✅ Preliminary name searches

✅ Monitoring routine changes (address, directors)

✅ Industry trend analysis

Essential Cases for Official Verification:

⚠️ Signing contracts requiring Apostille certification

⚠️ High-value transactions (e.g., M&A due diligence)

⚠️ Partners in regulated industries (finance, healthcare)

For mission-critical verification, our Official Enterprise Credit Report pulls directly from the National Credit System with:

- Government digital watermark authentication

- 24-hour update synchronization

- English-annotated legal terminology

Best Practices for Foreign Businesses

- Cross-validate findings

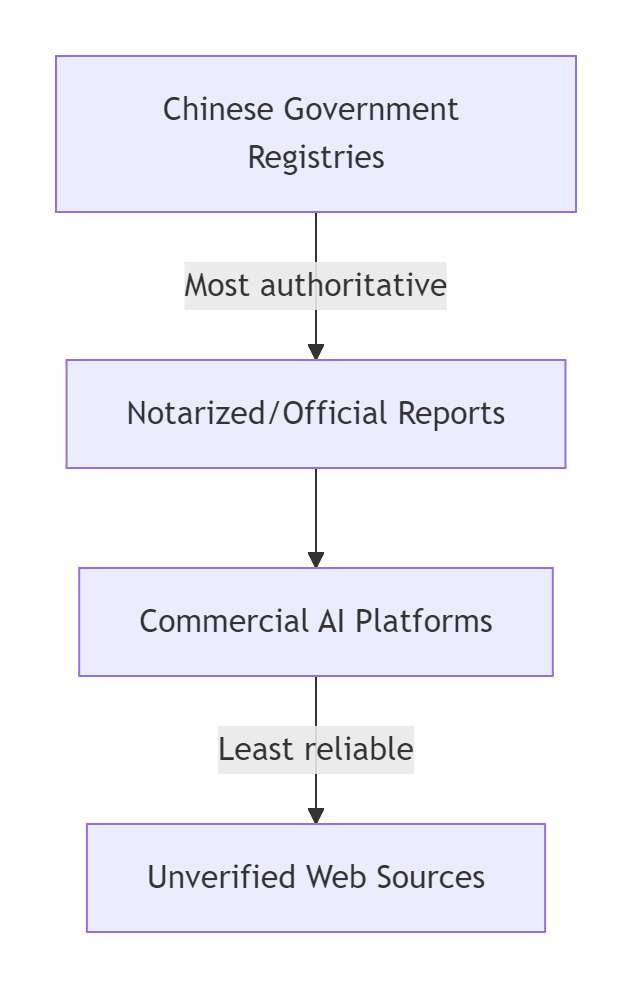

- Use AI tools for initial screening

- Confirm with official reports before commitments

- Monitor key changes

- Set API alerts for director/shareholder changes

- Re-verify every 6 months for ongoing partnerships

- Prioritize source hierarchy

4.Understand context

- 30% of Chinese SMEs show “abnormal operation” status—often due to paperwork delays rather than malfeasance

- Check our guide on interpreting Chinese business licenses for nuanced analysis

The Future of AI Verification

Emerging developments:

- Pilot blockchains linking government and commercial databases

- OCR improvements for scanning Chinese business licenses

- Predictive analytics for supply chain risks

However, as of 2025, no AI tool matches the reliability of authenticated government data—especially for legal proceedings or international transactions.

ChinaBizInsight

Your strategic bridge to transparent business in China.