Key Changes, Compliance Steps, and Risk Mitigation for Foreign Businesses

China’s updated Company Law, effective July 1, 2024, introduces critical reforms for cross-border guarantees. For multinationals using Chinese subsidiaries, these changes demand urgent attention. This guide breaks down the new rules, compliance workflows, and due diligence strategies to secure your transactions.

Why the New Rules Matter

Under the revised law (Art. 15, Art. 178–180), parent companies guaranteeing subsidiary debts face stricter approval processes and heightened liability. This responds to historical abuses where opaque guarantees exposed lenders and investors to hidden risks.

Key Implications:

- Approval Hierarchy: Guarantees now require board resolutions; major guarantees (>10% of net assets) need shareholder approval (Art. 15).

- Director Liability: Officers approving non-compliant guarantees bear personal financial responsibility if losses occur (Art. 191).

- Anti-Circumvention Clauses: “Shadow directors” (e.g., actual controllers) are equally liable (Art. 192).

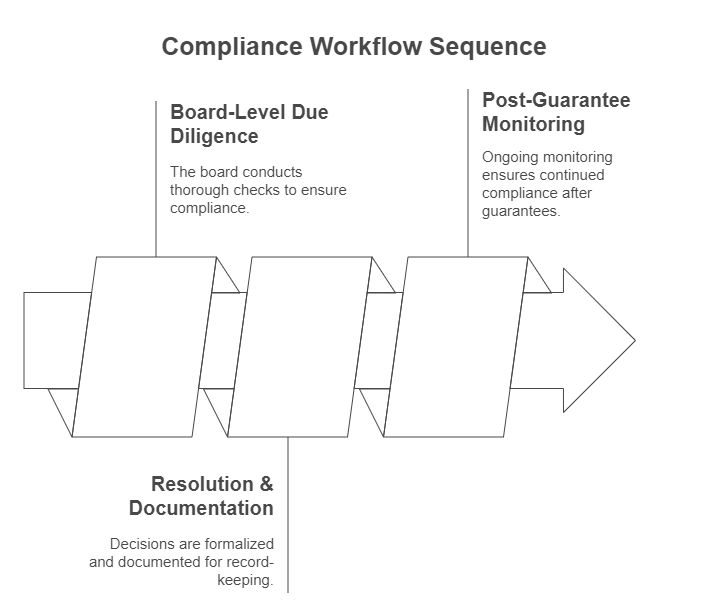

Step-by-Step Compliance Workflow

1. Board-Level Due Diligence

Before approval, directors must:

- Verify the subsidiary’s debt purpose aligns with business scope.

- Assess repayment capacity using audited financials and credit reports.

Failure risks voiding the guarantee.

2. Resolution & Documentation

- Board Resolution: Details the guarantee’s terms, recipient, and risk assessment.

- Shareholder Vote: Required if the guarantee exceeds 10% of the parent’s net assets (Art. 219).

- Public Disclosure: File resolutions with the National Enterprise Credit Information Publicity System.

⚠️ Red Flag: Art. 181 prohibits guarantees if the subsidiary’s activities violate Chinese public policy.

3. Post-Guarantee Monitoring

- Quarterly Audits: Track the subsidiary’s financial health.

- Immediate Reporting: If the subsidiary breaches covenants (e.g., missed payments), disclose to stakeholders within 15 days.

Case Study: Penalties for Non-Compliance

In 2023, before the new law, a European bank accepted a parent guarantee for a Chinese solar equipment supplier’s $5M loan. The subsidiary defaulted, and courts voided the guarantee because:

- Approval relied solely on CEO authority (no board resolution).

- The parent hadn’t verified the subsidiary’s tax compliance history.

Outcome: The bank absorbed 100% of losses ($5M + interest).

Under the 2024 law, the parent’s directors would also face fines up to $150K (Art. 253).

3 Due Diline Strategies to Reduce Risk

1. Investigate the Subsidiary’s Credibility

- Official Credit Reports: Validate business legitimacy via China’s National Enterprise Credit Information Publicity System. These documents confirm registration status, litigation history, and penalties.

📌 Tip: Use ChinaBizInsight’s Official Enterprise Credit Reports for real-time, government-sourced data.

- Executive Risk Profiles: Screen key personnel for past violations using Executive Risk Reports.

2. Secure Legal Endorsements

Guarantees for non-Hague Convention countries (e.g., UAE, Saudi Arabia) require:

- Notarization by a Chinese notary office.

- Consular Legalization by the borrower’s embassy.

For Hague members, use the streamlined Apostille process.

3. Contract Safeguards

- Default Triggers: Automatic guarantee termination if the subsidiary’s liabilities exceed assets.

- Collateral Clauses: Demand pledging of subsidiary assets (e.g., IP, equipment).

The Bigger Picture: China’s Compliance Shift

The reforms align with global anti-fraud standards but add complexity. For foreign lenders:

✅ Pros: Reduced risk of void guarantees; clearer director accountability.

❌ Cons: Longer approval cycles; higher due diligence costs.

Critical Takeaway:

“Guarantees are no longer signature exercises. Treat them as high-stakes investments requiring forensic scrutiny.”

— Legal Director, Global Bank (Asia Division)

Partner with China Experts

Navigating these rules demands local expertise. At ChinaBizInsight, we equip global businesses with:

- Due Diligence Tools: Credit reports, executive checks, and real-time compliance alerts.

- End-to-End Support: From document retrieval to Apostille certification.

Need a Compliance Partner?

→ Explore our Business Credit Reports

→ Contact Us for a risk assessment

Disclaimer: This article explains general legal principles. Consult qualified Chinese counsel for case-specific advice.

ChinaBizInsight

Your strategic bridge to transparent business in China.