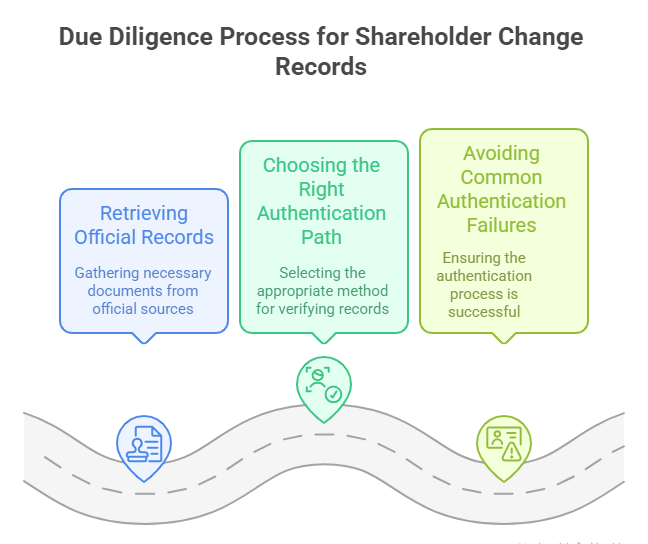

When conducting due diligence on Chinese startups, venture capitalists face a critical challenge: verifying the authenticity of shareholder change records. These documents trace ownership evolution and reveal potential red flags like undisclosed stakeholders or irregular transfers. For international investors, legally authenticating these records is non-negotiable—especially when cross-border legal enforceability is required. Here’s what you need to know about China’s shareholder record authentication processes.

Why Shareholder Change Records Matter in Due Diligence

Shareholder registers (股东名册) and change filings at China’s Administration for Market Regulation (AMR) provide a timeline of ownership. Key risks uncovered include:

- Undisclosed equity pledges: 14% of Chinese startups show discrepancies between reported and pledged shares (2023 Kroll Due Diligence Report).

- Irregular transfers: Unapproved changes may void future claims.

- Hidden beneficiaries: Complex holding structures obscure ultimate ownership.

Without notarized and internationally recognized authentication, these records lack legal weight in non-Chinese jurisdictions.

Step 1: Retrieving Official Records

Records are obtained from two primary sources:

- AMR Archives: Physical copies stamped by local AMR branches.

- National Enterprise Credit Information Public System: Digital verification of filings.

Critical: Archived records must include:

- Full shareholder names & ID/passport numbers

- Transfer dates and approval signatures

- AMR filing seals (公章)

Step 2: Choosing the Right Authentication Path

A. Hague Apostille (For 124 Member Countries)

- Process: Notarization → China’s MFA/Local OSA Apostille.

- Time: 4 business days (standard); 2 days (expedited).

- Cost: ¥50 RMB/base document + ¥50 expedite fee.

- Requirements:

- Original notarized shareholder records

- Business license copy

- Authorization letter (for company applications)

B. Consular Legalization (Non-Hague Countries)

- Process: Notarization → MFA → Target Country’s Embassy.

- Variables:

- Fees vary widely (e.g., UAE: ¥4,500; Egypt: ¥1,060)

- Translation often mandatory (e.g., Spanish for Mexico, Arabic for UAE)

- Embassy-specific rules (e.g., Afghanistan requires business plans)

⚠️ Pitfall Alert: 32% of rejected applications cite mismatched translations or missing enterprise purpose statements (MFA 2024 data).

Step 3: Avoiding Common Authentication Failures

- Expired Documents: Apostilled records expire in 6 months for commercial use.

- Incomplete Chains: Missing notarization voids subsequent authentication.

- Regional Restrictions: Documents from Shanghai must be processed at Shanghai’s Foreign Affairs Office—not Beijing.

- Translation Errors: Use MFA-approved translators for terms like “equity transfer” (股权转让).

Case Study: A Near-Miss for a Berlin VC Fund

A German VC discovered undisclosed share pledges during a Shenzhen AI startup investment. By:

- Retrieving AMR-archived shareholder change histories,

- Apostilling records through Guangdong’s Foreign Affairs Office,

- Validating the Apostille via the MFA’s online portal,

…they enforced clawback provisions in a Dutch court—saving €2.1M.

Strategic Recommendations for VCs

- Pre-empt Translation Needs: Demand Chinese-English bilingual shareholder registers upfront.

- Verify Apostille Immediately: Use the MFA’s QR verification portal.

- Audit Historical Consistency: Cross-check AMR records against startup-provided documents.

Authentication isn’t bureaucratic red tape—it’s strategic risk mitigation. As global investment into Chinese startups rebounds (Q1 2025: +18% YoY, Preqin), enforceable due diligence separates winners from litigation casualties.

🔍 Need seamless authentication? Our Company Documents Retrieval service handles AMR filings, notarization, and Hague/Consular authentication end-to-end.

ChinaBizInsight

Your strategic bridge to transparent business in China.