Securing payments from Chinese business partners remains a persistent challenge for foreign creditors. Traditional debt collection methods often hit dead ends when debtors conceal assets or restructure operations. However, China’s standardized corporate disclosure system provides a powerful, legally recognized tool for uncovering hidden financial trails: the Official Enterprise Credit Report (OECR).

Why Debtors Evade and How Assets Disappear

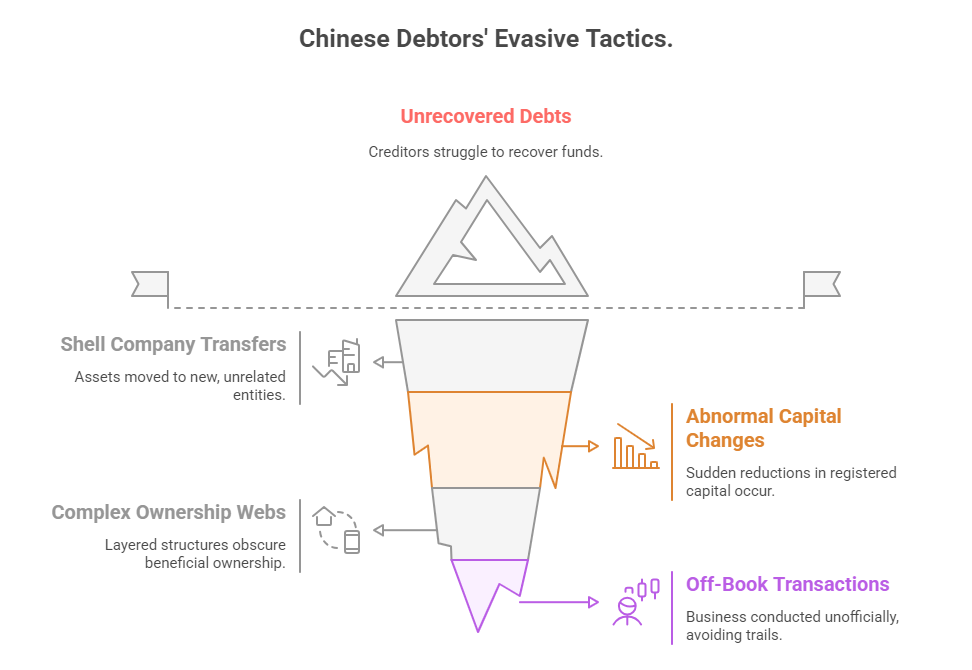

Chinese debtors employ several tactics to frustrate recovery efforts:

- Shell Company Transfers: Shifting valuable assets to newly established, seemingly unrelated entities

- Abnormal Capital Changes: Sudden reductions in registered capital before creditor claims arise

- Complex Ownership Webs: Using layered holding structures to obscure beneficial ownership

- Off-Book Transactions: Conducting business through unofficial channels to avoid paper trails

These maneuvers exploit information asymmetry. Without verified data, creditors face costly legal battles with uncertain outcomes.

The OECR: Your Legal Asset-Tracing Blueprint

Maintained by China’s State Administration for Market Regulation (SAMR), the OECR consolidates mandatory disclosures into a single authoritative document. Its real power for debt recovery lies in these sections:

- Registered Capital Analysis (Core Defense Indicator)

- Pre-2024: Companies could set 50-year capital contribution deadlines.

- Post-2024 Company Law: Strict 5-year maximum for capital infusion.

- Red Flags: Unexplained capital reductions signal potential asset stripping. Example: A manufacturing firm slashing registered capital from ¥50M to ¥5M while facing supplier lawsuits.

- Shareholder & Investment Networks

Reveals subsidiaries and affiliated companies – common repositories for transferred assets. Cross-referencing these with individual Directors/Shareholders Reports exposes hidden connections. - Equity Pledges & Mortgages

Lists assets pledged as collateral (equipment, property). These are often recoverable targets if the debtor defaults on those obligations too. - Administrative Penalties & Abnormal Operations

Repeated violations (tax, environmental, safety) or “Abnormal Operations” listings indicate financial distress or poor compliance – factors influencing collection strategy urgency. - Key Personnel Links

Identifies executives and major shareholders. Their personal assets or other companies may be reachable in certain legal scenarios.

Case Study: Tracing Assets Through an OECR

- Debtor: A Shenzhen-based trading company (Sample Report: Xintou Huaying Petrochemical)

- Red Flag: Multiple rapid shareholder changes (2022-2024), with Xinjiang XinTou Energy Development Co., Ltd. acquiring 49% stake just before creditor actions intensified.

- Action Taken: Creditor obtained OECR + Shareholder Report. Revealed Xinjiang XinTou had significant fixed assets. Enforcement action targeted the parent company’s assets successfully.

- Tool Used: Official Enterprise Credit Report

Integrating OECRs into Your Collection Strategy

- Pre-Transaction Due Diligence: Run OECRs before extending credit. Check capital adequacy, penalties, and ownership stability. Use a Standard Business Credit Report for initial risk screening.

- Post-Default Asset Mapping: Immediately obtain the debtor’s OECR upon default. Analyze investments, capital changes, and encumbrances.

- Enforcement Targeting: Use disclosed subsidiaries, shareholder info, and pledged assets to identify viable recovery targets for court applications.

- Ongoing Monitoring: Track OECR updates (quarterly/annual filings) for new asset transfers or risks. Consider a Professional Enterprise Credit Report for continuous monitoring and deeper risk analysis.

Beyond the Basics: Maximizing Recovery Odds

- Apostille for Court: OECRs submitted to non-Chinese courts require Hague Apostille certification.

- Combined Reports: Pair OECR with an Executive Risk Report to pressure key individuals via their linked liabilities.

- Financial Deep Dive: For solvent debtors hiding cash flow, a Financial & Tax Report (using invoice/indirect data) can reveal true capacity.

Conclusion: Turning Information into Recovery

China’s corporate transparency regime, anchored by the OECR, provides foreign creditors with a potent, legally recognized weapon against asset concealment. Understanding the specific indicators within these reports transforms them from static documents into dynamic roadmaps for debt recovery. Proactive use in due diligence and strategic deployment during collections significantly shifts the leverage balance towards the creditor. In the complex arena of China debt recovery, authoritative information isn’t just power—it’s the key to reclaiming what’s owed.

ChinaBizInsight

Your strategic bridge to transparent business in China.