For foreign investors and partners of Chinese companies, the phrase “minority shareholder rights in China” might historically have triggered concerns about vulnerability. Stories of squeezed-out small investors, opaque decision-making, and limited recourse fueled anxieties. However, sweeping reforms under China’s New Company Law (effective July 1, 2024) significantly strengthen the legal arsenal available to minority shareholders. While the term “class action” in the Western sense remains limited, the 2024 framework introduces powerful, practical mechanisms often overshadowed by the “loophole” narrative. Understanding these changes is crucial for anyone with stakes in Chinese ventures.

Why Minority Protection Matters in China’s Market

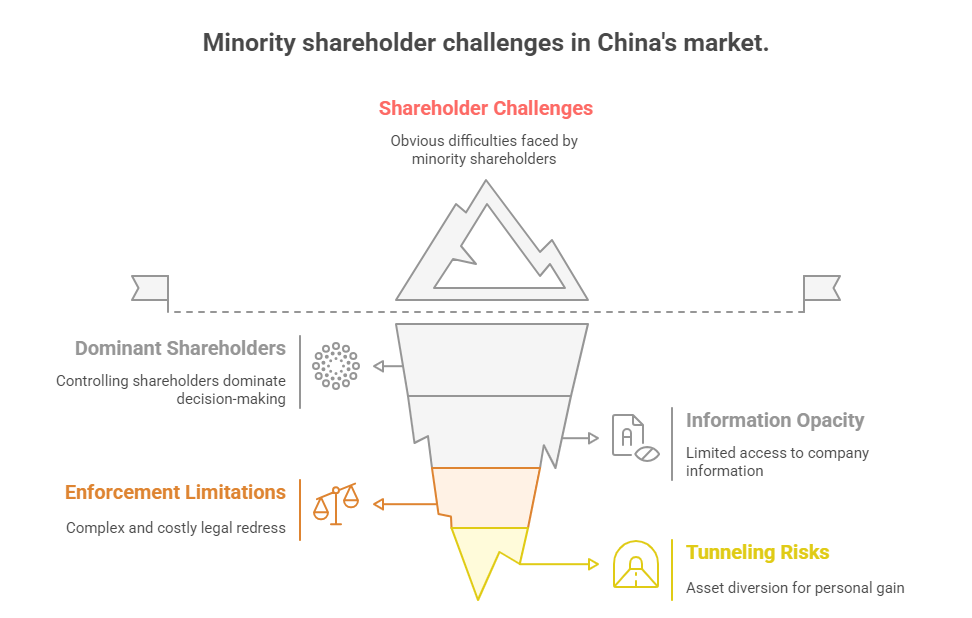

Minority shareholders – those holding less than 50% of a company’s shares, often including foreign portfolio investors, venture capitalists, or smaller strategic partners – historically faced significant challenges in China:

- Dominance of Controlling Shareholders: Concentrated ownership structures (state-owned entities, founding families, large conglomerates) could dominate decision-making through shareholder meetings or boards, sidelining minority voices on critical issues like profit distribution, major asset sales, or related-party transactions.

- Opaque Information Flow: Timely access to accurate financial data, board minutes, and material company information wasn’t always guaranteed, hindering oversight.

- Limited Enforcement Mechanisms: Proving wrongdoing and navigating courts to seek redress for oppression or unfair treatment was often complex, costly, and uncertain. Traditional derivative lawsuits (filed by shareholders on behalf of the company) faced procedural hurdles. Genuine class actions encompassing large groups of dispersed minority shareholders remain uncommon in China’s civil procedure system.

- “Tunneling” and Self-Dealing: Risks existed where controlling shareholders or management diverted company assets or opportunities for personal gain at the expense of minority investors.

A World Bank report (2020) ranked China 28th globally for protecting minority investors, highlighting room for improvement despite existing laws. The 2024 reforms directly target these weaknesses.

The 2024 Company Law Revolution: Closing Gaps, Empowering Minorities

The revised law fundamentally reshapes the landscape, moving beyond merely acknowledging rights to providing actionable tools:

- Enhanced Fiduciary Duties & Liability (Articles 180-181):

- Clearer Standards: Directors, supervisors, and senior management now owe explicit, heightened loyalty (avoiding conflicts, no secret profits) and diligence (reasonable care, skill, and prudence) duties to the company.

- Expanded Accountability: The scope of prohibited behaviors is clarified (e.g., misappropriation, unfair self-dealing, usurping corporate opportunities). Crucially, controlling shareholders and actual controllers who aren’t formally on the board but de facto manage the company are now explicitly held to the same fiduciary standards (Article 180, Para 3). This is a game-changer for piercing the veil of formal titles.

- Stronger Deterrence: Violations can lead to disgorgement of profits (Article 186) and liability for damages (Article 188).

- Supercharged Shareholder Derivative Lawsuits (Article 189):

- Lowered Thresholds: Minority shareholders in Limited Liability Companies (LLCs) and Joint Stock Companies (JSCs) can now initiate lawsuits against errant directors, supervisors, or senior managers on behalf of the company much more easily. Crucially for JSCs (often where foreign investors hold shares), the requirement is now just 1% shareholding held continuously for 180 days (down from previous hurdles). Companies can set lower thresholds in their articles!

- Clearer Process: The law outlines the procedural steps: a written demand to the board/supervisory board, who then have 30 days to act. If they refuse, act inadequately, or in urgent situations, the shareholder can proceed directly to court.

- Coverage for Wholly-Owned Subsidiaries: Shareholders can also initiate derivative actions concerning wrongdoing in the company’s wholly-owned subsidiaries (Article 189, Para 4), addressing a common vulnerability in corporate groups.

- Direct Shareholder Actions for Personal Harm (Article 190): Shareholders can directly sue directors or senior managers if their actions personally damage shareholder interests (e.g., through fraudulent misrepresentation affecting share value), separate from harm to the company itself.

- Strengthened Information & Inspection Rights (Articles 57 & 110):

- Broader Access: Shareholders have stronger rights to access and copy core documents (articles, shareholder registers, meeting minutes, financial reports). Critically, the right to inspect accounting books and vouchers (原始凭证) – the bedrock of financial verification – is solidified.

- Reasonable Purpose Test: Companies can only refuse inspection if they prove the shareholder has an “improper purpose” likely harming the company. Courts will scrutinize such refusals.

- Professional Assistance Allowed: Shareholders can engage accountants or lawyers to assist with inspections, enhancing their ability to detect irregularities.

- Appraisal Rights (Exit Rights) (Articles 89 & 161): Minority shareholders dissenting from major events like continuous non-payment of dividends (despite profitability), major asset sales, mergers, splits, or charter amendments extending company life, gain a clearer path to demand the company buy back their shares at a “fair price.” Tight deadlines apply (60 days to negotiate, 90 days to sue).

Beyond the Law: Practical Challenges & Verification Imperatives

While the 2024 law marks tremendous progress, effective protection still requires vigilance:

- Evidence is King: Successfully alleging fiduciary breaches or oppression hinges on concrete proof. This often requires the very documents (contracts, board minutes, financial records) that might be controlled by the majority.

- Court Interpretation & Enforcement: How courts interpret new provisions (like “improper purpose” for inspections or “fair price” for buybacks) will evolve. Enforcement efficiency varies.

- Cultural & Cost Factors: Pursuing litigation in China can be daunting for foreign minorities due to cost, time, and potential relationship damage.

This is where proactive verification becomes non-negotiable:

- Know Your Counterparty: Before investing or partnering, conduct thorough due diligence using authoritative sources like China’s Official Enterprise Credit Report. This report, sourced directly from the National Enterprise Credit Information Publicity System, provides the legal bedrock: registered capital (paid vs. subscribed), shareholders, key personnel, historical changes, licenses, administrative penalties, and risk flags. Scrutinize ownership structures and key personnel history.

- Monitor Continuously: Business environments change. Regularly monitor your Chinese partners using updated credit reports to track significant changes in ownership, management, legal status (e.g., becoming “abnormal”), penalties, or litigation that could signal instability or increased risk to minority interests. Look for patterns of frequent executive turnover or sudden major shareholder changes.

- Understand Governance: Review the target company’s Articles of Association. Do they further lower thresholds for derivative actions? Do they have clear profit distribution policies? What are the rules for shareholder meetings and information access?

- Document Everything: Maintain meticulous records of all communications, disclosures (or lack thereof), and shareholder meeting materials. This builds the evidence trail crucial if disputes arise.

Conclusion: Empowerment, Not Just Protection

The 2024 Company Law fundamentally shifts China’s minority shareholder landscape from vulnerability towards empowerment. The “class action loophole” narrative is increasingly outdated. While genuine US-style class actions remain rare, the powerful combination of enhanced fiduciary duties, significantly lowered barriers for derivative lawsuits, strengthened inspection rights, and clear appraisal rights provides minority shareholders – including foreign investors – with robust, actionable legal pathways to protect their interests.

However, laws are only as strong as their enforcement and the diligence of those they protect. Knowledge and verification are your primary shields. By leveraging authoritative information like the Official Enterprise Credit Report for ongoing due diligence and monitoring, minority shareholders can proactively identify risks, assert their rights effectively under the new law, and build more secure and profitable partnerships within the dynamic Chinese market. The tools are now in place; using them strategically is key to success.

ChinaBizInsight

Your strategic bridge to transparent business in China.