China’s corporate governance landscape has undergone a seismic shift. The newly revised Company Law of the People’s Republic of China, effective July 1, 2024, introduces stringent personal liability for directors and senior management, fundamentally altering risk exposure for foreign businesses engaging Chinese partners. Understanding these changes isn’t just advisable—it’s critical for mitigating financial and reputational damage.

1. The Core Shift: Personal Liability Takes Center Stage

Gone are the days when corporate structures fully shielded individuals. The 2024 amendments explicitly target directors and officers (Gaoji Guanli Renyuan) for personal accountability in key operational failures:

- Capital Contribution Enforcement (Article 53 & 252): Directors face joint liability if they fail to diligently verify shareholder capital contributions. If a shareholder evades or withdraws capital, responsible directors and senior managers must compensate the company alongside the shareholder. The CSRC can impose fines ranging from 3-10% of the evaded amount.

- Fiduciary Duty Expansion (Article 180 & 188): The law codifies enhanced “duty of loyalty” (Zhongshi Yiwu) and “duty of care” (Qinmian Yiwu). Directors must proactively avoid conflicts of interest and act with “reasonable care” expected of a prudent manager. Violations, such as misappropriating funds, accepting unauthorized commissions, or seizing corporate opportunities without disclosure and approval (Article 181-184), now carry explicit personal liability for resulting company losses.

- Creditor Protection Empowerment (Article 54): Creditors gain a powerful tool. If a company defaults on debts, creditors can demand early payment from shareholders whose capital contributions are not yet due. Directors facilitating contribution delays risk facilitating this creditor action against shareholders.

2. Why This Matters for Overseas Businesses

Your Chinese partners’ directors are now under unprecedented legal pressure. This directly impacts your risk profile:

- Increased Scrutiny on Partner Viability: Directors facing personal liability for under-capitalization or financial mismanagement signal deeper corporate instability. A partner whose directors are embroiled in legal disputes or enforcement actions poses a significant counterparty risk.

- Due Diligence Becomes Non-Negotiable: Verifying the credibility and track record of your partner’s directors is no longer optional. Are they known for compliance? Have they been implicated in past violations? Their personal risk is your business risk.

- Contractual Safeguards Need Updating: Force majeure clauses, indemnities, and representations/warranties regarding director compliance and company capitalization require review in light of these new liabilities.

3. Leveraging the Official Enterprise Credit Report: Your Due Diligence Shield

China’s National Enterprise Credit Information Publicity System (NECIPS) remains the bedrock of corporate transparency. The Official Enterprise Credit Report is now more vital than ever for identifying director-related risks:

- Director Identification & Tenure: The report lists all current directors, supervisors, and senior managers (like the General Manager), including their names and positions (see sample report, Page 3). Track sudden or frequent changes in key personnel.

- Capital Contribution Verification: While shareholder contributions are detailed, director liability under Article 53 arises from their oversight of this process. Cross-referencing shareholder contribution timelines and amounts helps assess potential director exposure.

- Regulatory Red Flags: The report surfaces critical compliance issues:

- Administrative Penalties: Records of fines or sanctions (Article 251) directly indicate governance failures, potentially implicating directors (Sample Report, Page 12).

- Abnormal Operations Listings: Inclusion on this list often stems from failures like unreported address changes or false disclosures – areas where director responsibility is heightened.

- Serious Violations: Major infractions carry severe consequences, including potential market bans for responsible directors (Article 262).

- Historical Changes: Director appointment/departure history within the “Change Information” section provides context on governance stability (Sample Report, Pages 3-11).

Pro Tip: Combine the Official Report with deeper dives. Our Professional Enterprise Credit Report integrates legal proceedings, financial risk assessments, and news, offering a clearer picture of director-related litigation or reputational issues.

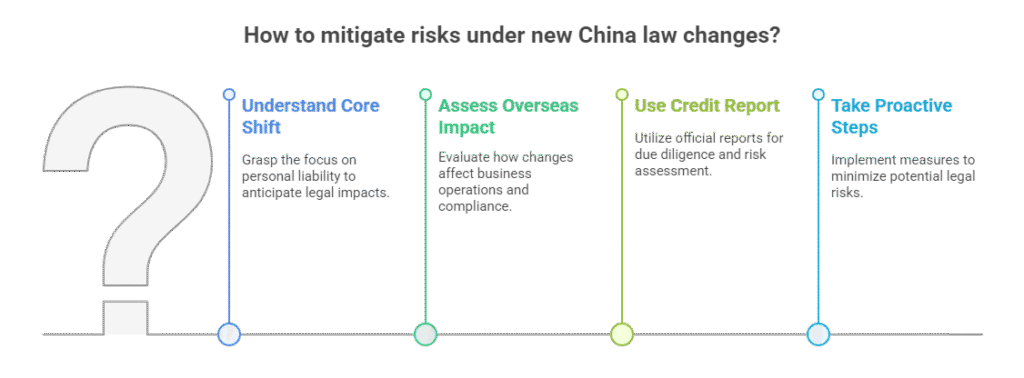

4. Proactive Steps for Risk Mitigation

Don’t wait for a crisis. Integrate director risk assessment into your China strategy:

- Mandate Comprehensive Credit Reports: Make the Official Enterprise Credit Report, and often a deeper Professional Report, a non-negotiable step before signing contracts or major transactions with any Chinese entity. Verify director identities and look for compliance red flags.

- Monitor Key Partners Continuously: Governance risk evolves. Implement regular (e.g., quarterly or biannual) updates of credit reports for critical partners to track changes in directorship, penalties, or operational status. Our Company Monitoring Service automates this.

- Strengthen Contractual Protections: Work with legal counsel experienced in the 2024 Company Law to update agreements. Include specific representations regarding director compliance and capitalization status, alongside robust indemnification clauses.

- Seek Expert Verification: For high-value engagements, consider verifying report authenticity through Apostille or Legalization if required for foreign legal proceedings.

Conclusion: Vigilance is the New Standard

The 2024 Company Law marks a decisive move towards greater director accountability in China. For international businesses, this translates to elevated counterparty risk tied directly to the actions and oversight of your Chinese partners’ leadership. Relying solely on past assurances is insufficient.

The Official Enterprise Credit Report is your frontline defense, providing essential, government-sourced data on directors and compliance status. By systematically integrating this intelligence into your due diligence and monitoring processes, you transform regulatory change from a threat into a managed risk. In the evolving landscape of Chinese corporate governance, knowledge of who is leading your partner company, and what liabilities they personally bear, is your most valuable asset. Stay informed, verify diligently, and protect your interests.

ChinaBizInsight

Your strategic bridge to transparent business in China.