Understanding how Chinese companies distribute profits is crucial for any foreign business partner. At the heart of this process lies China’s mandatory statutory reserve system – a legal framework designed to protect creditors and ensure corporate financial stability. This system impacts everything from joint venture negotiations to investment valuations.

The Legal Foundation: China’s Company Law

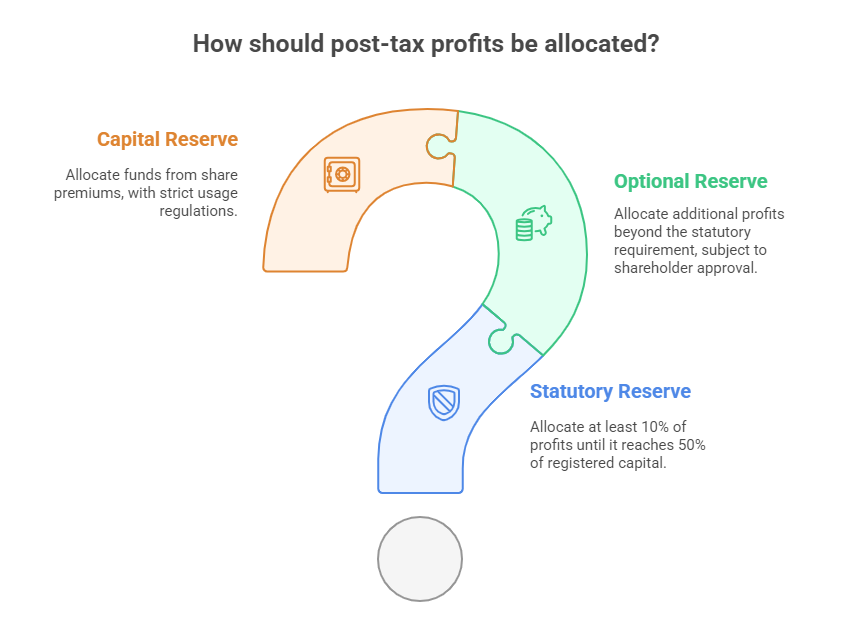

Under China’s Company Law (revised 2023, effective July 2024), Article 210 mandates that companies allocate a portion of post-tax profits to reserves before any shareholder distributions:

- Statutory Reserve (法定公积金): At least 10% of annual after-tax profits must be allocated until this reserve reaches 50% of the company’s registered capital.

- Optional Reserve (任意公积金): After fulfilling the statutory requirement, shareholders may approve allocating further profits to an optional reserve via shareholder resolution.

- Capital Reserve (资本公积金): Funds from sources like share premiums (issuing shares above par value) are placed here. Usage is strictly regulated.

Step-by-Step: The Profit Distribution Sequence

Chinese companies follow a strict legal sequence:

- Offset Prior Losses: Current profits must first cover accumulated losses from previous years.

- Allocate to Statutory Reserve: 10% of the remaining profit is transferred to the statutory reserve.

- Allocate to Optional Reserve (If Approved): Shareholders vote on whether to allocate further sums.

- Distribute Dividends: Remaining profits are distributed to shareholders proportionally (by shareholding or agreed ratios). Critically: Distributions cannot occur if the statutory reserve hasn’t met the 50% threshold and previous losses haven’t been fully covered (Article 225).

How Reserves Can Be Used (and Cannot Be Used)

The law strictly defines reserve usage (Article 214):

- Statutory & Optional Reserves:

- Primary Use: Covering company losses.

- Secondary Use: Converting to share capital (capital increase). Crucially, the remaining statutory reserve cannot fall below 25% of the original registered capital after conversion.

- Capital Reserve:

- Primarily used to cover losses after statutory and optional reserves are exhausted.

- Can only be converted to share capital under specific conditions; cannot be used for cash distributions.

Key Prohibition: Reserves cannot be distributed directly to shareholders as dividends. They are protective buffers, not distributable profits.

Why This Matters for Foreign Partners

- Assessing Financial Health: A company consistently failing to build its statutory reserve signals underlying losses or regulatory non-compliance. Reviewing this in an Official Enterprise Credit Report is essential.

- Predicting Dividend Payouts: High statutory reserve allocations reduce immediate distributable profits. Understanding a company’s reserve status helps forecast potential dividends.

- Due Diligence in M&A/JVs: Reserve levels impact a company’s net asset value and financial resilience. Scrutinize this during negotiations.

- Understanding Restrictions: Distributing profits without meeting reserve obligations is illegal. Profits received under such conditions may need to be repaid (Article 211).

Verifying Reserve Compliance: Accessing Official Records

Statutory reserve balances and profit distribution histories are public record in China. They appear in:

- Annual Reports: Filed with the National Enterprise Credit Information Publicity System (NECIPS).

- Official Enterprise Credit Reports: Issued directly by Market Supervision Bureaus via the NECIPS, containing verified financial snapshots.

Foreign businesses can access these critical records. An Official Enterprise Credit Report provides authoritative proof of a company’s adherence to reserve rules and overall financial standing – vital for mitigating risk. For reliable verification, consider obtaining this report through trusted channels like ChinaBizInsight’s Official Enterprise Credit Report service.

Conclusion: Reserves as a Pillar of Stability

China’s statutory reserve system is a fundamental mechanism safeguarding corporate solvency and creditor interests. While it may temporarily limit dividend payouts, it promotes long-term financial stability within the corporate sector. Foreign partners engaging with Chinese companies must prioritize understanding and verifying compliance with these rules through official documentation. This knowledge isn’t just about accounting; it’s about building partnerships on a foundation of financial transparency and regulatory adherence.

ChinaBizInsight

Your strategic bridge to transparent business in China.