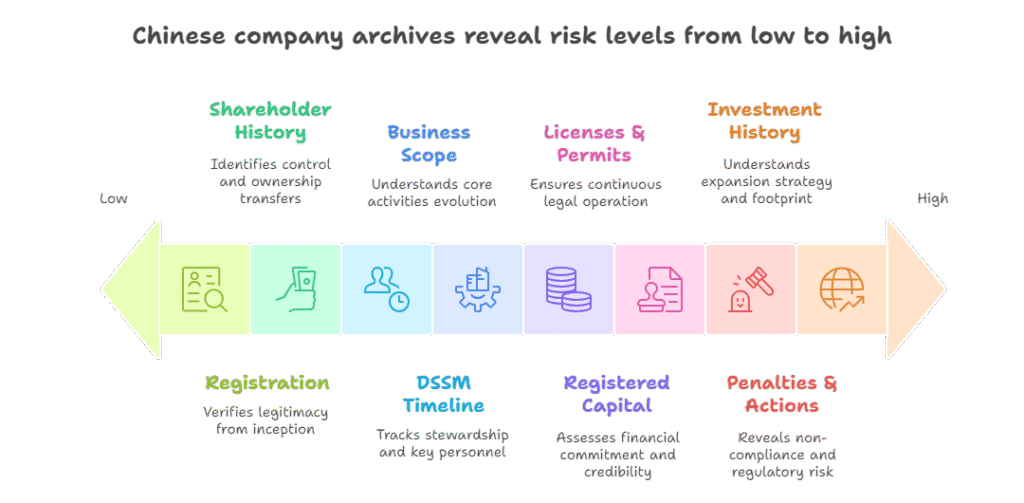

Understanding a Chinese company’s past isn’t just helpful—it’s essential for mitigating risk and making informed decisions. Historical records reveal patterns of compliance, financial stability, operational shifts, and potential red flags invisible in a current snapshot. For overseas businesses, investors, or legal advisors, navigating China’s corporate archives unlocks critical due diligence insights. Here are the 8 most vital historical searches you must conduct:

- Registration & Founding Documentation Evolution:

- Why it matters: Verify the company’s legitimacy from inception. Check the original business scope, registered capital, legal representative, and founding shareholders. Scrutinize changes to the Unified Social Credit Code (USCI), name, or registration address over time. Frequent changes can signal instability or restructuring.

- Key Documents: Original Registration Certificate, historical versions of the Business License, all Filing Notices for registration changes. Track filings made with the Administration for Market Regulation (AMR).

- Source: National Enterprise Credit Information Publicity System (NECIPS), local AMR archives.

- Shareholder & Ownership History:

- Why it matters: Identify who has truly controlled the company and track ownership transfers. Look for sudden influxes or exits of shareholders, increases/decreases in capital contributions, and transfers of equity (especially significant stakes). This reveals power shifts, potential undisclosed beneficial owners, or links to other entities.

- Key Data: Full history of shareholder names/entities, percentage stakes held, dates of entry/exit, details of capital injections (amount, date, method – cash/assets), equity transfer agreements (if accessible via public filings).

- Source: NECIPS, shareholder lists within Annual Reports (historical), Equity Pledge/Mortgage registries.

- Directors, Supervisors & Senior Management (DSSM) Timeline:

- Why it matters: Track the stewardship of the company. Frequent turnover in key positions (especially Legal Representative, Chairman, General Manager) can indicate internal strife, poor management, or attempts to distance individuals from past liabilities. Check for individuals holding multiple directorships concurrently.

- Key Data: Complete historical list of all DSSM members, positions held, appointment/removal dates, identification details (name/ID number basis). Focus on the Legal Representative’s history.

- Source: NECIPS filings (Director/Supervisor/Manager Changes), historical Annual Reports.

- Business Scope Modifications:

- Why it matters: Understand how the company’s core activities have evolved. Did it abandon its original purpose? Did it expand into high-risk or regulated sectors (finance, healthcare, education, hazardous materials)? Sudden shifts, especially into unrelated fields, can signal strategic pivots or financial distress.

- Key Data: Chronological record of all approved business scope changes, filing dates, and approval authorities. Compare original scope to current scope.

- Source: NECIPS, AMR filing records.

- Registered Capital Changes:

- Why it matters: Assess financial commitment and credibility. Track increases (showing growth/investment) or decreases (potentially indicating financial strain, asset stripping, or preparing for exit). Note the timing relative to major business events. Verify if capital reductions followed proper legal procedures and creditor notifications.

- Key Data: Dates and amounts of all capital increases/decreases, filing documents, shareholder resolutions approving changes, creditor protection announcements.

- Source: NECIPS, AMR filings, historical Annual Reports.

- Licenses, Permits & Certification History:

- Why it matters: Ensure continuous legal operation, especially in regulated industries. Check the validity history of critical permits (e.g., Business License, industry-specific licenses like Hazardous Chemicals Operation Permit, Environmental Permits, Food Production/Operation License, Import/Export License). Look for lapses, non-renewals, revocations, or suspensions.

- Key Data: Type of license/permit, issuing authority, issue date, validity period, status (valid, expired, revoked), renewal history, revocation/suspension notices (if public).

- Source: NECIPS (limited), specialized industry regulator databases, company disclosures (ideally verified).

- Administrative Penalties & Enforcement Actions:

- Why it matters: Reveal patterns of non-compliance and regulatory risk. Search for historical records of fines, warnings, production halts, license suspensions/revocations, confiscations of illegal gains, or orders for corrective action. Identify recurring issues (e.g., environmental violations, tax evasion, product quality issues, labor disputes, false advertising).

- Key Data: Type of violation, imposing authority, penalty amount/type, date imposed, case number, brief description of offense. Check tax, environmental, market supervision (AIC), labor, customs records.

- Source: NECIPS (centralized but not exhaustive), websites of specific regulators (Tax Bureau, MEE, SAMR, MOHRSS), local court websites for enforcement cases.

- Branch, Subsidiary & Investment History:

- Why it matters: Understand the company’s expansion strategy, operational footprint, and potential contingent liabilities. Map the establishment, changes (scope, address), and dissolution of branches. Identify investments in other companies (subsidiaries, joint ventures). Assess the performance and risk profile of these entities.

- Key Data: Names, registration numbers, locations, establishment/dissolution dates of branches/subsidies. Details of investments (company name, stake held, investment amount).

- Source: NECIPS (shows branches and direct investments), company Annual Reports (investment disclosures).

Why Relying Solely on Current Data is Risky:

A company’s present status is just one frame in its movie. Historical archives provide the narrative:

- Uncover Hidden Liabilities: Past penalties, unresolved lawsuits, or unpaid debts may not be immediately apparent but can resurface.

- Assess Management Stability & Integrity: Frequent leadership changes or individuals linked to failed ventures raise red flags.

- Validate Growth Claims: Track if expansion (capital, scope, branches) aligns with reported performance.

- Identify Regulatory Compliance Patterns: A history of violations indicates higher future risk.

- Perform Thorough Due Diligence for M&A/JVs: Understand the true legacy you might be acquiring.

- Mitigate Supply Chain Risk: Ensure partners have a stable, compliant operating history.

Navigating the Complexity: Accessing Chinese Corporate Archives

While the National Enterprise Credit Information Publicity System (NECIPS) is the primary source for mandatory disclosures, accessing a comprehensive historical archive is challenging:

- Fragmented Sources: Vital information resides across NECIPS, specialized regulator databases, court systems, and physical AMR archives.

- Language & Technical Barriers: Interfaces are predominantly in Chinese, and navigation requires local expertise.

- Verification & Context: Raw data often needs professional interpretation and verification against official paper records held by authorities.

- Non-Mandatory Data: Information not legally required for public disclosure (e.g., detailed financials in older reports, certain contracts) is harder to obtain reliably.

ChinaBizInsight: Your Partner in Historical Due Diligence

Unearthing and interpreting decades of a Chinese company’s history demands specialized knowledge, local access, and persistence. ChinaBizInsight provides authoritative Official Enterprise Credit Reports and deeper-dive Business Credit Reports, meticulously compiling verified historical data from official sources. We translate complex records into clear, actionable insights in English, empowering you to see the full picture and make decisions with confidence. Don’t gamble on an incomplete history – ensure your ventures in China are built on a foundation of thorough understanding.

ChinaBizInsight

Your strategic bridge to transparent business in China.