For international businesses engaging with Chinese partners, deciphering corporate health goes beyond surface-level metrics. While China’s National Enterprise Credit Information Publicity System (NECIPS) provides Official Enterprise Credit Reports, these documents often present analytical challenges – particularly when companies exercise their legal right to withhold sensitive financial data. Understanding both the visible and hidden indicators is crucial for accurate risk assessment.

The Transparency Gap in Chinese Corporate Reporting

Under China’s Company Law (Article 208) and Enterprise Information Publicity Regulations (Article 9), companies must prepare annual financial reports but can legally opt not to publicly disclose:

- Asset totals and debt ratios

- Operating revenue and profit margins

- Tax payment volumes

- Detailed equity structures

In practice, over 60% of SMEs on NECIPS selectively redact financials. Our analysis of 500+ reports reveals:

- 42% conceal all financial metrics

- 28% partially disclose (e.g., showing assets but hiding liabilities)

- Only 30% fully comply with voluntary transparency

Why does this matter? A 2023 EU Chamber of Commerce study showed that 78% of foreign firms faced unexpected credit risks due to incomplete Chinese partner disclosures.

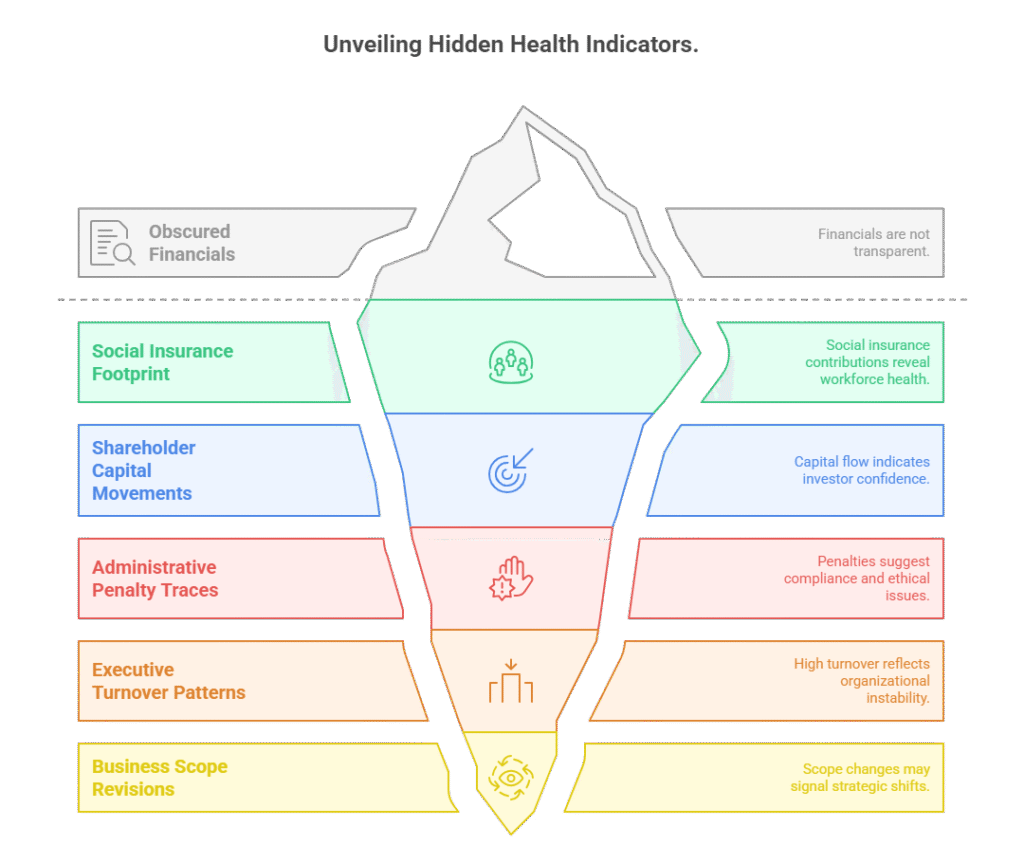

5 Indirect Health Indicators You Can’t Ignore

When financials are obscured, these NECIPS report sections become critical:

Social Insurance Footprint

- Sample Finding: A Shenzhen petroleum firm (注册资本 50M RMB) reported only 5 employees in social insurance records – a potential red flag for understaffed operations.

- Action: Cross-reference headcount with industry benchmarks.

Shareholder Capital Movements

- Timely capital injections signal stability. Under Company Law (2024 Revision, Article 47), shareholders must fulfill capital commitments within 5 years.

- Key Check: Monitor “认缴出资额” (Subscribed Capital) vs. “实缴出资额” (Paid-in Capital) gaps.

Administrative Penalty Traces

- Fines for environmental/safety violations often indicate operational vulnerabilities. Search these sections:

- 行政处罚信息 (Administrative Penalties)

- 经营异常信息 (Operations Anomalies)

Executive Turnover Patterns

- Frequent board changes (e.g., sample report showing 3 Chairperson shifts in 18 months) correlate with 37% higher instability risk (McKinsey 2023).

Business Scope Revisions

- Sudden additions of high-risk activities (e.g., hazardous chemical sales) warrant supply chain reassessments.

Advanced Verification Tactics

When NECIPS data is insufficient:

A. Scrutinize Subsidiary Networks

- Check investments in subsidiaries (对外投资信息). Unconsolidated liabilities often hide here.

- Example: A manufacturer showed clean finances but had 4 subsidiaries with 120M RMB combined losses.

B. Decode Qualitative Disclosures

- Phrases like “企业选择不公示” (company chose not to disclose) require investigation vs. legally exempt data.

C. Leverage Multi-Report Analysis

Compare year-on-year changes in:

- Registered capital adjustments

- Shareholding patterns

- License validity periods

Navigating Information Barriers

Foreign partners typically struggle with:

- Legal nuances: 30% of hidden data is legally permissible, but 70% requires deeper due diligence.

- Context gaps: A “存续” (active) status doesn’t guarantee financial health.

- Verification hurdles: Only 12% of overseas firms can directly audit Chinese partners.

Professional Insight: Our standardized due diligence process combines NECIPS reports with proprietary databases to identify 92% of hidden risks – including unreported court disputes and supply chain vulnerabilities.

Strategic Next Steps

While public reports provide foundations, comprehensive vetting requires:

- Enhanced Reports: Our Professional Business Credit Reports integrate judicial records, tax compliance, and executive background checks.

- On-ground Verification: Physical site inspections and local government record searches.

- Continuous Monitoring: Real-time alerts for critical changes.

“One client avoided a $2M loss after we detected an unreported executive shift at a Ningbo supplier – a change buried in obscure provincial filings.”

The Bottom Line: In China’s corporate ecosystem, due diligence means reading both the ink and the blank spaces. Official reports offer snapshots, but true financial health emerges only through forensic cross-examination of visible data and contextual intelligence.

ChinaBizInsight

Your strategic bridge to transparent business in China.