Verifying the legitimacy of a potential Chinese business partner isn’t just prudent – it’s essential for mitigating risk. Counterfeit companies, inflated credentials, and hidden operational issues are real dangers in the complex Chinese market. Fortunately, China’s National Enterprise Credit Information Publicity System (NECIPS) provides a powerful, free tool: the Official Enterprise Credit Report. This guide shows you how to leverage it for a rapid, basic authenticity check in about 10 minutes.

Why Verification Matters in China

China’s dynamic market offers immense opportunity, but information asymmetry can be a major hurdle. Relying solely on a company’s website or sales pitch is risky. The Official Enterprise Credit Report, sourced directly from Chinese government registries, provides a foundational layer of verified data crucial for:

- Avoiding Scams: Confirming the company legally exists and is actively registered.

- Assessing Stability: Identifying red flags like abnormal operations or pending dissolution.

- Building Trust: Verifying core details match what the company claims.

- Informed Decision-Making: Providing a baseline for further due diligence.

The 10-Minute Verification Checklist Using the Official Report

Access the NECIPS website: www.gsxt.gov.cn (Chinese language only). You’ll need the company’s exact Chinese name or its Unified Social Credit Code (USCC). If you only have the English name, finding the precise Chinese equivalent might require an initial search (consider using a reputable service like ChinaBizInsight if this proves difficult). Once on the site, search for the company.

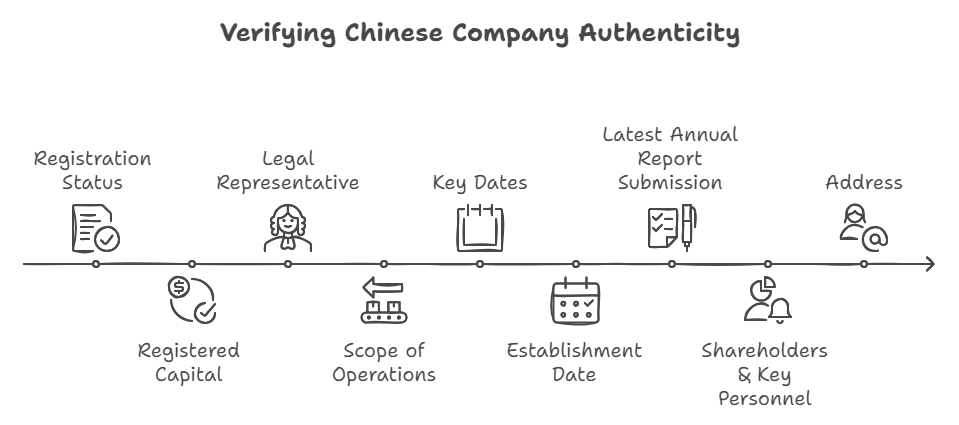

Found in under 10 minutes? Focus on these critical sections:

- Registration Status (登记状态): Crucial! Look for “存续” (Cúnxù – Operating/In Existence), “在营” (Zàiyíng – In Operation), or “开业” (Kāiyè – Open for Business). Immediate Red Flags: “吊销” (Diàoxiāo – Revoked), “注销” (Zhùxiāo – Cancelled/Dissolved), “停业” (Tíngyè – Suspended), or “清算” (Qīngsuàn – In Liquidation). Avoid companies with these statuses. If listed on the “经营异常名录” (Abnormal Operations List), investigate why (common reasons: failed annual report submission or unreachable at registered address).

- Registered Capital (注册资本): This is the capital pledged by shareholders. Note if it’s in RMB or foreign currency. Important Context: Under China’s 2024 Company Law (Article 47), shareholders generally have 5 years to fully pay in this capital. A very high registered capital figure might be aspirational rather than paid-in. Cross-reference this figure with what the company states.

- Legal Representative (法定代表人): This is the individual legally authorized to represent the company. Verify the name matches your contacts and any public information. You can search this person’s name separately within NECIPS to see their other affiliations (potential conflicts of interest).

- Scope of Operations (经营范围): This lists the business activities the company is legally permitted to engage in. Key Check: Does the core activity you’re dealing with (e.g., manufacturing, import/export of specific goods) explicitly appear here? If their main offering isn’t listed, it raises serious questions about their authority to conduct that business.

- Key Dates:

- Establishment Date (成立日期): How long has the company been operating? Newer companies inherently carry more risk.

- Latest Annual Report Submission (年报年份): Companies must submit annual reports by June 30th each year. Check the most recent year is listed (e.g., “2023年”). Failure to report lands them on the Abnormal Operations List.

- Shareholders (发起人及出资信息) & Key Personnel (主要人员): Identify major shareholders (individuals or parent companies). Review the list of Directors (董事), Supervisors (监事), and Senior Managers (高级管理人员). Does the ownership and management structure seem plausible for the claimed business scale? Sudden, frequent changes in key personnel can indicate instability.

- Address (住所): Verify the registered legal address. You can map it using Baidu Maps or Google Earth. Is it a real location? Does it match the location they provide for business? A virtual office or unclear location warrants caution.

Interpreting What You Find (The 10-Minute Assessment)

- Green Flags: “存续” status, reasonable registered capital matching business scale, legal rep identifiable, relevant business scope, consistent annual reporting, plausible address, stable management.

- Yellow Flags: Newly established, on the Abnormal Operations List (check reason!), business scope only partially matches core activity, virtual office address.

- Red Flags: Revoked/Cancelled/Dissolved status, core business activity missing from scope, legal rep not matching contact, implausible registered capital, failure to submit annual reports, unreachable at registered address.

The Limits of a 10-Minute Check

This quick NECIPS check provides vital foundational legitimacy verification. However, it has limitations for deeper due diligence:

- Limited Financial Data: The official report shows very little financial detail (companies often choose not to disclose assets, revenue, profit).

- No Risk Context: It won’t show lawsuits (unless resulting in a formal administrative penalty listed), debt obligations, negative news, or deep operational risks.

- Surface-Level Ownership: Reveals shareholders but not complex ownership structures or ultimate beneficial owners (UBOs).

- Language Barrier: Navigating NECIPS requires Mandarin proficiency.

- Data Gaps: Information relies on company submissions and government updates; inaccuracies or delays can occur.

When You Need More Than 10 Minutes

If your potential deal involves significant investment, ongoing partnerships, or sensitive transactions, the basic report is insufficient. Comprehensive due diligence is essential. This involves:

- Deeper Credit Reports: Reports like our Standard or Professional Business Credit Reports integrate NECIPS data with legal records, financial risk analysis, public notices, news, and operational insights.

- Legal Verification: Confirming specific licenses and permits relevant to the industry.

- On-the-Ground Verification: Physically verifying operations, assets, and management claims.

- Financial Analysis: Assessing real financial health and stability (beyond registered capital).

Conclusion: Verify First, Trust Later

Spending 10 minutes accessing and reviewing a Chinese company’s Official Enterprise Credit Report is the smartest first step in any potential business engagement. It provides government-verified proof of existence, operational status, and core legal details. While it won’t uncover all risks, it effectively filters out illegitimate or high-risk entities immediately. For significant ventures, use this report as the essential starting point before investing in deeper due diligence services to fully understand your potential partner’s financial health, legal standing, and operational reality. Never skip the verification step.

Need a Verified English Report or Deeper Insights? Navigating NECIPS in Chinese can be challenging. ChinaBizInsight provides official, English-translated Official Enterprise Credit Reports sourced directly from the system, along with comprehensive due diligence solutions. Explore our company verification services for a safer entry into the Chinese market.

ChinaBizInsight

Your strategic bridge to transparent business in China.

Please, what is the authencity of a company from called Qing Fei Techtalent (Jiangsu Qingfei Talent Technology Co., Ltd,)?