A sudden shift in a Chinese company’s shareholder structure isn’t just paperwork – it’s often a flashing red light. For international businesses relying on Chinese suppliers, partners, or investment targets, unexplained ownership changes can signal hidden crises that threaten contracts, supply chains, and financial stability. Understanding these risks isn’t optional; it’s essential for protecting your interests.

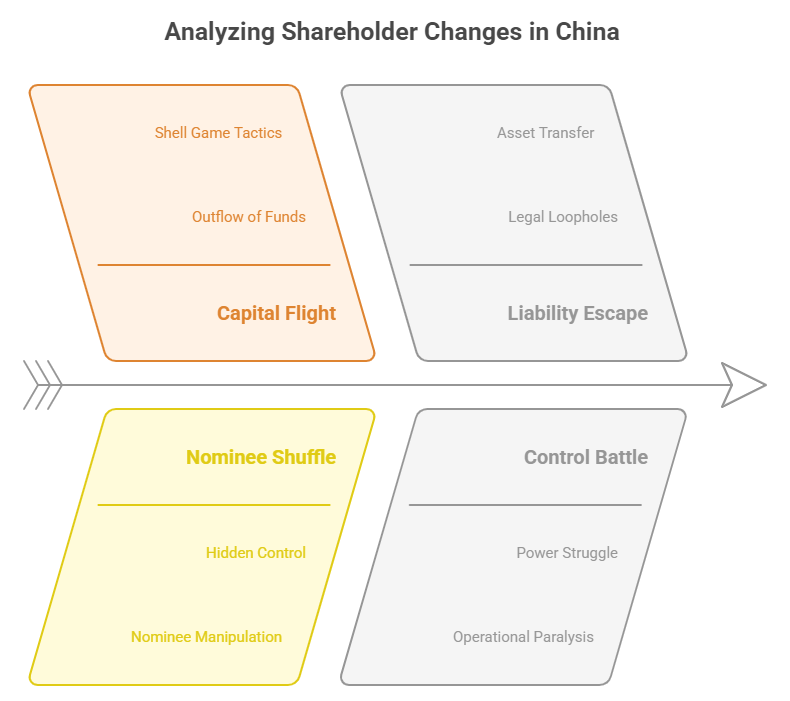

Here are 4 critical crisis scenarios triggered by abrupt shareholder changes in China and how to spot them:

Scenario 1: The Capital Flight & Shell Game

- The Crisis: A financially troubled company transfers valuable assets or key subsidiaries to a newly established entity controlled by the original shareholders (or their associates) via sudden ownership changes. The original company is left as an empty shell with debts and liabilities, while the valuable business operations continue elsewhere, shielded from creditors.

- Real-World Indicator: Look for the transfer of major assets (real estate, intellectual property, profitable subsidiaries) coinciding with new, often low-profile shareholders appearing in the original entity. The Official Enterprise Credit Report will show these asset transfers under “Change Information” and list the new, often undercapitalized shareholders. A sharp drop in registered capital in the original entity is another red flag.

- Consequence: Your unpaid invoices, warranty claims, or contractual disputes become unenforceable against the asset-rich new entity. You’re left chasing a company with no resources.

Scenario 2: The Nominee Shuffle & Hidden Control

- The Crisis: Visible shareholders (often individuals with minimal profiles) are suddenly installed, acting as fronts (“nominees”) for the real, hidden controllers. This is frequently used to bypass industry licensing restrictions, conceal conflicts of interest (e.g., a competitor secretly taking control), or obscure beneficial ownership for illicit purposes. The 2024 Company Law (Article 140) explicitly forbids illegal shareholding arrangements for listed companies, reflecting the broader regulatory concern.

- Real-World Indicator: The introduction of individual shareholders with no discernible business connection to the company’s industry or prior history, replacing established entities or individuals. Cross-referencing their names in other company reports (using services like an Enterprise Credit Report – Professional Edition) might reveal they act as shareholders for multiple unrelated businesses – a classic nominee pattern. Unexplained changes shortly before a major tender or regulatory inspection are particularly suspicious.

- Consequence: You lose visibility into who you’re truly dealing with, exposing you to undisclosed risks like sanctions evasion, regulatory non-compliance by the hidden controller, or sudden policy shifts favoring the hidden owner’s other interests.

Scenario 3: The Liability Escape Hatch

- The Crisis: Facing imminent lawsuits, major debt defaults, or regulatory penalties, controlling shareholders rapidly sell their stakes to unrelated third parties (sometimes individuals with limited means). Under China’s 2024 Company Law (Article 88), if the original shareholder failed to meet capital contribution obligations or inflated non-monetary contributions, they remain jointly liable with the new shareholder for those deficiencies, unless the buyer genuinely didn’t know. However, proving the buyer’s knowledge is difficult, and recovering funds from an original shareholder who has exited can be a protracted legal battle.

- Real-World Indicator: A sudden, complete exit of major shareholders, especially founders or long-term controllers, replaced by unknown entities or individuals, particularly if the company is known to be under financial strain or regulatory scrutiny. The timing relative to known disputes is key. The credit report’s “Shareholder & Contribution Information” and “Penalty Information” sections provide crucial context.

- Consequence: Your ability to enforce judgments or collect debts is severely hampered. The new shareholders may lack assets, and pursuing the original shareholders who have fled responsibility is costly and uncertain.

Scenario 4: The Control Battle & Operational Paralysis

- The Crisis: A sudden, significant influx of new shareholders (or a major stake purchase by a single entity) triggers a battle for board control. This leads to management deadlock, abrupt strategy shifts, key personnel departures, and halted operations. The Interim Regulations on Enterprise Information Publicity (2024 Revision) mandates disclosure of major shareholder changes, but the underlying power struggle is often the real story.

- Real-World Indicator: Multiple large-scale shareholder changes within a short period, followed by frequent changes in the legal representative, directors, or supervisors listed in the credit report. News searches might reveal rumors of internal conflicts or leadership disputes coinciding with the ownership shifts. A drop in registered operating capital can signal paralysis.

- Consequence: Your joint projects stall, orders go unfulfilled, quality control collapses, and communication breaks down. The instability makes the company an unreliable partner.

Why the Official Enterprise Credit Report is Your First Line of Defense

The National Enterprise Credit Information Publicity System (NECIPS) Official Enterprise Credit Report is the authoritative document capturing these critical shareholder changes. Here’s what it reveals:

- Historical Shareholder Timeline: Shows exactly who held shares, when they entered/exited, and their contribution amounts (registered capital). Sudden exits or entries of major players are immediately visible.

- Change Records: Details every registered change, including shareholder names, contribution percentages, and contribution amounts. Unexplained major shifts stand out.

- Key Personnel Changes: Lists changes to the Legal Representative, Directors, Supervisors, and Senior Management. Mass changes often accompany control battles.

- Subsidiaries & Investments (Outbound): Reveals if the company is setting up new entities or transferring key assets around the time of shareholder changes (Scenario 1).

- Penalties & Abnormal Operations: Provides context – were changes preceded by regulatory trouble or financial distress (Scenarios 1 & 3)?

- Ultimate Beneficial Ownership (UBO) Clues (Professional Reports): While basic reports show legal shareholders, enhanced reports can help trace complex ownership chains, identifying potential nominee structures (Scenario 2).

Proactive Due Diligence is Non-Negotiable

Sudden shareholder changes in China are rarely benign. Treat them as a high-priority alert demanding immediate investigation. Regularly monitoring your Chinese partners’ and suppliers’ Official Enterprise Credit Reports is the most efficient way to detect these changes early. For high-value relationships or significant investments, supplement this with deeper dives using Professional Enterprise Credit Reports or Executive Risk Reports to uncover hidden connections and liabilities.

Ignoring these shifts leaves your business exposed to financial loss, supply chain disruption, legal entanglement, and reputational damage. In China’s dynamic market, knowledge of who truly owns and controls your partners is the foundation of secure business.

Ensure you have the latest insights on your Chinese partners. Get an Official Enterprise Credit Report today or explore our comprehensive due diligence solutions for deeper risk analysis.

ChinaBizInsight

Your strategic bridge to transparent business in China.