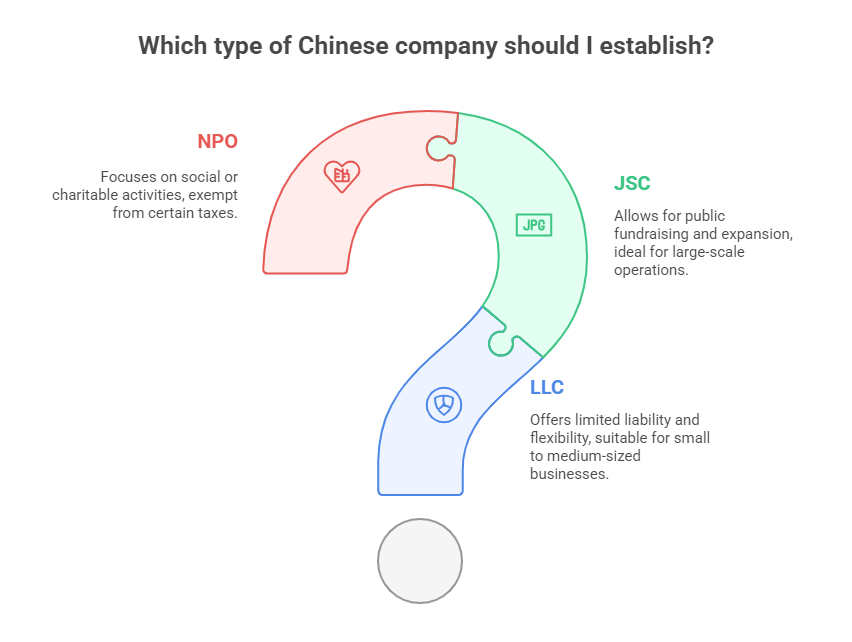

Navigating China’s business landscape starts with understanding its fundamental corporate structures. For foreign investors and partners, the distinctions between Limited Liability Companies (LLCs), Joint Stock Companies, and Non-Profit Organizations (NPOs) impact everything from liability and governance to compliance and scalability. Here’s a clear breakdown of each entity type under China’s updated legal framework (2024 Company Law).

I. Limited Liability Companies (LLCs)

Definition & Core Features

- Legal Status: Separate legal entity; shareholders’ liability capped at their capital contribution.

- Governance:

- Shareholders’ Meeting: Highest authority.

- Board/Director: Manages operations.

- Supervisor/Audit Committee: Oversees compliance.

- Capital Requirements: No minimum capital (unless industry-specific); contributions must be paid within 5 years (2024 Company Law, Art. 47).

Setup Process

- Draft Articles of Association.

- Register with SAMR (State Administration for Market Regulation).

- Obtain business license.

Best For: SMEs, joint ventures, and foreign market entrants prioritizing risk containment.

Compliance & Risks

- Annual Reports: Filed via the National Enterprise Credit Information Publicity System.

- Key Risks: Shareholder disputes; underfunding penalties.

Example: A German machinery supplier partners with a Chinese LLC. The supplier’s liability is limited to its investment, shielding global assets from the LLC’s debts.

II. Joint Stock Companies (JSCs)

Definition & Core Features

- Legal Status: Capital divided into shares; suited for large-scale operations.

- Governance:

- Mandatory Bodies: Board, Supervisory Board (≥3 members), and Shareholders’ Assembly.

- Public Offerings: Require CSRC (China Securities Regulatory Commission) approval.

- Capital Rules:

- Minimum ¥5 million for private JSCs; ¥30 million for listed companies.

- Shares can be ordinary or preferential (e.g., enhanced dividends/voting rights).

Setup Process

- Secure approval for share issuance (if public).

- Register with SAMR; list on exchanges (SSE/SZSE) for IPOs.

Best For: High-growth tech firms, manufacturers scaling production, or companies planning IPOs.

Compliance & Risks

- Disclosure: Strict financial reporting (e.g., quarterly EPS).

- Risks: Market volatility; hostile takeovers.

Case: A Shanghai-based EV battery JSC attracts U.S. venture capital by issuing preferential shares with 2x voting rights.

III. Non-Profit Organizations (NPOs)

Definition & Core Features

- Legal Forms: Social Organizations (SOs), Foundations, Private Non-Enterprises (PNEs).

- Purpose: Social welfare, education, or charity; profits reinvested, not distributed.

- Registration:

- SOs/Foundations: Approved by Civil Affairs Bureaus.

- Foreign NPOs: Must file with Public Security Bureau under the 2017 Overseas NGO Law.

Governance & Funding

- Structure: Council-driven; annual activity/financial audits.

- Revenue Streams: Donations, government grants, service fees.

Best For: NGOs, research institutes, or international charities operating in China.

Compliance & Risks

- Oversight: Annual disclosures to the Ministry of Civil Affairs.

- Risks: Political sensitivity; funding freezes for non-compliance.

Example: A French environmental foundation partners with a Chinese SO to run reforestation projects, funded by corporate CSR programs.

Key Differences at a Glance

| Criteria | LLC | Joint Stock Company | Non-Profit |

|---|---|---|---|

| Liability | Limited to contribution | Limited to share value | No owner liability |

| Min. Capital | None (flexible) | ¥5M (private); ¥30M (public) | Varies by type/region |

| Governance | Shareholders + Board | Shareholders + Board + Auditors | Council/Board |

| Profit Distribution | To shareholders | Dividends to shareholders | Reinvested into mission |

| Ideal For | SMEs, foreign ventures | Large enterprises, IPOs | NGOs, charities, research |

Why Entity Verification Matters

Foreign partners often face hidden risks:

- Ghost Companies: Fictitious LLCs with forged registrations.

- Debt Traps: JSCs with undisclosed liabilities.

- Compliance Gaps: NPOs operating beyond permitted scopes.

An Official Enterprise Credit Report from ChinaBizInsight validates:

✅ Legitimacy of registration

✅ Shareholding structure

✅ Regulatory penalties

✅ Operational status (active/revoked).

For due diligence beyond basics, our Professional Enterprise Credit Report adds risk analysis across 11 dimensions, from legal disputes to supply chain exposure.

Conclusion

China’s corporate ecosystem rewards those who align entity choice with strategic goals:

- LLCs = Agility + asset protection.

- JSCs = Capital access + scalability.

- NPOs = Mission-driven impact.

Yet, entity selection is only step one. Persistent verification shields against China’s opaque risks. Whether you’re drafting a JV agreement or funding an NPO, ground decisions in data—not assumptions.

Need to verify a Chinese partner’s credentials?

Retrieve Company Documents with ChinaBizInsight—from credit reports to bylaws, apostilled for global acceptance.

ChinaBizInsight

Your strategic bridge to transparent business in China.