For foreign businesses, establishing trust with Chinese partners is fundamental. Yet, navigating the complexities of corporate creditworthiness in China can be daunting. Negative credit records – stemming from operational hiccups, administrative penalties, or past compliance issues – can significantly hinder a Chinese company’s ability to secure contracts, attract investment, or maintain smooth supply chains. With the implementation of China’s revised Company Law effective July 1, 2024, emphasizing stricter corporate governance, transparency, and creditor protection, proactively managing and repairing corporate credit is more critical than ever.

This guide provides a clear, actionable roadmap for understanding and navigating corporate credit repair in China within the new legal framework.

Why Corporate Credit Matters in China (Especially Now)

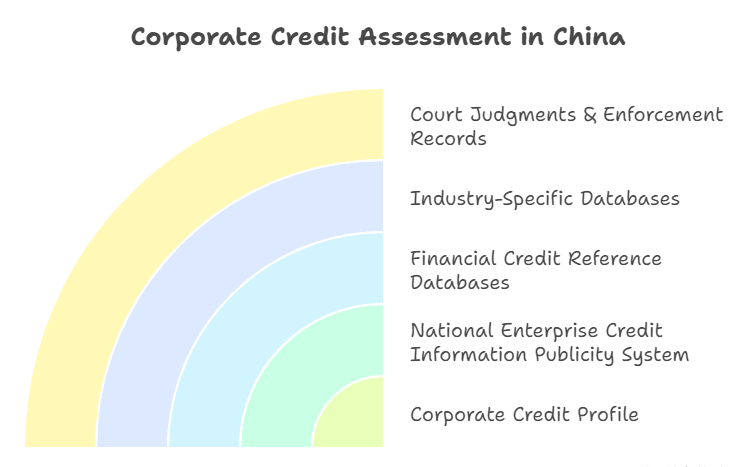

A Chinese company’s credit profile is a vital indicator of its reliability and financial health. Key sources of credit information include:

- National Enterprise Credit Information Publicity System (NECIPS): The primary government platform showcasing official registration details, administrative penalties, abnormal operations listings (“经营异常名录”), and serious violations lists (“严重违法失信名单”).

- Financial Credit Reference Databases: Operated by the People’s Bank of China (PBOC) and licensed agencies, covering loan repayment histories and financial obligations.

- Industry-Specific Databases: Relevant sectors may have additional compliance or credit tracking systems.

- Court Judgments & Enforcement Records: Publicly accessible information on lawsuits and debt enforcement.

Negative records can stem from:

- Late tax payments or filings

- Failure to submit mandatory annual reports

- Unresolved administrative penalties (e.g., environmental, safety, market regulation violations)

- Court judgments for breach of contract or debt defaults

- Providing false information on official registrations

- Being listed as a “Losing Party” (“失信被执行人”) due to unpaid court judgments.

The 2024 Company Law reinforces the consequences of poor credit:

- Enhanced Director/Officer Liability (Articles 178, 180, 181, 188): Directors and senior managers face stricter fiduciary duties (loyalty and diligence). Breaches leading to losses can result in personal liability claims by the company or shareholders.

- Capital Contribution Rules (Articles 47, 49, 50, 52, 53): Stricter enforcement of timely and adequate capital contributions. Shareholders failing to pay face liability, potential loss of equity (“失权”), and directors can be held liable for not diligently pursuing contributions. False capital contributions carry significant penalties (Article 252).

- Transparency & Disclosure (Article 40): Mandates accurate public disclosure of shareholder contributions and other key information via NECIPS. Non-compliance invites penalties (Article 251).

- Strengthened Creditor Protection (Articles 23, 54): “Lifting the corporate veil” is explicitly codified for shareholders abusing limited liability to evade debts. Creditors can demand early capital contributions from shareholders if the company cannot pay due debts.

The Corporate Credit Repair Process: A Step-by-Step Guide

Repairing credit is not instantaneous but involves systematic effort:

- Comprehensive Credit Assessment & Root Cause Analysis:

- Obtain Official Reports: Start with the Official Enterprise Credit Report from NECIPS. This is the authoritative baseline.

- Deeper Due Diligence: Supplement with a Standard or Professional Enterprise Credit Report to uncover legal disputes, operational risks, financial health indicators (if available), and historical changes. An Executive Risk Report is crucial to assess if key personnel (legal rep, directors, supervisors) have personal risk records impacting the company.

- Identify Specific Records: Pinpoint exactly what negative listings exist (e.g., “Abnormal Operations” for unreported address, “Serious Violation,” specific penalty notice numbers, court case numbers).

- Understand the Cause: Determine why the record exists. Was it an administrative oversight? A resolved penalty? An ongoing dispute? The remedy depends entirely on the root cause. Thorough due diligence is essential.

- Rectification & Compliance Correction:

- Address the Underlying Issue: This is non-negotiable.

- Pay Penalties/Fines: Settle all outstanding administrative fines in full and on time. Obtain official payment receipts.

- File Missing Reports: Submit overdue annual reports, address change filings, or other required disclosures to relevant authorities (Market Regulation, Tax Bureau).

- Correct Violations: Implement concrete changes to fix the operational or compliance failure that led to the penalty (e.g., improve environmental controls, rectify safety hazards, cease unlicensed activity).

- Fulfill Court Judgments: Satisfy court-ordered payments or obligations. Obtain proof of completion from the court.

- Resolve Capital Deficiencies: Ensure all shareholder capital contributions are made fully and on schedule as per the company’s Articles of Association and the new 5-year limit under Article 47.

- Formal Application for Record Removal:

- Administrative Penalties: Once paid and the violation is corrected, apply to the issuing authority (e.g., local Market Regulation Bureau, Ecology Bureau) for removal from the penalty database. Provide proof of payment and rectification.

- Abnormal Operations Listing: After correcting the issue (e.g., filing the overdue report, updating the registered address), apply online via NECIPS or offline at the local Market Regulation Bureau for removal. Usually processed within a few working days after verification.

- Serious Violation List: Removal is more complex and typically requires a waiting period (often 5 years from the violation date) AND demonstrable corrective actions. Apply to the listing authority.

- Court Enforcement Records (“Losing Party” List): After fulfilling the court judgment, apply to the enforcing court for removal. The court will verify compliance before updating the public database.

- Address the Underlying Issue: This is non-negotiable.

- Rebuilding & Monitoring:

- Maintain Impeccable Compliance: Rigorously adhere to all reporting deadlines, tax obligations, licensing requirements, and operational regulations. The new Company Law’s emphasis on director liability makes this paramount.

- Strengthen Internal Governance: Implement robust financial controls, internal audit procedures, and compliance monitoring systems aligned with the enhanced duties under the new law. Document everything.

- Proactive Credit Monitoring: Regularly check the company’s NECIPS profile and consider periodic Professional Enterprise Credit Reports to monitor for any new negative information or inaccuracies. Early detection is key.

- Demonstrate Positive Trajectory: Build a track record of timely payments to suppliers, successful contract completions, and positive business relationships. While less formal, this contributes to overall reputation recovery.

Key Considerations in the New Legal Landscape

- Timeliness is Crucial: The new law tightens timelines (e.g., 5-year capital contribution window, specific deadlines for director actions). Address credit issues promptly to avoid compounding penalties or director liability.

- Director Accountability: Directors must actively ensure compliance and capital adequacy. Negligence in addressing credit-damaging issues can now more easily lead to personal liability suits.

- Transparency is Enforced: Expect stricter scrutiny of disclosures on NECIPS. Inaccuracies or omissions carry higher risks under the amended penalties (Articles 251, 252).

- Professional Guidance is Highly Recommended: The complexity of regulations, application procedures, and the heightened stakes under the new Company Law make consulting with experienced local legal and financial advisors specializing in Chinese corporate compliance invaluable. They can navigate bureaucracy, ensure correct procedures are followed, and mitigate risks.

How ChinaBizInsight Empowers Your Due Diligence

Understanding a potential Chinese partner’s credit status, including any repair efforts, is vital for risk mitigation. ChinaBizInsight provides the authoritative data you need:

- Verify Current Standing: Obtain the definitive Official Enterprise Credit Report directly sourced from NECIPS, showing the current status of administrative penalties and listings.

- Uncover Historical Context & Risks: Our Professional Enterprise Credit Report offers deep insights into historical penalties (even if resolved), litigation history, operational risks, and the background of key personnel via the Executive Risk Report.

- Monitor Changes: Track the evolution of a company’s credit profile over time with updated reports.

Conclusion: Vigilance and Proactive Management

Corporate credit repair in China demands diligence, patience, and strict adherence to compliance within the evolving regulatory framework, especially under the stricter 2024 Company Law. Successfully repairing credit opens doors to better financing, stronger partnerships, and sustainable growth. For international partners, accessing accurate, timely, and comprehensive corporate credit information is the cornerstone of informed decision-making and building trustworthy business relationships in China. Proactive credit management isn’t just about fixing the past; it’s about securing a more stable and reputable future under China’s enhanced corporate governance regime.

ChinaBizInsight

Your strategic bridge to transparent business in China.