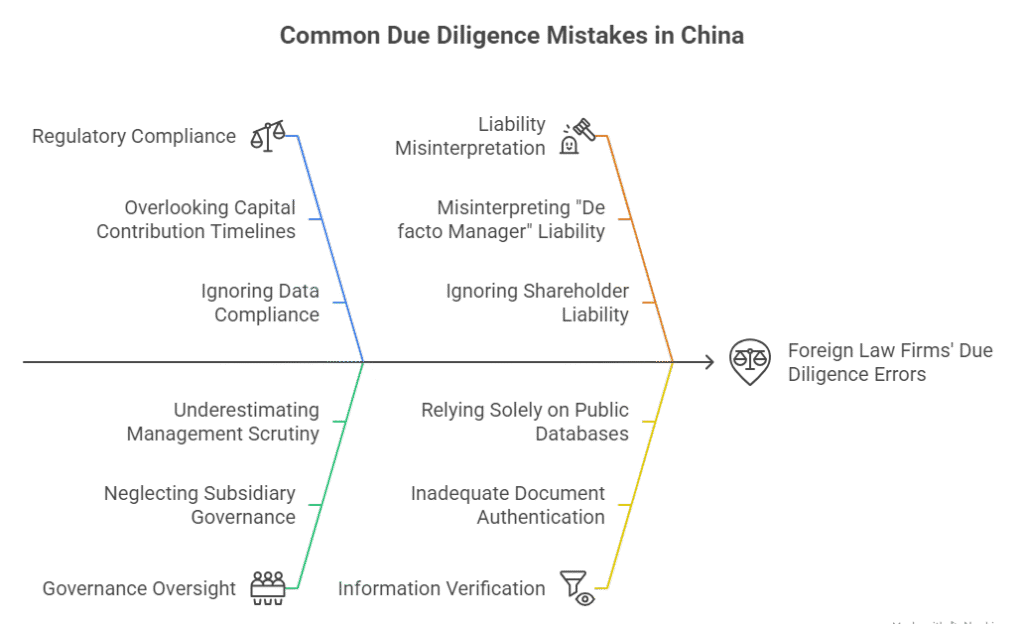

China’s dynamic business landscape demands meticulous due diligence. With the 2024 Company Law effective July 1st, the rules have changed significantly. Foreign law firms navigating Chinese M&A, investments, or partnerships face heightened risks if relying on outdated practices. Based on common pitfalls observed in cross-border transactions, here are the top 10 due diligence mistakes and how the new law impacts them:

- Overlooking Stricter Capital Contribution Timelines (Art 47):

- Mistake: Assuming long-term (e.g., 20-30 year) capital subscription schedules from old registries are still valid.

- New Law Risk: Art 47 mandates all shareholders contribute subscribed capital within 5 years of company establishment. Failure triggers board obligations to demand payment (Art 51) and potential share forfeiture (Art 52).

- Solution: Verify the actual paid-in capital and payment deadlines against the new 5-year rule. Scrutinize shareholder agreements for compliance. Obtain an updated Official Enterprise Credit Report to confirm capital status.

- Ignoring Enhanced Shareholder/Controller Liability (Art 23, 53):

- Mistake: Failing to deeply investigate ultimate beneficial owners (UBOs) and their potential for abusing limited liability.

- New Law Risk: Art 23 “pierces the corporate veil” for shareholders who evade debts or severely harm creditors. Art 53 makes directors, supervisors, and senior management jointly liable for losses caused by capital withdrawal. Controlling shareholders/non-director de facto managers face fiduciary duties (Art 180).

- Solution: Conduct thorough Executive & Shareholder Risk Reports to uncover hidden controllers, related-party networks, and historical liability issues. Scrutinize financial flows for signs of asset stripping.

- Underestimating Director/Senior Management Scrutiny (Art 178-188):

- Mistake: Performing only cursory background checks on key personnel.

- New Law Risk: Expanded definitions of loyalty/duty of care (Art 180), stricter conflict-of-interest rules (Arts 181-186), and clearer shareholder derivative suit mechanisms (Art 189) mean problematic directors pose a major liability.

- Solution: Rigorous checks for disqualifications (Art 178), conflicts, related transactions, and past compliance issues via Executive Risk Reports. Verify reported roles against official records.

- Neglecting Subsidiary Governance & Reporting (Art 13, 57, 110, 192):

- Mistake: Focusing solely on the parent company without verifying subsidiary structures, finances, and compliance.

- New Law Risk: Parent companies bear subsidiary liabilities (Art 13). Shareholders have rights to access subsidiary records (Art 57 for LLCs, Art 110 for JSCs). Holding companies can be liable for directing wrongdoing (Art 192).

- Solution: Map the entire corporate group. Obtain and analyze official records (credit reports, filings) for key subsidiaries. Ensure consolidated financials are available and audited.

- Misinterpreting “De facto Manager” Liability (Art 180):

- Mistake: Overlooking individuals who exert control without formal titles (e.g., shadow directors, influential founders).

- New Law Risk: Art 180 explicitly applies fiduciary duties (loyalty and care) to controlling shareholders/actual controllers who manage company affairs without being directors.

- Solution: Go beyond the org chart. Identify true decision-makers through shareholder analysis, contract reviews, and executive interviews. Include them in background checks.

- Failing to Verify New Audit Committee Powers (Art 69, 121, 137):

- Mistake: Not confirming if a company uses an Audit Committee instead of a Supervisory Board, and misunderstanding its authority.

- New Law Risk: Companies can replace the Supervisory Board with a Board Audit Committee (Arts 69 for LLCs, 121 for JSCs). For listed companies, this committee has veto power over key financial decisions (hiring auditors, appointing CFOs, report disclosure – Art 137).

- Solution: Determine the governance structure (Board Committee vs. Supervisory Board). For companies with Audit Committees, understand their composition, authority, and approval history on critical matters. Review relevant board resolutions.

- Inadequate Document Authentication for Cross-Border Use:

- Mistake: Assuming Chinese company documents (reports, certificates) are readily accepted overseas without proper legalization.

- Risk: Unauthenticated documents are often rejected by foreign courts, regulators, or banks, delaying transactions or causing disputes.

- Solution: Ensure critical documents obtained during DD (e.g., Credit Reports, Licenses, Articles) undergo proper Apostille (for Hague members) or Consular Legalization (for non-members) for validity abroad. Factor this into the DD timeline. Learn about China’s Apostille process.

- Overlooking Stricter Data Compliance (Art 217 & Data Security Law):

- Mistake: Not assessing how the target company collects, stores, and processes data, especially sensitive or personal data.

- New Law Risk: Art 217 prohibits off-book accounts. Broader data privacy laws (DSL, PIPL) impose heavy fines and operational restrictions for non-compliance. Due diligence itself must handle data legally.

- Solution: Include data governance and security practices in the DD checklist. Verify compliance with Chinese data laws. Ensure your own DD process respects data transfer and privacy regulations.

- Underestimating Shareholder Exit Rights (Art 89, 161):

- Mistake: Not modeling scenarios where minority shareholders trigger compulsory buyouts.

- New Law Risk: Arts 89 (LLCs) & 161 (JSCs) allow dissenting shareholders to demand buyouts in specific scenarios (e.g., 5yr+ profits but no dividends, major asset sales, charter changes to avoid dissolution). This impacts valuation and deal structure.

- Solution: Review shareholder agreements and charter clauses related to exit rights. Analyze financials and distribution history to assess buyout risk. Model potential buyout costs.

- Relying Solely on Public Databases (Ignoring Deep Dives):

- Mistake: Treating a basic National Credit Information Publicity System (NECIPS) report as sufficient due diligence.

- Risk: NECIPS provides foundational data but lacks depth on risks (litigation, financial health, operational issues, group structures, UBOs). It won’t reveal unregistered pledges, off-book liabilities, or emerging operational risks.

- Solution: Combine NECIPS checks with comprehensive Professional Business Credit Reports and Financial & Tax Reports. Conduct site visits, management interviews, and independent verification of critical claims. For complex groups or high-risk targets, Custom Due Diligence Reports are essential. Explore our full suite of due diligence solutions.

Why Partner with ChinaBizInsight?

The 2024 Company Law intensifies the complexity and stakes of Chinese due diligence. Foreign law firms cannot afford oversights stemming from unfamiliarity with the new regime or difficulties accessing authoritative, verified information.

ChinaBizInsight is your dedicated partner on the ground. We specialize in providing international businesses and advisors with:

- Authoritative Official Documents: Directly sourced from Chinese government registries.

- In-Depth Intelligence Reports: Standard, Professional, Financial/Tax, and Custom Due Diligence Reports tailored to uncover the risks that matter.

- Executive & Shareholder Risk Profiling: Identify key players and their potential liabilities.

- Seamless Document Legalization: Apostille and Consular Legalization services ensuring your evidence holds weight globally.

- Expert Interpretation: Helping you understand the practical implications of Chinese regulations like the new Company Law.

Don’t let due diligence blind spots derail your China deal. Ensure your investigations are thorough, compliant, and leverage the most reliable sources.

Ready to conduct bulletproof due diligence under China’s new Company Law? Contact ChinaBizInsight today for a consultation.

ChinaBizInsight

Your strategic bridge to transparent business in China.