China’s revised Company Law (effective July 1, 2024) significantly clarifies and intensifies the responsibilities of liquidation obligors (清算义务人). For directors of Chinese companies – especially foreign-invested enterprises or JV partners – understanding these obligations is critical to avoid severe personal liability. This guide breaks down key risks and compliance strategies under the updated legal framework.

Who Exactly is the Liquidation Obligator? (Art. 232)

Under the 2024 law, company directors are explicitly designated as liquidation obligors. When dissolution triggers occur (e.g., license revocation, shareholder resolution, court order), directors must form a liquidation committee within 15 days. Key dissolution triggers include:

- Expiry of operational term in Articles of Association

- Shareholder resolution for dissolution

- License revocation/forced closure by authorities

- Court-ordered dissolution due to deadlock

Failure to initiate liquidation promptly exposes directors to personal liability.

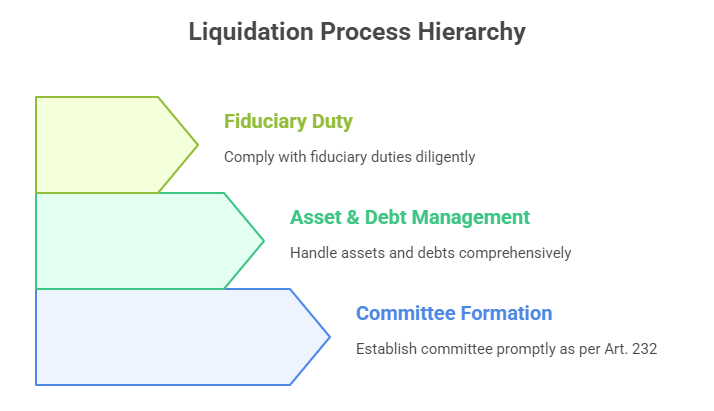

3 Critical Obligations & How to Fulfill Them

- Timely Liquidation Committee Formation (Art. 232)

- Action: Draft a board resolution immediately upon dissolution trigger. Document committee formation date.

- Evidence: Maintain board meeting minutes, dissolution notice (e.g., administrative penalty), and committee appointment records.

- Risk Mitigation: Use China’s National Enterprise Credit Information Publicity System (NECIPS) to publicly announce dissolution reasons within 10 days (Art. 229).

- Comprehensive Asset & Debt Handling (Art. 234-237)

- Asset Inventory: Prepare a detailed asset/debt list within 60 days. Engage licensed appraisers for complex assets.

- Creditor Notification: Notify known creditors directly within 10 days and announce publicly via NECIPS/newspaper within 60 days.

- Sequential Payment: Strictly follow the statutory payment hierarchy:

- Liquidation costs

- Employee wages/social insurance/severance

- Taxes

- Unsecured debts

- Bankruptcy Petition: If assets are insufficient, file for bankruptcy immediately (Art. 237). Delaying this voids limited liability protection.

- Fiduciary Duty Compliance (Art. 238)

Liquidators owe “diligence and loyalty” duties akin to directors. Prohibited acts include:- Transferring assets pre-liquidation

- Preferential debt repayments

- Concealing financial records

- Consequence: Personal liability for company/creditor losses + potential disqualification from future directorships.

Simplified Deregistration: A Narrow Escape Hatch (Art. 240)

Companies meeting ALL criteria below may qualify for expedited deregistration:

- Zero liabilities outstanding OR full debt settlement completed

- Unanimous shareholder commitment (written declaration)

- 20-day public notice via NECIPS with no creditor objections

Crucially: Shareholders bear joint liability for pre-deregistration debts if declarations are false.

Dire Consequences of Non-Compliance

- Personal Liability: Directors face joint liability for unpaid company debts + damages (Art. 233, 238).

- Fines: RMB 10,000 – 100,000 on the company; RMB 10,000 – 100,000 on responsible personnel (Art. 256).

- Operational Bans: Disqualified from director/executive roles for 3+ years.

- Criminal Risk: Asset concealment or fraudulent reporting may trigger criminal investigation (Art. 264).

Proactive Compliance Checklist for Directors

- Document Dissolution Triggers: File revocation notices/court orders immediately.

- Board Resolution: Formally resolve to establish liquidation committee <15 days.

- Public Announcements: Use NECIPS for dissolution notice + creditor notifications.

- Asset Freeze: Suspend non-essential operations; secure company seals/accounts.

- Creditor Engagement: Maintain transparent communication; document claims.

- Professional Advisors: Engage legal counsel + licensed accountants early. For due diligence on potential risks, consider our Company Credit Reports.

- Audit Trail: Archive all minutes, notices, inventories, and payment records.

Key Takeaway

The 2024 Company Law places directors squarely in the crosshairs during liquidation. Procedural rigor, transparency, and speed are non-negotiable. Relying on historical practices is perilous – the updated statute demands meticulous compliance. When in doubt, seek expert verification of company status and obligations through reliable Business Document Retrieval Services. Your personal assets and professional future depend on it.

ChinaBizInsight

Your strategic bridge to transparent business in China.