Introduction

When a Chinese debtor enters bankruptcy, foreign creditors face unique challenges securing repayment. China’s updated Company Law (effective July 1, 2024) clarifies creditor hierarchies and enforcement mechanisms—critical knowledge for protecting cross-border investments. This guide breaks down the key changes and strategic steps for foreign creditors.

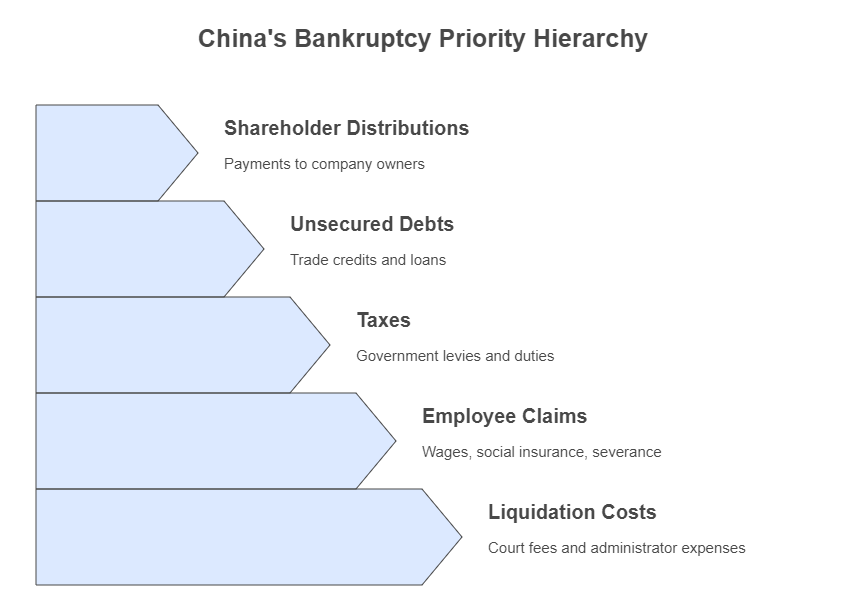

The Priority Hierarchy Under China’s New Framework

Article 236 of the 2024 Company Law establishes a clear payment sequence during liquidation:

- Liquidation costs (court fees, administrator expenses)

- Employee claims (wages, social insurance, severance)

- Taxes

- Unsecured debts (including trade credits and loans)

- Shareholder distributions

Critical Insight: Foreign unsecured creditors rank after employee claims and taxes but before shareholders. Documentation is paramount—informal agreements rarely survive bankruptcy scrutiny.

Key Changes Impacting Foreign Creditors

- Enhanced Transparency (Article 40):

Debtors must disclose asset/debt details via China’s National Enterprise Credit Information Publicity System. Foreign creditors can access insolvency notices here to monitor proceedings.

Practical Tip: Set automated alerts for debtor registrations. - Strict Director Liability (Article 53 & 188):

Directors face personal liability for asset concealment or fraudulent transfers. Foreign creditors can petition courts to claw back diverted assets.

Case Example: In 2023, Shanghai courts ordered directors of a bankrupt textile exporter to repay $2.1M in illegally transferred funds to EU suppliers. - Streamlined Cross-Border Claims (Article 248):

Foreign judgments are now enforceable in Chinese bankruptcies if:

- The debtor’s main assets are in China

- Reciprocity exists between jurisdictions

- Claims are filed within 45 days of public notice (Article 235)

Step-by-Step Enforcement Strategy

- Pre-Bankruptcy Due Diligence

Verify debtor solvency through:

- Official credit reports (showing liens, court rulings)

- Shareholder audits (identifying asset-stripping risks)

- Claim Filing Protocol

- Submit notarized debt evidence (contracts, invoices) within 45 days of liquidation notice

- Include Chinese translations with embassy legalization

- Prioritize Secured Status

Per Article 162, secured claims (e.g., asset mortgages) are paid before administrative costs. Register collateral with:

- People’s Bank of China Credit Reference Center (movable assets)

- State Land Administration (real estate)

- Challenge Suspicious Transactions

Courts can void:

- Asset transfers within 1 year of bankruptcy (Article 256)

- Preferential payments to select creditors (Article 20)

Why Proactive Monitoring Matters

In 2022, only 32% of unsecured foreign claims in Chinese bankruptcies recovered >20% of dues. Early intervention is critical:

“Recovering debt after liquidation starts is like finding a ring in a landfill—possible, but painfully unlikely without a map.”

— Li Wei, Shanghai Insolvency Court Judge

How ChinaBizInsight Supports Your Claims

We help foreign creditors:

- Verify debtor assets via Official Enterprise Credit Reports

- Track director risks using Executive Liability Checks

- Legalize claim documents for Chinese courts with Apostille Services

Conclusion

The 2024 Company Law brings needed structure to China’s bankruptcy system, but foreign creditors must act decisively. Prioritize secured status, document rigorously, and monitor debtors pre-emptively. In high-risk engagements, comprehensive due diligence isn’t optional—it’s your financial shield.

Need to assess a Chinese partner’s solvency?

Verify their credit status now

Key Takeaways

| Priority Level | Claim Type | Recovery Likelihood |

|---|---|---|

| 1st | Secured debts | 70-90% |

| 2nd | Employee/taxes | 50-75% |

| 3rd | Unsecured foreign debts | 15-35% |

| Last | Shareholders | 0-10% |

Source: Supreme People’s Court 2023 Bankruptcy Recoveries Report

ChinaBizInsight

Your strategic bridge to transparent business in China.