Key Takeaways

- Legal representatives hold unilateral binding authority for company actions

- Personal liability applies for: illegal instructions, negligence, or conflicts of interest

- New 2024 amendments clarify resignation rules and shareholder protections

- Verification of representative status is critical for international partners

Who Qualifies as a Legal Representative?

Under Article 10 of China’s Company Law (2024 Revision):

- Appointed via公司章程 (Articles of Association)

- Must be the董事长 (Chairman), 执行董事 (Executive Director), or 经理 (Manager)

- Acts as the company’s sole official signatory with binding authority

Example: When signing contracts with Chinese suppliers, only documents bearing the legal representative’s signature create enforceable obligations for the company.

Core Responsibilities & Legal Exposure

(Articles 11, 180-184)

| Authority | Limitations | Personal Liability Triggers |

|---|---|---|

| Signing contracts | Cannot violate company bylaws | Acting beyond authorized scope |

| Legal proceedings | Must serve company interests | Self-dealing/conflict of interest |

| Financial operations | Subject to shareholder oversight | Intentional misconduct or gross negligence |

| Regulatory compliance | Must obey Chinese laws | Failure to perform statutory duties |

Critical Change (2024):

- Resignation takes effect immediately upon company notification (Art. 10)

- Companies have 30 days to appoint successors after resignation

When Personal Assets Are At Risk

Pierced Corporate Veil Scenarios (Art. 23):

- Asset mixing: Personal funds used for company expenses (or vice versa)

- Fraudulent transfers: Moving assets to avoid debts

- Undercapitalization: Insufficient capital for business risks

Direct Liability Claims (Art. 188):

- Shareholders may sue representatives for damages caused by:

- Violating laws/articles of association

- Neglecting fiduciary duties

- Unauthorized profit-taking

Case Note: In 2023, a Shanghai court ordered a legal representative to pay ¥8.2M personally after falsifying export documents.

Foreign Partners: 3 Verification Essentials

Before signing agreements with Chinese companies:

- Confirm Representative Identity

- Cross-check with official Enterprise Credit Report

- Validate through National Enterprise Credit Information Publicity System

- Check Authority Limitations

- Obtain current公司章程 (Articles of Association)

- Review board resolutions restricting signing authority

- Monitor Changes

- Track resignations/appointments via credit system updates

- Require notarized proof of authorization

Pro Tip: Our Official Enterprise Credit Reports include real-time legal representative verification with government seals.

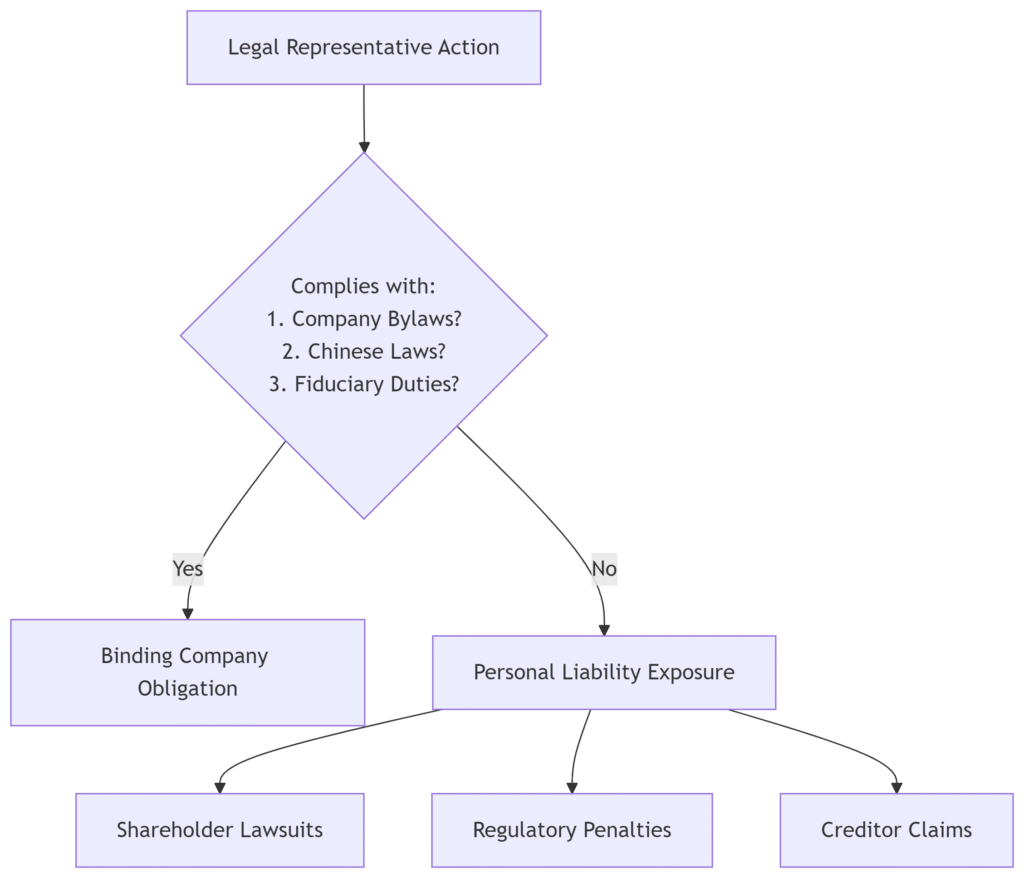

The Compliance Flowchart

Mitigation Strategies for International Businesses

- Due Diligence First

- Obtain authenticated Business Credit Reports verifying representative status

- Review 5-year directorship history for red flags

- Contract Safeguards

- Include “Authority Warranty” clauses

- Require board resolutions for high-value deals

- Continuous Monitoring

- Subscribe to Executive Risk Alerts

- Verify notarized documents for representative changes

2024 Law Impact: New Article 191 exposes representatives to third-party liability for duty violations – a critical risk for suppliers.

Why Verification Matters More Than Ever

The 2024 amendments increase accountability while accelerating corporate processes. For overseas partners:

- 30-day resignation gap creates signing authority uncertainty

- Strengthened piercing provisions threaten contract security

- Electronic registration enables faster fraudulent changes

Solution: Regular verification through Official Document Retrieval prevents unauthorized transactions.

ChinaBizInsight helps over 600 global clients verify Chinese partners annually. Access authenticated records with government-stamped Enterprise Credit Reports. Questions? Consult our compliance team.

ChinaBizInsight

Your strategic bridge to transparent business in China.