Protect your investments and partnerships in China with this essential guide. The revised Company Law of the People’s Republic of China, effective July 1, 2024, introduces significant changes impacting corporate governance, shareholder rights, and compliance. For overseas businesses engaging with Chinese partners, thorough due diligence is no longer optional—it’s critical for risk mitigation and success. This updated checklist for 2025 incorporates the latest legal requirements.

I. Core Company Verification & Legitimacy

- Business License & Registration Status:

- Verify Authenticity: Confirm the license is genuine and current via the National Enterprise Credit Information Publicity System (NECIPS). Cross-check registration number, company name, address, and legal representative. (New Law: Art. 33 mandates NECIPS publication of key registration details; Art. 40 requires companies to publish shareholder/contributor info).

- Scope of Operations: Ensure the company’s actual business activities fall within its registered scope. (New Law: Art. 9 allows scope changes via charter amendment).

- Registered Capital: Scrutinize the capital structure and paid-in status. The new law imposes stricter timelines: Contributions must be fully paid within 5 years of establishment (Art. 47). Investigate any significant discrepancies between subscribed and paid-in capital. Assess shareholder liability for unpaid contributions (Art. 50, 52).

- Subsidiaries & Branches: Identify and verify any subsidiaries (independent legal entities) and branches (no independent status).

- Corporate Structure & Governance:

- Shareholders & Ultimate Beneficial Owners (UBOs): Obtain the shareholder register. Identify major shareholders (especially those holding >50% or exerting significant influence – New Law Art. 265 defines “Controlling Shareholder”) and trace ownership chains to uncover UBOs. Be alert for undisclosed nominee arrangements.

- Directors, Supervisors & Senior Management: Verify identities and backgrounds. Check for disqualifications (New Law: Art. 178 – e.g., incapacity, specific criminal convictions, bankruptcy/dishonesty history). Assess potential conflicts of interest (Art. 182-184). Note enhanced duties of loyalty and diligence (Art. 180-181).

- Board Structure: Determine if the company utilizes the new option of an Audit Committee (composed of directors) instead of a traditional Board of Supervisors (Art. 69, 121). Understand its role and membership.

- Charter (Articles of Association): Obtain and review. Pay close attention to provisions on share transfers, profit distribution, voting rights, and any special rights granted to specific shareholders or classes of shares (if applicable – Art. 144).

II. Financial Health & Compliance

- Financial Statements & Audit Reports:

- Request Audited Reports: Secure the latest annual financial statements audited by a reputable Chinese accounting firm. (New Law: Art. 208 requires annual audits). Look for unqualified opinions.

- Analyze Performance: Assess profitability, liquidity, solvency, and debt levels. Compare trends over several years. Identify significant assets and liabilities.

- Capital Reserves: Understand the status of statutory and discretionary surplus reserves, and capital reserves (Art. 210, 213, 214). Note restrictions on distributions if reserves are insufficient.

- Tax Compliance:

- Request proof of tax registration and recent tax payment certificates.

- Inquire about any ongoing tax disputes, audits, or significant penalties received.

- Debt & Financing:

- Disclosed Debts: Review loan agreements, bond issuances (if any – Art. 194), and major supplier credit terms.

- Contingent Liabilities: Investigate potential liabilities from guarantees (Art. 15 outlines strict approval processes, especially for shareholder/controller guarantees), lawsuits, environmental issues, or tax disputes. New Law: Art. 54 allows creditors to demand early contribution from shareholders if the company cannot pay debts, even if the contribution period hasn’t expired.

III. Operational & Legal Risks

- Legal Disputes & Litigation:

- Search court records (where accessible) for pending or past lawsuits involving the company, its key shareholders, or senior management.

- Check the NECIPS and judicial publicity websites for records of enforcement actions or judgments.

- Inquire directly about significant disputes, arbitration, or regulatory investigations.

- Regulatory Compliance:

- Industry-Specific Licenses/Permits: Verify all necessary operational licenses and permits are valid and match the business scope.

- Environmental, Health & Safety (EHS): Assess compliance records, especially for manufacturing or resource-intensive businesses. Look for past violations or fines.

- Labor Practices: Review standard employment contracts. Check for social security contribution records and inquire about any significant labor disputes or non-compliance issues (Art. 16-17 emphasize employee rights).

- Asset Ownership & Encumbrances:

- Key Assets: Verify ownership or valid lease agreements for core assets like real estate (property deeds), major equipment, and critical intellectual property.

- Encumbrances: Check for mortgages, pledges (Art. 162 prohibits using the company’s own shares as pledge collateral), or liens registered against significant assets (e.g., real estate registries,动产融资统一登记公示系统 – Unified Movable Property Registration).

- Intellectual Property (IP):

- Registered IP: Verify ownership and validity of trademarks, patents, and copyrights crucial to the business through official databases. (New Law: Art. 21 clarifies shareholder rights to inspect IP records).

- Infringement Risks: Assess risks of infringing others’ IP or vulnerability of the company’s own IP to infringement.

IV. Reputational & Market Standing

- Industry Reputation & News:

- Conduct media searches (Chinese and international) for positive/negative news, product recalls, scandals, or regulatory actions.

- Check industry forums and social media for customer sentiment and complaints.

- Utilize business intelligence databases for risk reports.

- Key Partners & Customers:

- Understand the stability and reputation of major suppliers and customers. Assess concentration risk.

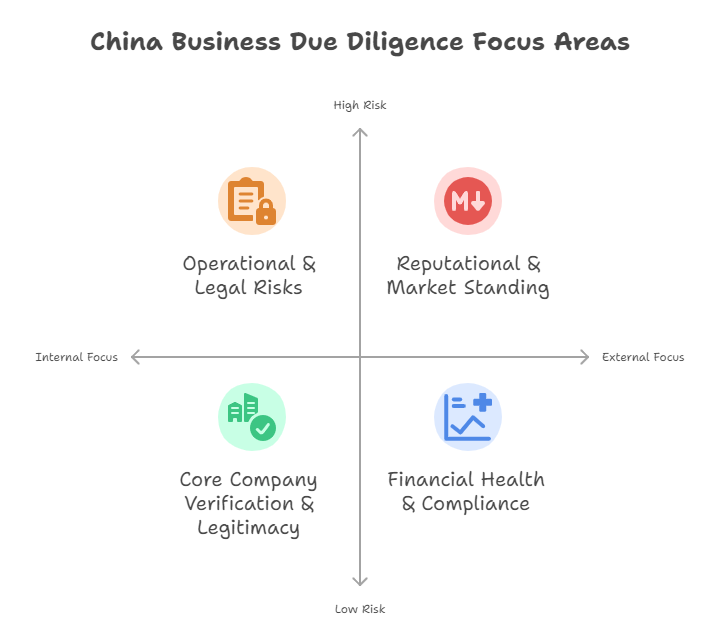

V. Impact of the 2024 Company Law Revisions – Key Due Diligence Focus Areas

- Shareholder Contributions: Crucially verify the timeline and status of capital contributions. Failure to pay within 5 years risks share forfeiture (Art. 52). Assess potential liability for existing shareholders and new transferees (Art. 88).

- Director/Senior Management Liability: Scrutinize governance practices. Enhanced duties (Art. 180-181) and clearer paths for shareholder derivative suits (Art. 188-192) increase personal liability risks for wrongdoing.

- Corporate Group Structures: Pay special attention to transactions within groups, potential abuse of control, and liability piercing risks (Art. 23 addresses “piercing the corporate veil”).

- Minority Shareholder Protections: Note strengthened rights, including enhanced information access (Art. 57 expands inspection rights to accounting vouchers; Art. 110 for JSCs), appraisal rights for dissenting shareholders in major events (Art. 89, 161), and mechanisms for holding controllers accountable.

- Audit Committees: Understand if this governance model is adopted and its effectiveness. Note its mandatory pre-approval role for certain matters in listed companies (Art. 137).

- Simplified Dissolution: Be aware of the new simplified dissolution procedure for solvent companies (Art. 240), but verify creditor clearance thoroughly.

VI. Document Verification & Authentication

- Authenticate Critical Documents: For documents like the Business License, Articles of Association, Board Resolutions, or financial reports to be legally valid overseas, they typically require:

- Notarization by a Chinese notary public.

- Authentication:

- Apostille (Hague Certification): For use in other Hague Apostille Convention member countries. (China acceded Nov 2023; effective Nov 7, 2024).

- Consular Legalization: For use in non-Hague member countries, requiring authentication by the Chinese Foreign Ministry and the consulate of the destination country.

- Ensure Validity: Confirm notarization and authentication are recent and completed correctly for the intended destination country. Our Document Authentication & Apostille Service streamlines this complex process.

Essential Tools for Your Due Diligence:

- Official Enterprise Credit Report: The foundation, sourced directly from the NECIPS. Obtain the Official Report Here.

- Standard Business Credit Report: Incorporates NECIPS data plus core risk screenings. Explore the Standard Report.

- Professional Enterprise Credit Report: Deep dive with financial risk, legal proceedings, industry benchmarking, and news monitoring. Deepen Your Investigation.

- Financial & Tax Risk Report: Focuses on financial health, tax compliance, and supplier/customer stability. Assess Financial Risk.

- Executive Risk Report: Profiles key personnel (Directors, Supervisors, Senior Mgmt) for investments, roles, and associated risks. Check Key Personnel.

The 2024 Company Law strengthens China’s corporate governance framework but also introduces new compliance requirements and potential liabilities. A meticulous due diligence process, updated for these changes, is paramount for any overseas entity entering into business relationships in China. This checklist provides a comprehensive framework, but the depth of investigation should always be tailored to the specific transaction risk.

Doing business in China? Ensure you start with verified information. Explore our full suite of due diligence reports and reliable document authentication services designed for international clients at ChinaBizInsight. Know Your Chinese Partners.

ChinaBizInsight

Your strategic bridge to transparent business in China.