Securing financing or opening accounts with overseas banks? Here’s exactly what documentation you’ll need from your Chinese partners – and how to get it properly legalized.

Foreign banks face significant due diligence hurdles when dealing with Chinese companies. Regulatory scrutiny, cross-border verification complexities, and fraud risks make robust documentation non-negotiable. Under China’s New Company Law (effective July 1, 2024), requirements for document validity and disclosure have tightened. This guide details the 6 critical documents foreign banks demand, their updated legal significance, and precise authentication steps.

Why Document Legitimacy Matters More Than Ever (New Company Law Impact)

The 2024 Company Law introduces stricter rules affecting document validity:

- Capital Contribution Deadlines (Art 47): Shareholders must fully pay registered capital within 5 years of establishment. Older licenses without paid-in capital verification are now red flags.

- Enhanced Shareholder Liability (Art 53): Shareholders risk joint liability for debt evasion or capital withdrawal. Banks scrutinize shareholder lists and capital records.

- Mandatory Public Disclosures (Art 40): Companies must公示 (publicly disclose) shareholder contributions, equity changes, and licenses via National Enterprise Credit Information Publicity System (NECIPS). Inconsistent documents = high risk.

Without compliant documents, banks face regulatory penalties and asset recovery challenges.

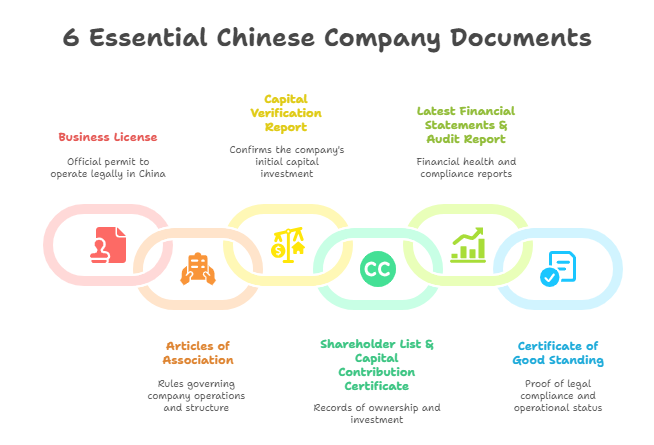

✅ 6 Essential Chinese Company Documents (+ Authentication Requirements)

1. Business License (营业执照)

- Purpose: Confirms legal existence, scope, registered address, and legal representative.

- New Law Changes: Electronic licenses (Art 33) hold equal legal force as paper. Verify via QR code on the license linking to NECIPS.

- Authentication:

- Hague Members: Apostille on notarized copy.

- Non-Hague: Notarization → Provincial China Council for Promotion of International Trade (CCPIT) attestation → Consular legalization.

2. Articles of Association (公司章程)

- Purpose: Details governance structure, shareholder rights, capital structure, and profit distribution.

- Critical Clauses for Banks: Capital contribution schedules (Art 47), share transfer restrictions (Chap 4), and liquidation procedures (Art 229).

- Authentication: Notarization + Apostille/legalization of certified copy.

3. Capital Verification Report (验资报告)

- Purpose: Audited proof of paid-up capital.

- 2024 Law Alert: Banks require verification that capital is fully paid within 5 years (Art 47). Reports older than 5 years are invalid.

- Authentication: Issued by a Chinese CPA firm → Notarized → Apostille/legalization.

4. Shareholder List & Capital Contribution Certificate (股东出资证明书)

- Purpose: Validates ultimate beneficial owners (UBOs) and equity stakes.

- Bank Focus: Shareholder identity, payment timelines, and transfer history (Art 84-88). Watch for undisclosed nominee arrangements.

- Source: NECIPS extract + company’s internal register (Art 56).

- Authentication: Notarized extract + Apostille/legalization.

5. Latest Financial Statements & Audit Report (审计报告)

- Purpose: Assesses solvency and repayment capacity.

- Requirement: Must be stamped by a Chinese CPA firm (Art 208). Unaudited statements are rejected.

- Key Checks: Debt ratios, related-party transactions, and contingent liabilities.

- Authentication: Notarized copies of audited reports + Apostille/legalization.

6. Certificate of Good Standing (存续证明)

- Purpose: Confirms no active dissolution/liquidation proceedings (Art 229-230).

- Issuer: Local Administration for Market Regulation (AMR) or notary office.

- Validity: Typically 3-6 months from issue date.

- Authentication: Directly notarized + Apostille/legalization.

⚠️ Red Flags Banks Reject:

- Mismatches between NECIPS data and submitted documents.

- Unnotarized/unaligned English translations.

- Expired Good Standing Certificates (>6 months).

- Signatures by unauthorized persons (Legal Rep must sign; Art 10).

🔑 Authentication: Hague Apostille vs. Consular Legalization

| Document Type | Hague Member (e.g., US, EU) | Non-Hague (e.g., UAE, KSA) |

|---|---|---|

| Business License | Notary → Apostille (China) | Notary → CCPIT Attestation → Embassy |

| Articles of Association | Notarized Copy → Apostille | Notarized Copy → CCPIT → Embassy |

| Audit Reports | Notarized Copy → Apostille | Notarized Copy → CCPIT → Embassy |

Processing Time: Apostille (1-2 weeks); Legalization (3-6 weeks). Expedited services available.

How ChinaBizInsight Ensures Your Documents Pass Bank Scrutiny

- Real-Time NECIPS Verification: We cross-check every document against China’s official registry for inconsistencies.

- Direct Notary Partnerships: Avoid backlogs with our streamlined notarization workflow.

- End-to-End Authentication: We handle CCPIT attestation, Apostilles, and embassy legalization under one roof.

- New Company Law Expertise: Our reports highlight compliance with 2024 updates (e.g., capital deadlines).

“After two document rejections by our bank, ChinaBizInsight secured an Apostilled Business License and Capital Verification Report in 7 days. The deal closed smoothly.” — Global Trade Finance Bank, Singapore

Need Bank-Compliant Chinese Documents?→ Explore our verification services: China Company Due Diligence Reports

Disclaimer: Requirements vary by bank and jurisdiction. Consult your banking partner for specifics. This guide reflects China’s New Company Law (2024).

Key Takeaways for Foreign Banks

- Expired = Rejected: Capital reports >5 years old or Good Standing Certificates >6 months are invalid.

- NECIPS is Gospel: Always cross-check documents against China’s official registry.

- Authentication is Non-Negotiable: Un-Apostilled/legalized documents lack cross-border enforceability.

- Expertise Saves Time: Partner with a verification provider who understands both banking compliance and China’s 2024 legal reforms.

Verify with confidence. Bank with clarity.

ChinaBizInsight

Your strategic bridge to transparent business in China.