For foreign investors and partners in Chinese companies, accessing reliable operational and financial data has historically been challenging. China’s newly revised Company Law, effective July 1, 2024, significantly strengthens shareholder rights – particularly the right to access company information under Article 57. This guide explains exactly how overseas shareholders can exercise these rights effectively.

What is Shareholder Information Right (知情权)?

Shareholder information rights, or “知情权” (zhīqíng quán), are fundamental legal entitlements allowing shareholders to access key company documents. These rights are crucial for:

- Monitoring Management: Ensuring directors act in the company’s best interests.

- Valuing Investments: Accurately assessing the company’s financial health.

- Making Informed Decisions: Exercising voting rights effectively.

- Protecting Interests: Identifying potential mismanagement or fraud.

Article 57 of the New Company Law (2024) significantly expands these rights, especially for minority shareholders.

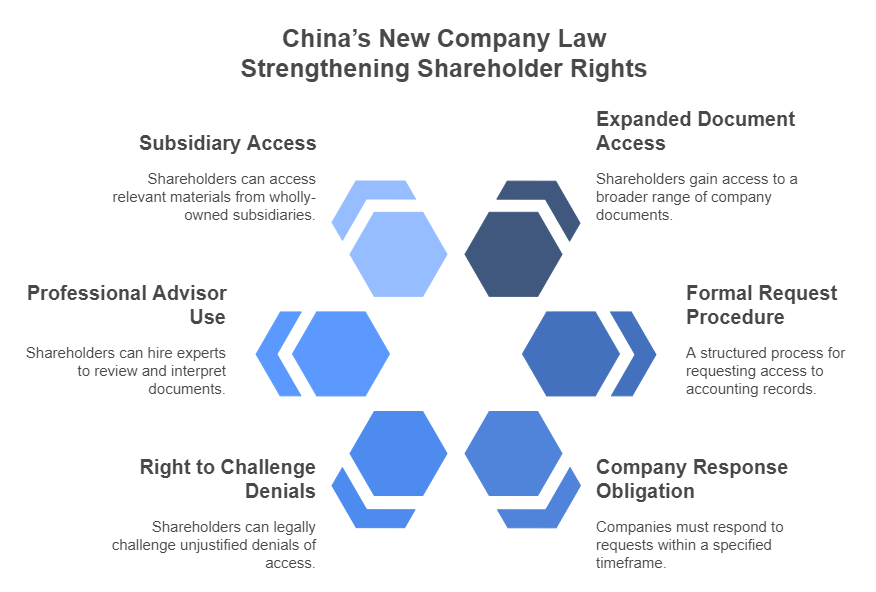

Key Changes under Article 57: Empowering Shareholders

The revised Article 57 provides a more robust framework for shareholder access:

- Expanded Scope of Accessible Documents: Shareholders can now request:

- Basic Documents: Articles of Association, Shareholder Registers, Minutes of Shareholder Meetings, Board Resolutions, Supervisory Board Resolutions, Financial & Accounting Reports (as before).

- Crucial Financial Records (New Right): Accounting Books (会计账簿) and Accounting Vouchers (会计凭证). This includes source documents like contracts, invoices, bank statements, and transaction records – the bedrock of financial transparency.

- Formal Request Procedure: Access to accounting books/vouchers requires a written request (书面请求) submitted to the company, clearly stating the purpose (说明目的).

- Company’s Obligation to Respond: The company must respond within 15 days (自股东提出书面请求之日起十五日内) of receiving the request.

- If access is granted, arrangements must be made.

- If denied, the company must provide a written justification (书面答复并说明理由) explaining its reasonable belief that the shareholder has an “improper purpose” (不正当目的) that may harm the company’s legitimate interests.

- Right to Challenge Denials: Shareholders can file a lawsuit (向人民法院提起诉讼) if the company refuses access without valid grounds.

- Use of Professional Advisors (New Right): Shareholders can engage third-party experts (委托会计师事务所、律师事务所等中介机构) like accountants or lawyers to inspect and copy documents on their behalf, ensuring technical comprehension.

- Subsidiary Access: Shareholders also have the right to access relevant materials of the company’s wholly-owned subsidiaries (全资子公司).

The “Improper Purpose” Defense: What Companies Can Argue

Companies can legally deny access to sensitive financial records (books/vouchers) only if they can demonstrate a reasonable belief that the shareholder’s purpose is improper and potentially harmful. Courts often consider purposes like:

- Competitive Harm: Seeking trade secrets to benefit a competitor.

- Harassment: Intending to disrupt company operations unreasonably.

- Breach of Confidentiality: Planning to disclose information in violation of legal duties.

- Unrelated Personal Gain: Pursuing information for purely personal reasons unrelated to shareholder interests.

As an overseas shareholder, clearly articulating a legitimate purpose in your written request is critical. Common legitimate purposes include:

- Assessing the company’s financial performance and position.

- Investigating suspected mismanagement or breaches of duty by directors/officers.

- Determining the fair value of shares.

- Preparing for a shareholder vote on a major transaction.

- Protecting shareholder rights in the context of a dispute.

Step-by-Step Guide: Exercising Your Rights under Article 57

- Draft a Formal Written Request:

- Clearly state your identity (name/nationality) and shareholding details.

- Precisely list the documents you wish to access/copy (e.g., “Accounting books and vouchers for the fiscal year 2023,” “Contracts related to Project X”).

- Crucially, state your purpose clearly and legitimately (e.g., “To assess the company’s financial performance and compliance for the purpose of evaluating my investment” or “To investigate the valuation basis of the proposed asset sale”).

- Specify if you intend to use a professional advisor (accounting/law firm).

- Request a specific method and timeframe for access.

- Send via traceable method (e.g., certified mail, email with read receipt).

- Await the Company’s Response (15-Day Deadline):

- The company must respond within 15 days.

- If access is granted, coordinate the inspection/copying.

- If denied, you will receive a written explanation citing “improper purpose.”

- Evaluate the Denial & Consider Legal Action:

- Carefully review the company’s justification. Is the claimed “improper purpose” reasonable based on your stated purpose?

- Consult immediately with legal counsel experienced in Chinese corporate law.

- If the denial appears unjustified, your lawyer can file a lawsuit requesting a court order compelling access. The lawsuit must be filed within the timeframe (the law implies urgency but doesn’t specify a strict deadline here; act promptly).

- Utilize Professional Advisors:

- Engage a reputable China-based accounting firm and/or law firm. Provide them with your written request and any company response.

- They will handle the technical aspects of reviewing complex financial records and advising on compliance/red flags.

- Comply with Confidentiality Obligations:

- You and your advisors must strictly protect any confidential information obtained (trade secrets, personal data). Unlawful disclosure can lead to serious liability.

Why Article 57 is a Game-Changer for Overseas Investors

- Access to Core Financial Data: Moving beyond summary reports to underlying vouchers enables genuine verification of financial health.

- Leveling the Playing Field: Provides minority shareholders, often foreign investors, tools to counter information asymmetry.

- Enhanced Due Diligence: Critical for pre-investment checks and ongoing monitoring of joint ventures or portfolio companies.

- Stronger Enforcement Mechanism: The clear right to sue empowers shareholders against obstructive companies.

- Professional Support Recognized: Acknowledges the need for expert assistance in navigating complex records.

Challenges & Practical Considerations

- Language Barrier: Core documents are primarily in Chinese. Engaging bilingual advisors is non-negotiable.

- Cultural & Operational Differences: Chinese companies may be unfamiliar or resistant to such requests from foreign shareholders. Persistence and proper procedure are key.

- Defining “Proper Purpose”: Disputes may arise. Clear articulation and legal backing are essential.

- Enforcement Timelines: Court processes can be time-consuming.

Conclusion: Empowerment Requires Proactive Steps

Article 57 of China’s 2024 Company Law grants overseas shareholders unprecedented tools to access vital company information. However, exercising these rights effectively demands a proactive and informed approach:

- Understand Your Rights: Know what documents you can request.

- Follow Procedure: Submit a clear, purpose-driven written request.

- Engage Experts: Utilize accountants and lawyers for both the request process and document review.

- Be Prepared to Enforce: Understand the process to challenge unjustified denials legally.

- Maintain Confidentiality: Handle all obtained information responsibly.

For international partners conducting due diligence, monitoring investments, or resolving disputes in Chinese companies, mastering Article 57 is no longer optional – it’s fundamental to protecting your interests and ensuring transparency in the world’s second-largest economy. While the law provides the framework, successful navigation often requires expert local guidance to overcome practical hurdles and ensure your rights are fully realized.

ChinaBizInsight

Your strategic bridge to transparent business in China.